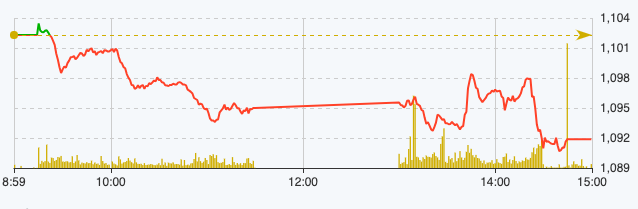

After a few minutes of opening with a glimmer of green, selling pressure increased sharply, causing the VN-Index to quickly reverse and fall below the reference level.

Large-cap stocks are still the main burden on the market as most stocks turn red, except for a few lucky stocks that escaped but the increase is only within the range of 0.5%.

The retail group was most negatively affected when all stocks were covered in red such as MWG down 2.45%, PNJ down 0.76% and FRT down 1.69%,...

At the end of the morning session on December 18, VN-Index decreased by 7.31 points, equivalent to 0.66% to 1,094.99 points. The entire floor had 91 stocks increasing and 362 stocks decreasing. HNX-Index decreased by 1.3 points to 225.73 points. UPCoM-Index decreased by 0.32 points, equivalent to 0.37% to 84.73 points.

VN-Index performance on December 18 (Source: FireAnt).

Entering the afternoon session, investor sentiment continued to be cautious, the market fluctuated, causing the electronic board to continue to be filled with red.

At the end of the trading session on December 18, VN-Index decreased by 10.42 points, equivalent to 0.95% to 1,091.88 points. The entire floor had 112 stocks increasing, 415 stocks decreasing, and 68 stocks remaining unchanged.

HNX-Index decreased by 1.29 points, equivalent to 0.57% to 225.73 points. The whole floor had 65 stocks increasing, 99 stocks decreasing and 55 stocks remaining unchanged. UPCoM-Index decreased by 0.17 points to 84.88 points.

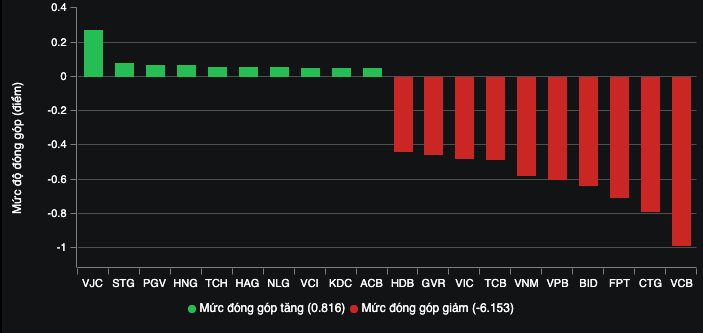

In the VN30 basket alone, 25 stocks decreased in price. The large-cap group was in red, notably VCB, CTG, FPT, BID, VPB, VNM, TCB, VIC, GVR, HDB, which took away more than 6 points from the general market. Only 3 stocks remained green: ACB, VJC and VRE, and 2 reference stocks were VHM and SSB.

The banking group was the main factor causing the market to decline sharply when VPB lost 1.6% and took away nearly 1 point, STB decreased by 2.95%, EIB decreased by 1.92%, SHB decreased by 0.93%, HDB decreased by 3.16%, CTG decreased by 2.43%, VIB decreased by 1.33%, TCB decreased by 1.8%, KPB decreased by 1.59%,...

The retail group continued to be negatively affected when the three leading stocks MWG, DGW, FRT decreased by 2.82%, 2.37%, 0.2%,... respectively.

Along with retail, the food manufacturing industry is equally pessimistic, for example DBC decreased by 0.79%, VNM decreased by 1.62%, VHC decreased by 3.84%, ANV decreased by 2.31%, PAN decreased by 1.81%, MSN decreased by 0.16%, IDI decreased by 1.69%,...

Codes that affect the general market.

The total order matching value in today's session reached VND16,466 billion, down 8% compared to the previous session, of which the order matching value on the HoSE floor reached VND14,727 billion, down 7%. In the VN30 group, liquidity reached VND7,043 billion.

Foreign investors continued to net sell with a value of 772.8 billion VND, of which this group disbursed 2,852.6 billion VND and sold 3,625 billion VND.

The codes that were sold strongly were FUEVFVND 209 billion VND, VNM 92 billion VND, STB 66 billion VND, VPB 55 billion VND, CTG 50 billion VND, etc. On the contrary, the codes that were mainly bought were NLG 28 billion VND, IDC 25 billion VND, FTS 12 billion VND, HAG 10 billion VND, VRE 9 billion VND, etc.

Source

![[Photo] Prime Minister Pham Minh Chinh chairs Government Standing Committee meeting on Gia Binh airport project](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/10/6d3bef55258d417b9bca53fbefd4aeee)

![[Photo] General Secretary To Lam holds a brief meeting with Russian President Vladimir Putin](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/10/bfaa3ffbc920467893367c80b68984c6)

Comment (0)