Gold price today, February 1, 2025, at the beginning of the trading session in the US continued to increase, above the 2,800 USD/ounce mark, amid increased demand for shelter.

At the end of the session on January 31, the price of gold bars at SJC was listed at 86.8-88.8 million VND/tael (buy - sell). Doji announced the price of gold bars at 86.9-88.9 million VND/tael (buy - sell).

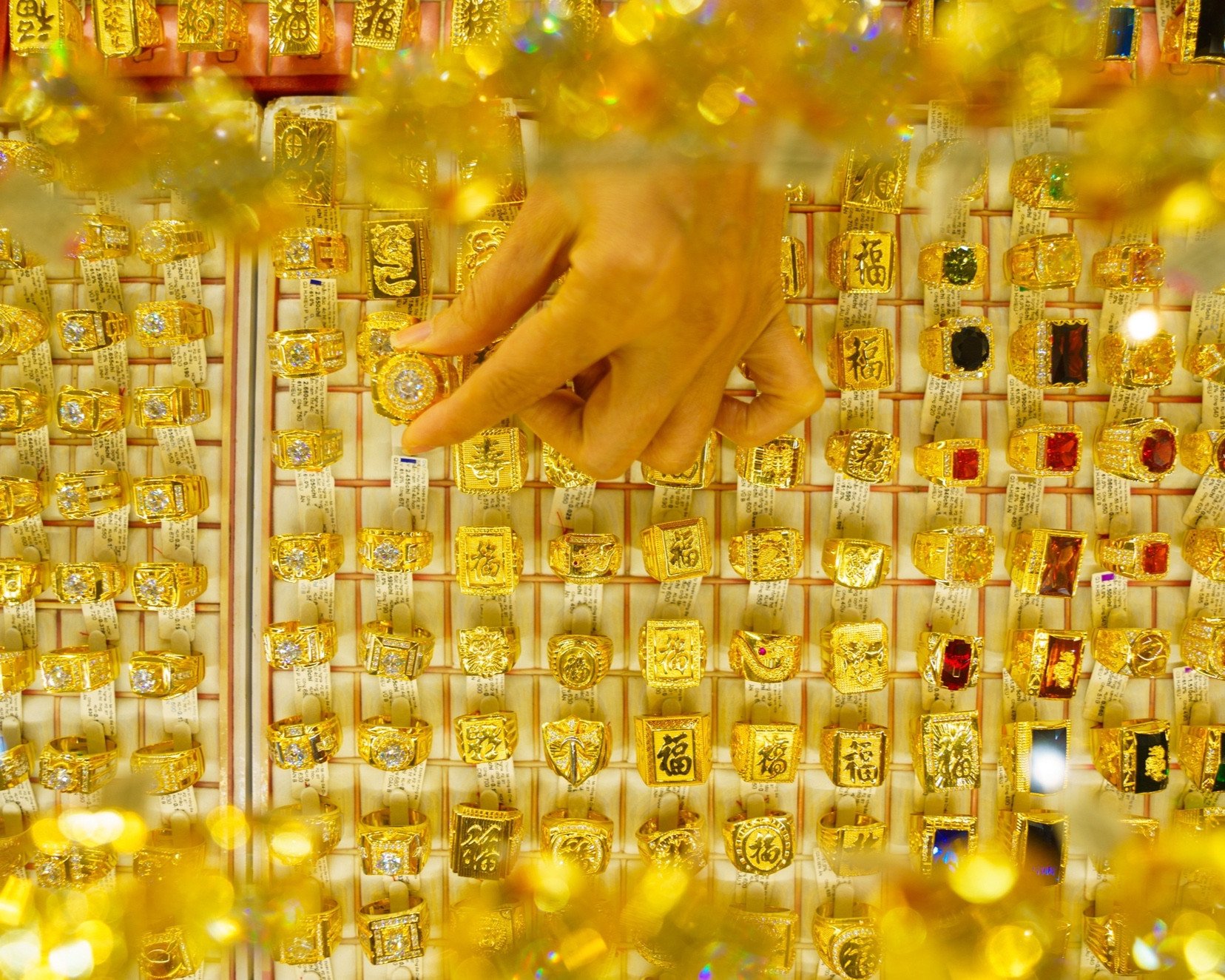

The price of 1-5 chi SJC gold rings is listed at 86.3-88 million VND/tael (buy - sell). The price of 9999 gold rings at Doji closed the session at 86.6-88.1 million VND/tael.

Spot gold price at 8:00 p.m. (January 31, Vietnam time) was at $2,805/ounce, up 0.36% from the beginning of the session. Gold futures price for April 2025 on the Comex New York floor was at $2,847/ounce.

The US Dollar Index (DXY), which measures the greenback's movements against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF) stood at 108.27 points.

World gold prices continued to increase at the beginning of the US trading session, above the 2,800 USD/ounce mark, amid increased demand for shelter.

Soaring US debt, uncertainty over Federal Reserve policy and changes in the global economy are fueling renewed interest in gold as a safe haven asset, according to expert Robert Kiyosaki.

The US national debt has now surpassed $36.4 trillion, raising concerns about financial stability.

Despite persistent economic uncertainty, the Fed paused interest rate cuts, leaving the federal funds rate unchanged at 4.25% to 4.5% after three consecutive cuts in previous meetings.

Fed Chairman Jerome Powell reiterated that future policy decisions will depend on economic data and external political pressure for further easing. However, President Donald Trump has called for further rate cuts, arguing that they are necessary to sustain economic growth.

Gold prices are always sensitive to the Fed's interest rate adjustments. Low interest rates weaken the US dollar, increasing the attractiveness of gold.

Another factor affecting gold prices is that US President Donald Trump on January 30 once again announced that the US could impose a 25% tax on imports from Mexico and Canada.

Rising uncertainty and concerns over new tariff policies from the Trump administration have supported gold's rise, said Jim Wyckoff, senior analyst at Kitco.

In Europe, the European Central Bank cut interest rates by 0.25% in its fifth consecutive rate hike after data showed the economy was slowing.

Gold trading volume was thin as Chinese markets were closed for the Lunar New Year holiday.

Gold Price Forecast

Gold prices have risen nearly 20% over the past year, driven by record central bank purchases, inflation concerns and geopolitical uncertainty, said Robert Kiyosaki. Continued money printing and debt expansion will further weaken fiat currencies, pushing gold prices higher.

George Milling-Stanley, gold expert at SSGA, said renewed investment demand is pushing gold back to all-time highs. He forecasts a 50% chance that gold will trade between $2,600 and $2,900 an ounce and a 30% chance that it could reach $3,100 an ounce.

Source: https://vietnamnet.vn/gia-vang-hom-nay-1-2-2025-vot-tang-vuot-moc-2-800-usd-ounce-2367585.html

Comment (0)