Reporting and receiving comments on the draft Land Law on the morning of January 15, Chairman of the National Assembly's Economic Committee Vu Hong Thanh said that it is necessary to soon impose higher tax rates on people with many houses and lands to regulate the difference in land rent due to state planning.

Going back to the past, at the Conference chaired by the Prime Minister on Removing difficulties for the real estate market on August 3, 2023, Deputy Minister of Finance Nguyen Duc Chi also said that the Ministry of Finance is studying the taxation of second homes and slow-used land.

At that time, the Deputy Minister of Finance said that each tax policy has different and multi-dimensional impacts. Therefore, the tax policy can achieve the goal of avoiding speculation but limit aggregate demand for the real estate market.

Furthermore, the Government proposed a pilot property tax (housing) in Ho Chi Minh City in 2017. The Ministry of Finance also submitted a draft Law on Property Tax to the Government in 2018. However, these policies later received mixed opinions from the public and were not approved by competent authorities.

Up to now, the story of taxing people with many houses and lands continues to be "dissected" when the Land Law (amended) has just been passed.

Property tax - a double-edged sword

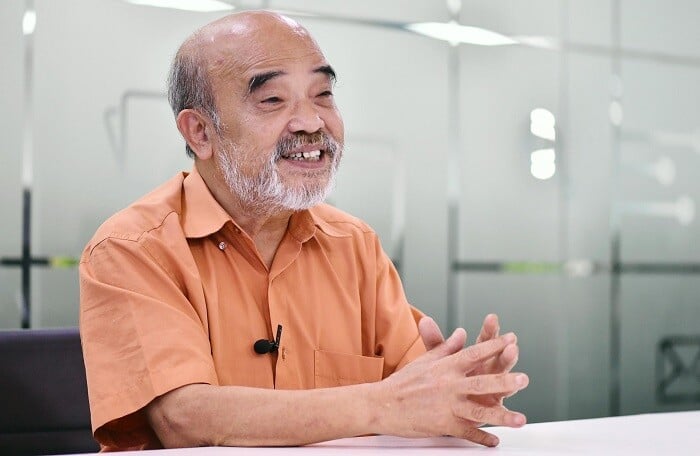

Talking to Nguoi Dua Tin about the above issue, Professor Dang Hung Vo - former Deputy Minister of Natural Resources and Environment said that the above policy had been planned and discussed by the State many times since 2008, but "it was built very enthusiastically, many opinions were raised for discussion" and until now it has not been able to be concretized and applied in practice.

Mr. Vo said that one of the main goals of the above tax is to build a reasonable real estate price level, not to be "inflated" and to avoid speculation. If there is a reasonable tax policy, land speculation will be prevented, real estate prices will immediately decrease, serving the common people. However, if "drawing" many things to tax, the professor also said that it will cause many problems.

“The problem is how to “fight” appropriately to prevent speculation without stunting the real estate market supply,” said Mr. Vo.

Accordingly, the professor believes that reforming a tax law requires a roadmap, but in particular, Mr. Vo emphasized that taxation in the Vietnamese market at this time should aim at changing supply and demand first, rather than immediately putting the goal of changing real estate prices first.

Prof. Dang Hung Vo - former Deputy Minister of Natural Resources and Environment.

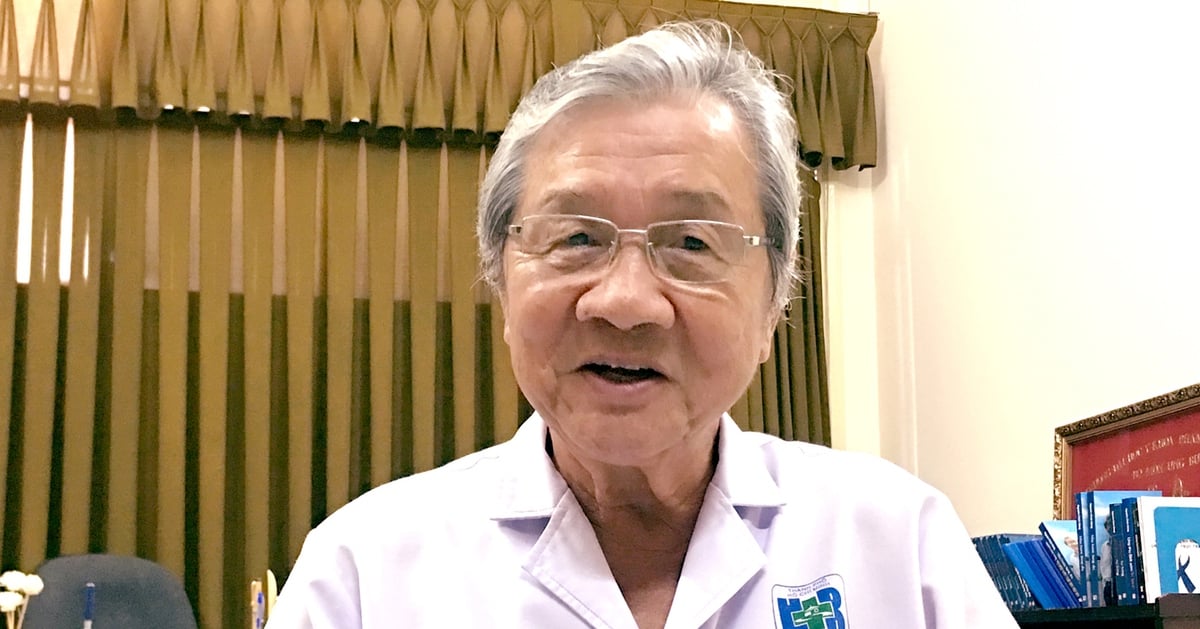

Also sharing about the above issue, Mr. Nguyen Quoc Anh - Deputy General Director of Batdongsan.com.vn commented that tax is a good solution in the current context, but the tax story also causes two sides of the problem.

On the positive side, taxation will help increase revenue for the state budget, and at the same time contribute to adjusting the market in the short term from the first few months to the first few years.

However, on the other hand, imposing higher taxes on people with many houses and lands is not necessarily a long-term solution, according to Mr. Quoc Anh.

Besides, in the current situation, the real estate market is facing the problem of lack of supply and scarce products on the market, so imposing taxes is unlikely to be effective.

For example, in some developed countries, Mr. Quoc Anh said that direct taxation on property ownership still has no effect in controlling housing and land prices or really regulating prices in the market. Even real estate prices are still high and speculation continues despite the use of tax tools.

Be especially careful when making laws.

Faced with the opportunities and challenges that come with imposing higher taxes on people with many houses and lands, the Deputy General Director of Batdongsan.com.vn believes that it is necessary to prepare very carefully in terms of legal aspects, standards, targets, segments, etc. for taxation.

Firstly, it is necessary to clearly distinguish each real estate segment, divide it into each type to have separate mechanisms, and avoid leveling which causes conflicts.

Second, it is necessary to study and apply appropriate tax rates for each type and each class. This helps ensure the balance of supply and demand in the market, maintain stable growth of real estate, and must find a way to promote supply instead of narrowing it.

Third, the above policy is correct but needs to closely follow the orientation and shift of the real estate market. Regardless of the purpose, taxation needs to be long-term and solve the overall problem, not calculating immediate benefits.

And especially, Mr. Quoc Anh emphasized that although the above tax is imposed to balance the market and prevent real estate speculation, it also pays attention to the right to own and accumulate assets of the people, especially those with low incomes and those who are disadvantaged in society.

Mr. Nguyen Quoc Anh - Deputy General Director of Batdongsan.com.vn.

In addition, Professor Dang Hung Vo said that taxes are used to regulate the use of assets, ensuring social justice. Taxing assets is also a direct tax, directly applied to the users and owners of assets, so if it is not applied to the right subjects and in the right cases, it will be difficult to implement and destroy the original good purpose that this tax revenue brings.

Therefore, when imposing taxes on the largest land owners, it is necessary to clearly define who is subject to or not subject to tax, and regularly evaluate the effectiveness during implementation, ensuring compliance with the policies of the Party and State.

"It is necessary to carefully study and calculate the appropriate collection levels, types of collection, and collection subjects to receive high consensus and agreement from the people," said Mr. Vo .

In a petition sent to management levels, the Ho Chi Minh City Real Estate Association (HoREA) requested that the Ministry of Finance, when developing the Property Tax Law Project (Real Estate Tax), need to fully and accurately assess the impact of the tax law on taxable entities.

In particular, for households and individuals, it is necessary to assess the impact of tax laws fully and accurately so that tax laws both generate revenue for the state budget and are suitable for taxable subjects, foster revenue sources, and do not over-collect, and are an effective tool to regulate the real estate market to develop healthily and sustainably.

HoREA proposes not to pilot an increase in non-agricultural land use tax on residential land, and not to increase personal income tax when transferring a second or more real estate in Ho Chi Minh City.

Source

![[Photo] Prime Minister Pham Minh Chinh receives Cambodian Minister of Commerce](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/be7f31fb29aa453d906df179a51c14f7)

![[Photo] Prime Minister Pham Minh Chinh and Japanese Prime Minister Ishiba Shigeru attend the Vietnam - Japan Forum](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/fc09c3784d244fb5a4820845db94d4cf)

![[Photo] A long line of young people in front of Nhan Dan Newspaper, recalling memories of the day the country was reunified](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/4709cea2becb4f13aaa0b2abb476bcea)

![[Photo] Signing ceremony of cooperation and document exchange between Vietnam and Japan](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/e069929395524fa081768b99bac43467)

Comment (0)