Breakout to 8-month peak

Last week, Hoa Phat Group's HPG stock performed positively and surpassed an important resistance level to reach its highest price in 8 months, reaching VND22,350/share. Since the bottom in November 2022, HPG stock has increased by 85%.

Mr. Tran Dinh Long has nearly 1 billion USD more, firmly standing in the Forbes list of USD billionaires. In November 2022, Mr. Tran Dinh Long at one point fell out of the world's USD billionaire rankings.

However, according to the latest ranking published in early April, Mr. Tran Dinh Long has assets of 1.8 billion USD. As of April 15, Mr. Long's real-time assets were 1.9 billion USD, ranking 3rd among the richest people in the Vietnamese stock market, behind Vingroup Chairman Pham Nhat Vuong (4.4 billion USD) and VietJet Chairman Nguyen Thi Phuong Thao (2.2 billion USD).

HPG increased rapidly in the context of strong cash flow into this stock. In the last session of the week on May 12, more than VND 1,000 billion was poured into trading more than 45 million HPG shares. Strong cash flow pushed HPG shares to VND 22,350/share, the highest since October 2022 and far exceeding the threshold of VND 11,000-12,000/share recorded in November 2022.

HPG shares increased in the context that this group returned to profit in the first quarter of 2023 and was confident about selling products and reopening blast furnaces for production.

According to Vietcombank Securities (VCBS), Hoa Phat is planning to restart 2 blast furnaces, including 1 blast furnace in Hoa Phat Dung Quat and 1 blast furnace in Hoa Phat Hai Duong before May 20 and operate all 7 current blast furnaces by the end of May.

Previously, at the 2023 Annual General Meeting, Chairman Tran Dinh Long commented that the steel industry had passed the most difficult area.

VCBS also emphasized that the plan to reopen the blast furnace of this leading steel enterprise will be quite challenging in the context of difficult demand as it is now. Hoa Phat is known as the market leader in construction steel and steel pipes. However, this group plans to switch to producing high-quality steel, leaving the playing field for enterprises producing basic construction steel.

In fact, cash flow is not only pouring into Hoa Phat but also focusing on stocks in industries related to public investment (such as construction, construction materials...) in the context of the Government promoting disbursement of public investment capital, compensating for the slowdown in the production and export sectors.

Codes such as HSG, NKG, TLH, POM… all increased quite strongly.

Challenges remain, cash flow helps push up stock prices

According to VCBS, in the short term, HPG's business operations will still face difficulties due to the general situation of the steel industry. This securities company maintains its view that steel prices will remain low and consumption output will be poor in 2023.

VCBS forecasts that HPG's revenue in 2023 will decrease by 21% year-on-year to VND111,538 billion and profit will decrease by 18% to VND7,284 billion. The biggest risk for HPG is that domestic and international steel prices will continue to decline in the coming time.

In addition, bottlenecks in the legal corridor affecting the real estate market along with delays in disbursing public investment capital may affect HPG's ability to consume steel.

In fact, Hoa Phat is proactively seeking new growth drivers for the future after focusing on the Dung Quat 2 steel project.

Hoa Phat is considering many areas such as civil and industrial real estate. Besides, it is manufacturing household appliances.

Hoa Phat plans to boost its industrial real estate sector with plans to increase the number of industrial parks to 10 by 2030. The residential real estate sector is not expected to have many changes because the company is focusing resources on the Dung Quat 2 project.

On the stock market, HPG is still considered a "national stock" among investors because of its vibrant trading, even when the general market is booming or gloomy.

The sudden increase in HPG shares has helped a large number of investors, from professional organizations such as domestic and foreign funds (Dragon Capital), securities companies (Tri Viet) to "amateur" investors such as some listed companies (CMS, DHA)... and even individual investors breathe a sigh of relief.

After months of heavy losses, many investors in HPG national stocks have reduced their losses, some even made profits after entering later.

The sharp increase in HPG shares is part of the general trend in the stock market when stocks receive more cash inflows in the context of easier liquidity in all channels. The banking system tends to reduce interest rates and increase money injection into the economy.

According to ACBS Securities, investors expect policy changes to help resolve current difficulties. As internal problems are being resolved by management agencies by issuing Decree 08/2023/ND-CP on the corporate bond market, issuing Decree 10/2023/ND-CP on the Land Law and lowering a series of operating interest rates to help reduce short-term cash flow pressure of bond issuers and create conditions for legal perfection for real estate businesses.

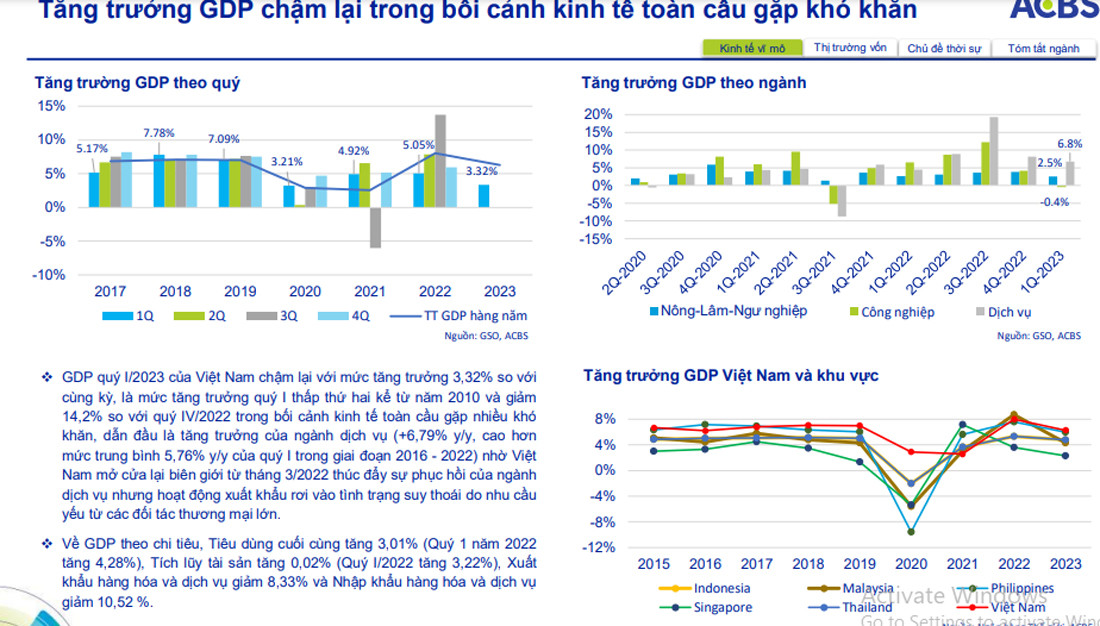

Despite some signs of slowing growth, overall economic conditions remain stable with interest rates falling, inflation slowing and remaining within the Government’s target. Compared to other markets on the watch list, the valuation of the VN-Index remains attractive for investors to accumulate stocks at reasonable valuations.

ACBS also expects that some important regulations to be considered at the National Assembly session in May will be positive factors for many sectors, especially real estate and construction.

According to VNDirect, the market was more positive than expected thanks to signs of domestic investors' cash flow returning after withdrawing at the end of April before the holidays. This was clearly seen when market liquidity increased by 14% in the last trading week.

In addition to the improvement in cash flow, the market has also received recent supportive information that has had a positive impact on the market outlook. Specifically, the US inflation data for April released last week maintained a downward trend and was lower than the market's previous forecast, further strengthening the possibility that the US Federal Reserve (Fed) may stop raising its key interest rate at its upcoming meeting in June.

Domestically, the State Bank said it is considering the possibility of further reducing operating interest rates in the coming time to support economic growth recovery. The Government is also speeding up the drafting process to soon approve the Power Plan VIII as well as preparing to submit to the National Assembly for consideration and approval of the Resolution on reducing VAT by 2% at the upcoming meeting.

According to VNDirect, with these positive signals, the expectation of a short-term uptrend in the market has been established. Some industry groups have supportive information and are having price strength that is superior to the general level such as banking, securities, public investment (infrastructure construction, construction materials) and energy (electricity, oil and gas).

Source

Comment (0)