(NLDO)- In the session on February 10, HPG shares of Hoa Phat Group decreased by 4.7% - the strongest adjustment in the past 6 months.

After US President Donald Trump announced a 25% tax on all steel and aluminum imported from countries including Vietnam, the stock prices of steel companies in yesterday's session, February 10, fell sharply, becoming the focus of the market.

Specifically, HSG shares of Hoa Sen Group decreased by 4.52%, down to VND16,900/share; NKG shares of Nam Kim Steel Joint Stock Company decreased by 3.6%, down to VND13,500/share; GDA shares of Ton Dong A decreased by 4.7%, down to VND24,000/share...

Notably, HPG shares of Hoa Phat Group fell sharply by 4.7% - the strongest adjustment in the past 6 months, down to VND25,400/share. Trading liquidity of this stock is the highest in the market, with more than 61 million units.

At the end of today's trading session, February 11, HPG shares of Hoa Phat Group increased again by 2.8%. Similarly, NKG shares of Nam Kim Steel increased by 1.1%. However, HSG shares continued to decrease by 0.9%, GDA decreased by 1.2%.

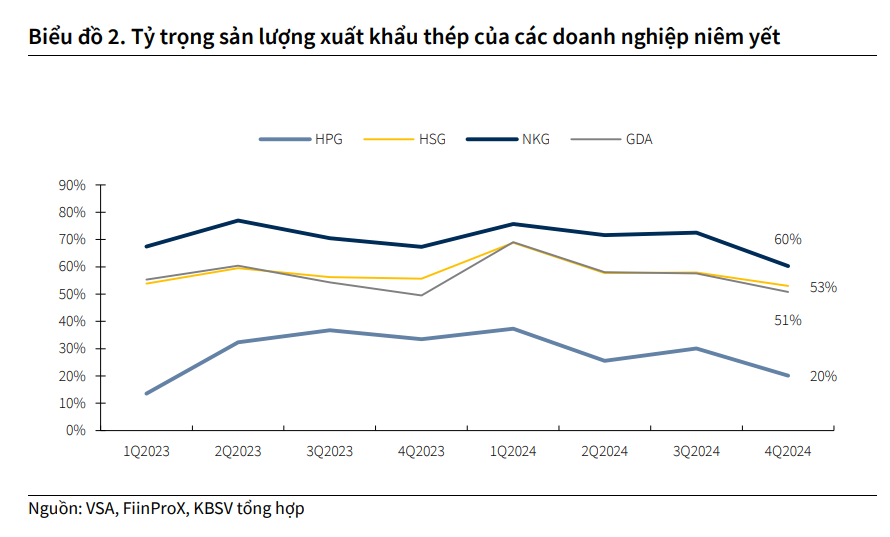

Proportion of steel export output of Hoa Phat, Hoa Sen, Nam Kim, Ton Dong A Source: KBSV

According to KB Securities Vietnam JSC (KBSV), previously, from September 2024, the US announced the investigation to establish a basis and prepare to impose anti-dumping tax on galvanized steel imported from Vietnam, with an expected tariff rate of 10-25%. Preliminary results are expected to be announced in April 2025.

According to KBSV statistics, galvanized steel export activities to the US - Mexico market contribute 18.6%, 26.2%, 31.9% of revenue, respectively, of Hoa Sen, Nam Kim and Ton Dong A in 2024.

KBSV believes that the US tariffs will have a general negative impact on the revenue growth prospects of galvanized steel manufacturers. However, Nam Kim will be the company under the greatest pressure due to high subsidies and a large proportion of revenue from the US - Mexico.

For Hoa Phat, revenue from the US - Mexico market is estimated to contribute 29% of total revenue.

KBSV believes that Hoa Phat will be least affected by anti-dumping measures because its upstream steel products (construction steel, HRC) are mainly consumed in the domestic market, with export channels contributing 30% of total output.

In addition, the main export markets of this enterprise are ASEAN and Asian countries such as Malaysia and Indonesia (accounting for 40% of export revenue).

According to KBSV's estimate, the HRC output needed to produce galvanized steel for Hoa Sen, Nam Kim, and Ton Dong A to export to the US - Mexico in 2024 is estimated to reach 450,000 tons (assuming that the above enterprises use HRC from Hoa Phat and Formosa at a ratio of 50%/50%).

If the export output of galvanized steel to the US market of the above three enterprises decreases by an average of 25% in 2025, the loss in HRC consumption demand will only account for approximately 2% of Hoa Phat's total production capacity in the period.

Besides, Hoa Phat also plans to use HRC to produce high quality steel such as tire bead, welding wire steel, welding rod core, elevator cable...

KBSV assesses the risk of Hoa Phat's HRC consumption output decreasing due to the consumption demand of Hoa Sen, Nam Kim, and Ton Dong A being affected by low US tariffs.

Along with that, the localization trend has taken place since the beginning of the second half of 2024 after information about the initiation of anti-dumping investigations on steel spread from many countries. Compared to the peak in the first quarter of 2024, the export output of galvanized steel in the fourth quarter of 2024 of Hoa Sen, Nam Kim, and Ton Dong A decreased by 19%, 31%, and 28%, respectively.

Hoa Phat's construction steel and HRC export output also decreased by 45%. This trend is supported by the return of domestic consumption demand, with the main driving force coming from the recovery of the civil real estate market and the continued implementation of public investment projects.

KBSV believes that steel manufacturing enterprises with large domestic market shares will have an advantage in maintaining revenue growth momentum in the coming time.

In addition, KBSV believes that export enterprises will also focus on expanding to new markets (areas that have not applied tariff barriers to Vietnamese steel) to maintain consumption output.

Source: https://nld.com.vn/khong-phai-hoa-phat-day-moi-la-cong-ty-thep-chiu-anh-huong-nang-nhat-sau-tuyen-bo-tu-ong-trump-196250211193309651.htm

![[Photo] Ready for the top competitions of Vietnamese table tennis](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/9c547c497c5a4ade8f98c8e7d44f5a41)

![[Photo] Many young people patiently lined up under the hot sun to receive a special supplement from Nhan Dan Newspaper.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6f19d322f9364f0ebb6fbfe9377842d3)

![[Photo] General Secretary To Lam visits exhibition of achievements in private economic development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/1809dc545f214a86911fe2d2d0fde2e8)

Comment (0)