The Government has just issued Decree 64 extending the deadline for paying value-added tax, corporate income tax, personal income tax and land rent this year.

According to Decree 64, the subjects eligible for extension include enterprises, organizations, households, business households, and individuals engaged in production activities in the fields of agriculture, forestry, and fisheries; construction; food production and processing, textiles; publishing activities; cinema activities; crude oil and natural gas exploitation; beverage production; transportation and warehousing...

In addition, there are also enterprises, organizations, households, business households, and individuals engaged in the production of priority supporting industrial products and key mechanical products.

Specifically, Decree 64 extends the tax payment deadline for the value-added tax (VAT) payable for the tax period from May to September (for cases of monthly VAT declaration) and the tax period of the second quarter of 2024 and the third quarter of 2024 (for cases of quarterly VAT declaration) of enterprises and organizations subject to the above extension.

The extension period is 5 months for VAT amounts of May, June and Q2/2024. And the extension period is 4 months for VAT amounts of July.

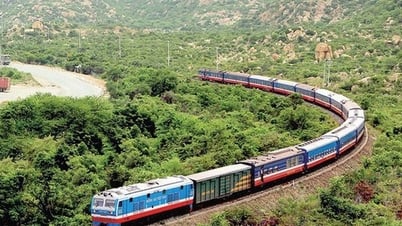

The Government has just issued Decree 64 extending the deadline for payment of value-added tax, corporate income tax, personal income tax and land rent in 2024 (Photo: Huu Thang).

The extension period is 3 months for the VAT amount of August and the extension period is 2 months for the VAT amount of September and the third quarter of 2024. The extension period is calculated from the end date of the VAT payment deadline according to the provisions of the law on tax administration.

For corporate income tax, the tax payment deadline is extended for the provisional corporate income tax payment of the second quarter of the 2024 corporate income tax period of enterprises and organizations eligible for the above extension.

Accordingly, the extension period is 3 months from the end date of the deadline for paying corporate income tax according to the provisions of the law on tax administration.

In addition, the Decree also extends the deadline for paying VAT and personal income tax for the tax payable in 2024 of business households and business individuals. Business households and business individuals must pay the extended tax amount in this clause no later than December 30 of this year.

Regarding land rent, the Government decided to extend the deadline for land rent payment for 50% of the land rent payable in 2024 of enterprises, organizations, households and individuals eligible for extension who are directly leasing land from the State according to the Decision or Contract of the competent State agency in the form of annual land rent payment. The extension period is 2 months from October 31.

This Decree takes effect from June 17 to December 31. After the extension period as prescribed above, the deadline for paying taxes and land rents shall be implemented according to current regulations .

Source: https://www.nguoiduatin.vn/chinh-phu-gia-han-nop-thue-thu-nhap-ca-nhan-vat-tien-thue-dat-a668897.html

![[Photo] Prime Minister Pham Minh Chinh chairs conference on anti-smuggling, trade fraud, and counterfeit goods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/14/6cd67667e99e4248b7d4f587fd21e37c)

Comment (0)