The market opened unfavorably as selling pressure still dominated and large-cap groups weighed down the VN-Index.

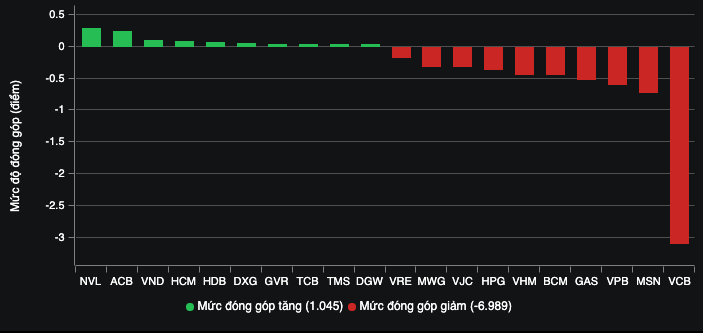

Banking stocks including VCB, CTG, VPB are the ones having the most negative impact on the index. Some other large-cap stocks such as MSN, GAS, BCM, MWG are also weighing heavily. MWG, FPT, HAG, VSC also decreased with high liquidity compared to the general market.

At the end of the morning session on December 15, VN-Index decreased by 5.29 points, equivalent to 0.48% to 1,104.84 points. The entire floor had 103 stocks increasing and 327 stocks decreasing. HNX-Index decreased by 0.65 points to 226.58 points. UPCoM-Index decreased by 0.4 points, equivalent to 0.47% to 84.82 points.

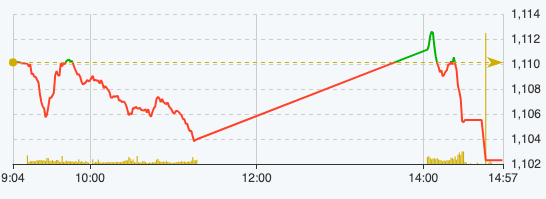

VN-Index performance on December 15 (Source: FireAnt).

Entering the afternoon session, the VN-Index had a few green bounces and then quickly turned around when investors pushed up selling in the ATC session, the electronic board was flooded with red.

At the end of the trading session on December 15, VN-Index decreased by 7.83 points, equivalent to 0.71% to 1,102.3 points. The entire floor had 162 stocks increasing, 338 stocks decreasing, and 87 stocks remaining unchanged.

HNX-Index decreased 0.21 points, equivalent to 0.09% to 227.02 points. The whole floor had 70 stocks increasing, 91 stocks decreasing and 65 stocks remaining unchanged. UPCoM-Index decreased 0.17 points to 85.05 points.

In the VN30 basket alone, 20 stocks decreased in price and only 5 stocks increased in price. VCB was the burden in today's session with a decrease of 2.61% and took away more than 3 points from the general market. Other stocks such as MSN, VPB, GAS, BCM, VHM, HPG, BJC, MWG, VRE also took away a total of nearly 4 points.

The banking group was less positive as the whole industry decreased by 0.82%, of which EIB decreased by 1.35%, VPB decreased by 1.58%, CTG decreased by 0.19%, VCB decreased by 2.16%, MSB decreased by 0.78%, VIB decreased by 0.53%, OCB decreased by 1.11%. Only ACB in the VN30 banking industry increased by 1.11%.

The real estate group was differentiated when NVL, DIG, PDR, CEO, DXG, CEO, TCH, ITA ended the session in green, especially HQC increased to the ceiling of 6.99%. On the contrary, the trio of Vin stocks VHM, VIC, VRE along with KBC, VHG, LDG, TIG, IDC, NLG, FIT ended the session down.

The securities group was the bright spot in today's session when green dominated the entire industry, notably VND, VIX, SHS, HCM, MBS, AGR, FTS, ORS, CTS, DSC, BSI. However, there were still a few stocks that decreased in points such as SSI, AAS, APG, VFS, ABW.

Codes that affect the general market.

The total order matching value in today's session reached VND17,937 billion, up 5% compared to the previous session, of which the order matching value on the HoSE floor reached VND15,885 billion, up 8%. In the VN30 group, liquidity reached VND6,132 billion.

Foreign investors continued to net sell with a value of VND 1,470 billion, of which this group disbursed VND 2,447 billion and sold VND 3,918 billion.

The codes that were sold strongly were HPG 287.7 billion VND, SSI 178 billion VND, DGC 137.7 billion VND, VCB 134.7 billion VND, FUEVFVND 105 billion VND,... On the contrary, the codes that were mainly bought were NVL 115 billion VND, VND 111 billion VND, CEO 84 billion VND, NKG 14 billion VND, NLG 13 billion VND,... .

Source

Comment (0)