Domestic gold price today March 31, 2025

At the time of survey at 4:30 a.m. on March 31, 2025, domestic gold prices temporarily stood still at a high level, gold ring prices rose to nearly 101 million VND/tael, and gold bar prices exceeded 100 million VND. Specifically:

The price of SJC gold bars listed by DOJI Group is at 98.4-100.7 million VND/tael (buy - sell), the price remains unchanged in both buying and selling directions compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 98.4-100.7 million VND/tael (buy - sell), unchanged in both buying and selling directions compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 98.4-99.8 million VND/tael for buying and selling. Compared to yesterday, the gold price decreased by 100 thousand VND/tael for buying and increased by 100 thousand VND/tael for selling compared to yesterday.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 98.5-100.7 million VND/tael (buying - selling), unchanged in both buying and selling directions compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 98.4-100.7 million VND/tael (buy - sell), gold price remains unchanged in both buying and selling directions compared to yesterday.

As of 4:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 98.4-100.7 million VND/tael (buy - sell); unchanged in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 98.9-100.9 million VND/tael (buy - sell); unchanged in both buying and selling directions.

The latest gold price list today, March 31, 2025 is as follows:

| Gold price today | March 31, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 98.4 | 100.7 | - | - |

| DOJI Group | 98.4 | 100.7 | - | - |

| Red Eyelashes | 98.4 | 99.8 | -100 | +100 |

| PNJ | 98.4 | 100.7 | - | - |

| Vietinbank Gold | 100.7 | - | ||

| Bao Tin Minh Chau | 98.5 | 100.7 | - | - |

| Phu Quy | 98.4 | 100.7 | - | - |

| 1. DOJI - Updated: March 31, 2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| AVPL/SJC HN | 98,400 | 100,700 |

| AVPL/SJC HCM | 98,400 | 100,700 |

| AVPL/SJC DN | 98,400 | 100,700 |

| Raw material 9999 - HN | 98,400 | 99,800 |

| Raw material 999 - HN | 98,300 | 99,700 |

| 2. PNJ - Updated: March 31, 2025 04:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 98,400 | 100,700 |

| HCMC - SJC | 98,400 | 100,700 |

| Hanoi - PNJ | 98,400 | 100,700 |

| Hanoi - SJC | 98,400 | 100,700 |

| Da Nang - PNJ | 98,400 | 100,700 |

| Da Nang - SJC | 98,400 | 100,700 |

| Western Region - PNJ | 98,400 | 100,700 |

| Western Region - SJC | 98,400 | 100,700 |

| Jewelry gold price - PNJ | 98,400 | 100,700 |

| Jewelry gold price - SJC | 98,400 | 100,700 |

| Jewelry gold price - Southeast | PNJ | 98,400 |

| Jewelry gold price - SJC | 98,400 | 100,700 |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 98,400 |

| Jewelry gold price - Jewelry gold 999.9 | 98,100 | 100,600 |

| Jewelry gold price - Jewelry gold 999 | 98,000 | 100,500 |

| Jewelry gold price - Jewelry gold 99 | 97,190 | 99,690 |

| Jewelry gold price - 916 gold (22K) | 89,750 | 92,250 |

| Jewelry gold price - 750 gold (18K) | 73,100 | 75,600 |

| Jewelry gold price - 680 gold (16.3K) | 66,060 | 68,560 |

| Jewelry gold price - 650 gold (15.6K) | 63,040 | 65,540 |

| Jewelry gold price - 610 gold (14.6K) | 59,020 | 61,520 |

| Jewelry gold price - 585 gold (14K) | 56,500 | 59,000 |

| Jewelry gold price - 416 gold (10K) | 39,500 | 42,000 |

| Jewelry gold price - 375 gold (9K) | 35,380 | 37,880 |

| Jewelry gold price - 333 gold (8K) | 30,850 | 33,350 |

| 3. SJC - Updated: 31/3/2025 04:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 98,400 | 100,700 |

| SJC gold 5 chi | 98,400 | 100,720 |

| SJC gold 0.5 chi, 1 chi, 2 chi | 98,400 | 100,730 |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 98,200 | 100,400 |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 98,200 | 100,500 |

| Jewelry 99.99% | 98,200 | 100,100 |

| Jewelry 99% | 96,109 | 99,109 |

| Jewelry 68% | 65,225 | 68,225 |

| Jewelry 41.7% | 38,896 | 41,896 |

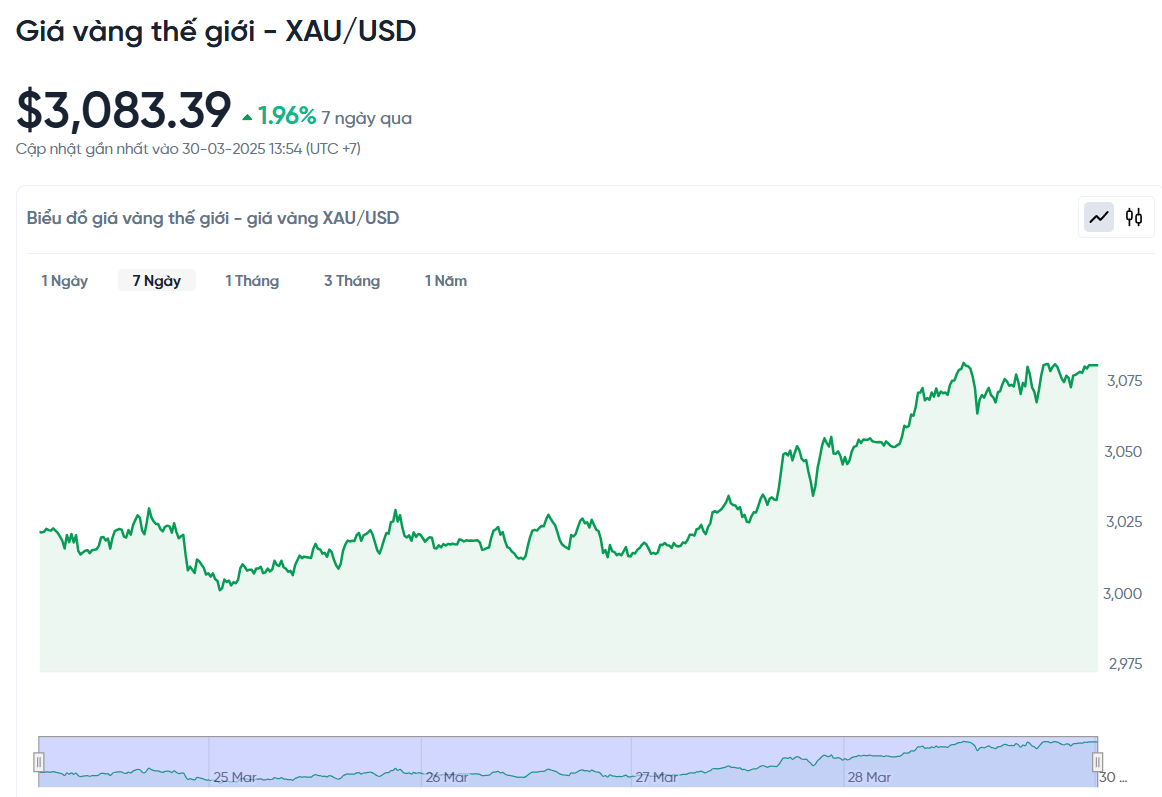

World gold price today March 31, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 am today, Vietnam time, was at 3,083.39 USD/ounce. Today's gold price remained unchanged compared to yesterday and increased by 59.13 USD/ounce compared to last week. Converted to the USD exchange rate, on the free market (25,960 VND/USD), the world gold price is about 97.56 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 3.14 million VND/tael higher than the international gold price.

The world gold price has maintained a strong upward momentum and is now likely to rise to a new record of over 3,100 USD/ounce this week. In March, the gold price increased by about 8%, and is expected to increase by 17% in the first quarter of 2025.

Although gold has rallied strongly since the beginning of the year, there is still room for price increases, according to Naeem Aslam, Chief Investment Officer at Zaye Capital Markets. He believes that the market has largely priced in the negative factors, so the possibility of a sharp decline is not high. However, factors such as trade tensions are still lurking, which could push gold prices higher after short-term corrections.

David Morrison, a market analyst at Trade Nation, said gold is overbought but still lower than it was six weeks ago. He warned investors to be cautious at current levels, as while profit-taking has only caused a small dip and has been immediately bought, a sharper correction is still possible.

Tom Bruce, investment strategist at Tanglewood Total Wealth Management, said gold remains an attractive safe haven despite its high price. He said the economic uncertainty and geopolitical tensions have only caused gold prices to correct slightly before continuing to rise. He predicted that gold prices will continue to rise due to both technical and fundamental factors, especially as US trade policy is causing many fluctuations.

Some experts see $3,100 an ounce as a key level that could mark a short-term top. James Stanley from Forex.com said that while the uptrend remains strong, buying at current levels is risky due to the rapid increase. He predicted that gold could correct in the near future, with $3,100 as a trigger.

Fawad Razaqzada, an analyst at StoneX Group, agreed, saying investors could take profits when the price hits this level. He noted that if the price breaks the $3,066 support level or drops below $3,000, a deeper decline could occur.

Recent U.S. economic data has shown slowing growth, continuing to support gold prices. Next week’s jobs report is expected to be volatile, and any signs of weakness in the labor market could send investors flocking to gold as a haven.

In addition, the US imposition of global trade tariffs from April 2 is also a factor to watch. Experts at TD Securities question the scope of the tariffs, the timing of implementation, and the market reaction, as all could impact gold prices.

The gold market will continue to attract attention this week with two important economic events that are likely to have a strong impact on gold prices. First, the Trump administration will officially impose global trade tariffs on Wednesday, followed by the March non-farm payrolls report on Friday morning.

Gold Price Forecast

Gold prices still have room to rise despite entering unprecedented territory, according to Alex Kuptsikevich, senior market analyst at FxPro. The reason for this increase is due to increasing trade tensions, causing investors to seek safe assets such as gold.

In addition, the weakening USD along with the decline of the US stock market also supported gold prices. He commented that the market is reflecting expectations of loose monetary policy from the Federal Reserve (Fed).

Kuptsikevich also stressed that the current rally is a logical continuation of the previous technical trend. He forecasts that gold prices could hit $3,180 in the coming weeks and head toward $3,400 by the end of the summer.

Experts at CPM Group recommend investors to maintain long positions or add to their gold positions with an initial target of $3,200. They said they are ready to buy gold even at a record high above $3,100, with bullish expectations in both the short-term (4 trading days) and medium-term (1 month) timeframes.

However, they also predict a short-term correction in mid-April, when prices could fall to $3,090 or even $3,040. CPM Group advises investors to maintain their long positions until at least April 2, possibly taking short-term profits after that, but still holding gold in the last two weeks of April.

Jim Wyckoff, senior analyst at Kitco, also agreed that gold prices will continue to rise next week thanks to safe-haven demand and positive technical signals.

In this week’s Kitco News survey, 20 analysts participated, of which 15 (75%) expect gold to continue rising. Only one expert (5%) predicts lower prices, while the remaining four (20%) see gold moving sideways.

The online survey of individual investors received 202 votes, with 64% (129 people) predicting gold prices to increase, 19% (39 people) thinking gold prices will decrease, and 17% (34 people) predicting gold prices will be stable next week.

Overall, experts are positive about the future of gold prices amid continued economic and geopolitical uncertainties, making gold one of the top choices for protecting assets against market volatility.

Source: https://baonghean.vn/gia-vang-hom-nay-31-3-2025-gia-vang-trong-nuoc-va-the-gioi-cho-tiep-mot-dot-tang-moi-tuan-nay-10294098.html

![[Photo] General Secretary To Lam receives King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/e5963137a0c9428dabb93bdb34b86d7c)

![[Photo] Close-up of Vietnam's sniffer dog team searching for earthquake victims in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/d4949a0510ba40af93a15359b5450df2)

![[Photo] Prime Minister Pham Minh Chinh meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/be2f9ad3b17843b9b8f8dee6f2d227e7)

![[Photo] President Luong Cuong and King Philippe of Belgium visit Thang Long Imperial Citadel](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/cb080a6652f84a1291edc3d2ee50f631)

![[Photo] Myanmar's capital in disarray after the great earthquake](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/7719e43b61ba40f3ac17f5c3c1f03720)

Comment (0)