Saigon Beer - Alcohol - Beverage Corporation (Sabeco, stock code SAB) has just announced its Consolidated Financial Report for the third quarter of 2023 with net revenue reaching VND 7,504 billion, down more than 14% over the same period.

After deducting the cost of goods sold, the company's gross profit reached nearly VND2,233 billion, down 17% over the same period. Gross profit margin reached 30.1%.

During the period, Sabeco's financial revenue increased by 31.3% to over VND373 billion, mainly due to increased interest income from bank deposits. Financial expenses increased by nearly 47% to VND19.4 billion.

Selling expenses and administrative expenses both decreased slightly compared to the same period last year.

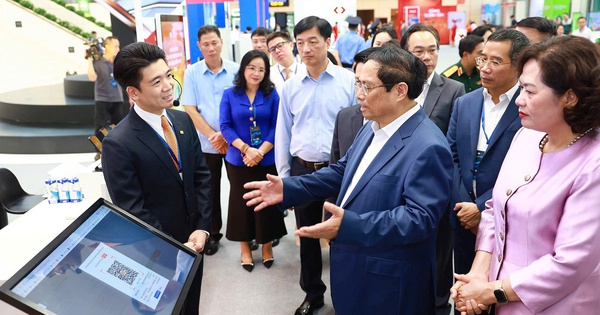

In the third quarter of 2023, Sabeco's profit decreased by 22%. (Illustration photo)

As a result, Sabeco reported a profit after tax of VND1,074 billion, down 23% year-on-year. The parent company's profit after tax reached VND1,044 billion, down 22% year-on-year.

Notably, in the revenue structure, beer sales brought Sabeco VND19,582 billion, down nearly 12% compared to the same period. Revenue from soft drinks and alcohol sales decreased by 28% and 7% respectively.

In the first 9 months, Sabeco recorded revenue of VND21,940 billion and net profit of VND3,170 billion, down 12% and 24% respectively compared to the same period last year. Thus, after 3 quarters, the company has completed about 57% of the annual profit plan.

According to Sabeco's leadership, in the first 9 months of this year, revenue and profit were lower than last year due to fierce competition in the market and lower consumer demand.

In addition, according to Sabeco, it is also due to "strict implementation of Decree 100". Meanwhile, input costs, sales costs, and business management costs are all higher.

As of September 30, Sabeco's total assets reached VND33,426 billion, down more than VND1,000 billion compared to the beginning of the year. Of which, the company's cash and bank deposits accounted for more than half of its total assets, at VND22,388 billion, down nearly 5% compared to the beginning of the year. Inventory was VND2,151 billion, unchanged from January 1.

Sabeco's total financial debt is VND647 billion, most of which is short-term debt. The company's main source of capital is equity, reaching VND26,518 billion. Of which, charter capital is VND6,412 billion, and undistributed profit after tax is VND17,637 billion.

In 2023, Sabeco plans to do business with net revenue of VND 40,272 billion, up 15.1% over the same period and expected after-tax profit of VND 5,775 billion, up 5% compared to the implementation in 2022.

At the end of the first 3 quarters of the year, Sabeco completed 54.5% of the revenue plan and 57% of the after-tax profit plan.

Ngoc Vy

Source

Comment (0)