USD exchange rate today 02/19/2025: The USD increased in value compared to major currencies as peace talks between Russia and Ukraine stalled.

USD exchange rate today 02/19/2025

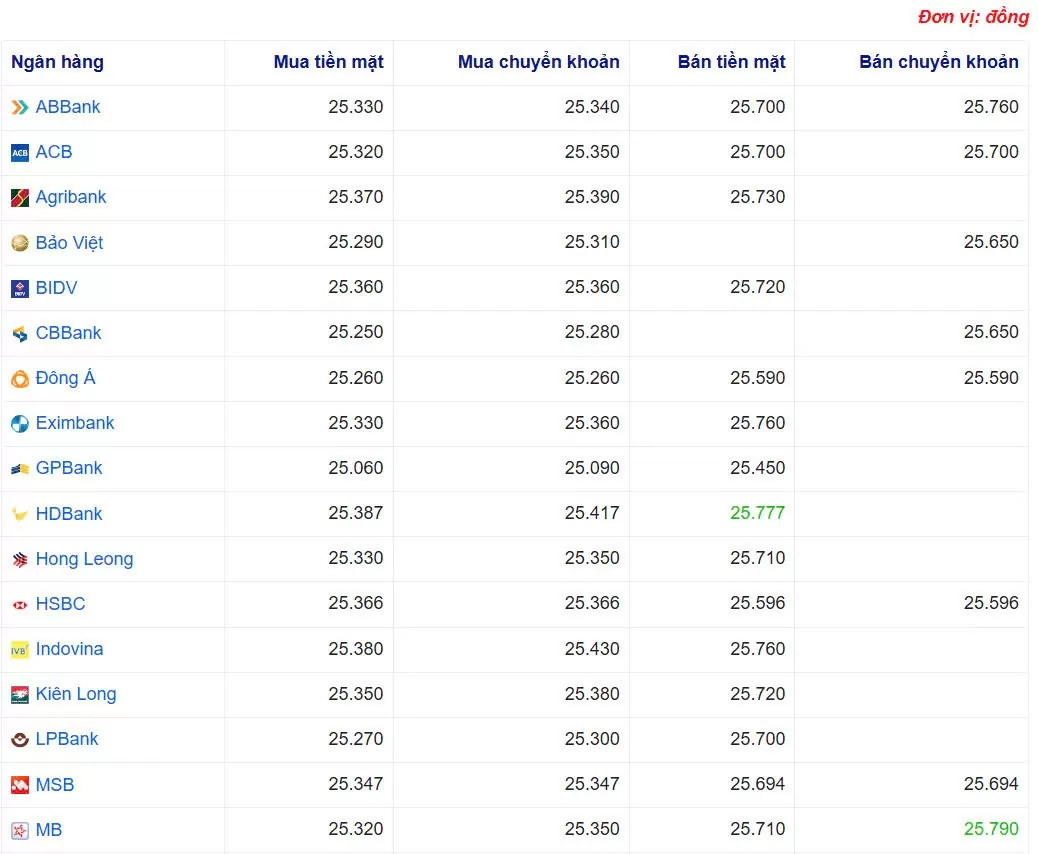

At the time of survey at 4:00 a.m. on February 19, the central exchange rate at the State Bank was currently 24,602 VND/USD, an increase of 25 VND compared to yesterday's trading session.

Specifically, at Vietcombank, the USD exchange rate is 25,310 - 25,700 VND/USD, an increase of 60 VND for buying and selling compared to yesterday's trading session.

TPB Bank is buying USD cash at the lowest price: 1 USD = 24,390 VND

TPB Bank is buying USD transfers at the lowest price: 1 USD = 24,430 VND

OCB Bank is buying USD cash at the highest price: 1 USD = 25,410 VND

VietinBank is buying USD transfers at the highest price: 1 USD = 25,549 VND

TPB Bank is selling USD cash at the lowest price: 1 USD = 24,870 VND

VIB Bank is selling USD transfers at the lowest price: 1 USD = 25,525 VND

HDBank is selling USD cash at the highest price: 1 USD = 25,777 VND

MB Bank is selling USD transfers at the highest price: 1 USD = 25,790 VND

|

| USD exchange rate at some banks today. Source Webgia.com |

| 1. Agribank - Updated: February 19, 2025 09:00 - Time of website supply source | ||||

| Foreign currency | Buy | Sell | ||

| Name | Code | Cash | Transfer | |

| USD | USD | 25,320 | 25,340 | 25,680 |

| EUR | EUR | 26,114 | 26,219 | 27,316 |

| GBP | GBP | 31,562 | 31,689 | 32,679 |

| HKD | HKD | 3,215 | 3,228 | 3,335 |

| CHF | CHF | 27,671 | 27,782 | 28,664 |

| JPY | JPY | 163.85 | 164.51 | 171.69 |

| AUD | AUD | 15,871 | 15,935 | 16,457 |

| SGD | SGD | 18,659 | 18,734 | 19,271 |

| THB | THB | 738 | 741 | 773 |

| CAD | CAD | 17,642 | 17,713 | 18,231 |

| NZD | NZD | 14,249 | 14,748 | |

| KRW | KRW | 16.93 | 18.69 | |

| 2. Sacombank - Updated: 12/22/2005 07:16 - Time of website source | ||||

| Foreign currency | Buy | Sell | ||

| Name | Code | Cash | Transfer | |

| USD | USD | 25335 | 25335 | 25695 |

| AUD | AUD | 15829 | 15929 | 16497 |

| CAD | CAD | 17621 | 17721 | 18276 |

| CHF | CHF | 27821 | 27851 | 28725 |

| CNY | CNY | 0 | 3468 | 0 |

| CZK | CZK | 0 | 1005 | 0 |

| DKK | DKK | 0 | 3540 | 0 |

| EUR | EUR | 26190 | 26290 | 27165 |

| GBP | GBP | 31659 | 31709 | 32830 |

| HKD | HKD | 0 | 3280 | 0 |

| JPY | JPY | 164.89 | 165.39 | 171.91 |

| KHR | KHR | 0 | 6,032 | 0 |

| KRW | KRW | 0 | 17.2 | 0 |

| LAK | LAK | 0 | 1,142 | 0 |

| MYR | MYR | 0 | 5890 | 0 |

| NOK | NOK | 0 | 2265 | 0 |

| NZD | NZD | 0 | 14285 | 0 |

| PHP | PHP | 0 | 414 | 0 |

| SEK | SEK | 0 | 2340 | 0 |

| SGD | SGD | 18619 | 18749 | 19470 |

| THB | THB | 0 | 702.8 | 0 |

| TWD | TWD | 0 | 775 | 0 |

| XAU | XAU | 8900000 | 8900000 | 9150000 |

| XBJ | XBJ | 8000000 | 8000000 | 9150000 |

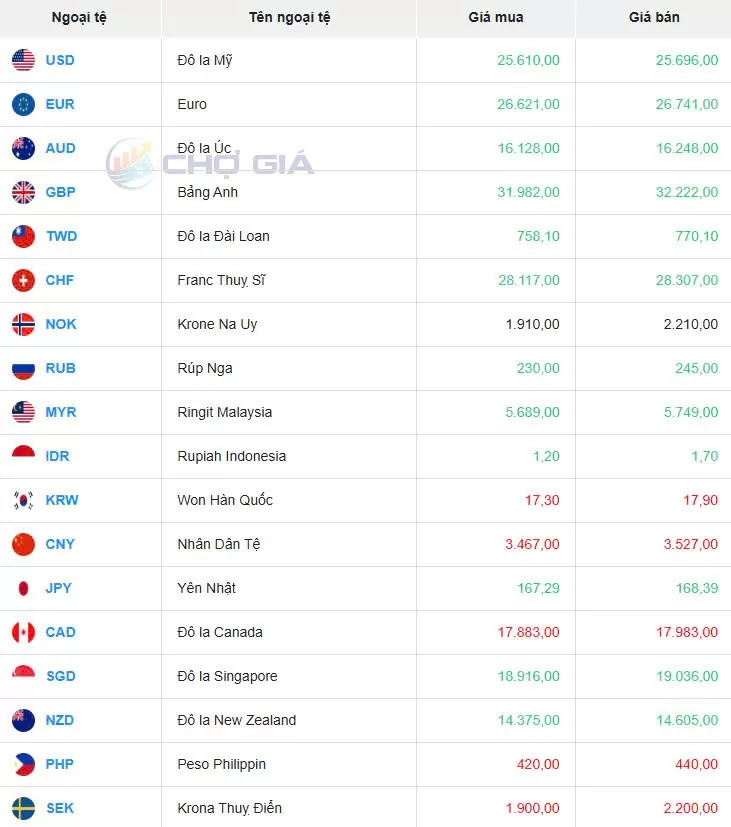

In the "black market", the black market USD exchange rate as of 4:00 a.m. on February 19, 2025, increased by 10 VND for buying and decreased by 4 VND for selling compared to yesterday's trading session, trading around 25,610 - 25,696 VND/USD.

|

| Black market on February 19, 2025. Photo: Chogia.vn |

USD exchange rate today February 19, 2025 on the world market

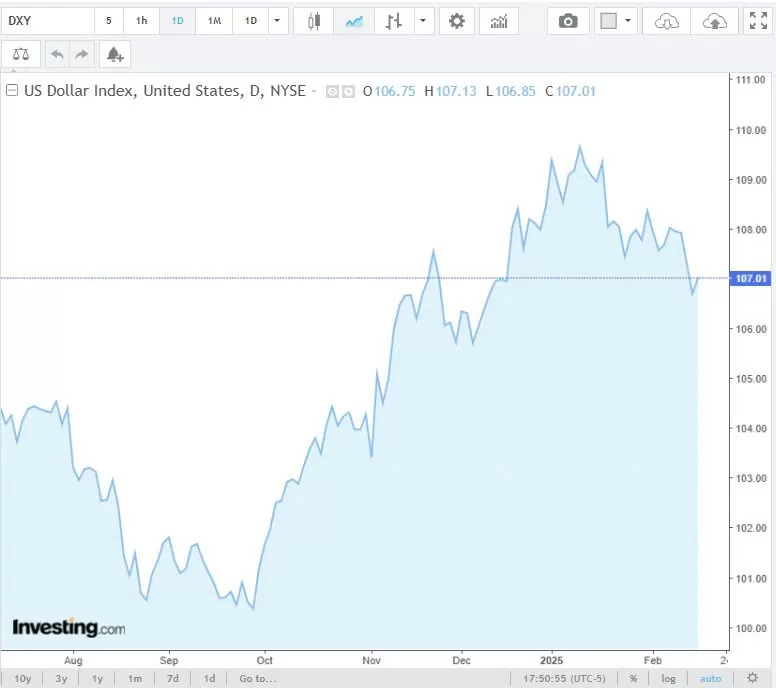

The Dollar Index (DXY), which measures the USD against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF), stopped at 107.01 - up 0.25 points compared to February 18, 2025.

|

| DXY index developments in recent times. Source Investing |

The dollar rose against major currencies on Tuesday, led by gains against the euro, thanks to safe-haven demand amid tariff concerns and tense negotiations over the Russia-Ukraine conflict.

Meanwhile, the Australian dollar initially held at a two-month high after the Reserve Bank of Australia cut interest rates, its first since the pandemic in 2020, but warned of further cuts. But widespread USD buying amid global geopolitical tensions has temporarily eroded support for the Aussie currency.

Traders are keeping an eye on talks in Saudi Arabia between US and Russian officials on Tuesday aimed at ending the Ukraine war.

Ukrainian President Volodymyr Zelenskiy said no peace deal could be struck behind his back. He postponed a visit to Saudi Arabia scheduled for Wednesday until March 10 to avoid “legitimizing” talks between the United States and Russia.

“The dollar will remain a safe haven amid uncertainty and what appears to be a chaotic effort to end a very tragic and costly conflict,” said Juan Perez, director of trading at Monex USA in Washington.

“The market seems to be so concerned about the chilly relations between the US and the EU (European Union) that the meeting between US and Russian leaders in Saudi Arabia did not include EU officials. This casts doubt on any initial enthusiasm that might have been generated by the possibility that Ukraine and Russia would find common ground and thus bring about a better economic situation for all concerned,” added Juan Perez.

The euro fell 0.4 percent to $1.0447 in afternoon trading, falling for a second straight session. Last week, the euro rose to a two-week high on hopes of a peace deal.

However, on Tuesday, Russia toughened its demands for a peace deal, insisting NATO had not kept a promise made at a summit in Bucharest in 2008 that Ukraine would join at an unspecified future date.

Meanwhile, US President Donald Trump has threatened to impose new tariffs on the EU over the bloc's trade surplus with the US, in an increasingly bellicose move that economists say could trigger a global economic downturn.

Against the yen, the dollar rose 0.3% to 151.95. Earlier, the dollar had pared gains after data showed U.S. homebuilder sentiment fell to a five-month low in February on concerns that tariffs would combine with higher mortgage rates to push up housing costs further.

The National Association of Home Builders/Wells Fargo Housing Market Index fell five points to 42 this month, its lowest level since September.

The yen has retreated after recent gains, boosted by strong growth data that increased the likelihood the Bank of Japan will raise interest rates once more this year, with its in-person meeting taking place in July rather than in the October-December period.

Japan’s solid October-December GDP data on Monday, along with recent inflation figures, helped lift the yen. The yen has gained 3.5% against the dollar so far in 2025.

The pound fell 0.2% to $1.2598, weighed down by a stronger dollar despite data showing UK wage growth is accelerating.

Investors will also focus on minutes from the Federal Reserve's January meeting due to be released on Wednesday, which could show how policymakers are factoring in the risk of a broader tariff war arising from President Donald Trump's trade policies.

Data last week showed U.S. consumer prices rose at their fastest pace in nearly 18 months in January, reinforcing the Fed’s message that it is in no rush to cut interest rates further amid growing economic concerns.

According to LSEG estimates, US interest rate futures have priced in around 37 basis points (bps) of easing by 2025, compared with 41 bps late Friday using January 2026 futures. Futures also imply the Fed is likely to cut rates again at its September or October policy meeting.

The dollar index, which measures the currency's performance against six other major currencies, rose 0.3% to 107.08, not far from a two-month low of 106.56 hit on Friday.

In Australia, the RBA cut the cash rate by 25 basis points to 4.10% on Tuesday and said it was cautious about the prospect of further policy easing.

The Australian dollar fell 0.1% to $0.6349 after an initial fluctuation following the decision. The Australian dollar hit a two-month high of $0.6374 on Monday and is up 2.4% in February.

The swap implies just a 20% chance of further rate cuts in April, although that move has already been factored into the price.

|

| USD exchange rate today February 19, 2025. Illustration photo |

Refer to the popular addresses for Foreign Currency Exchange - Buying and Selling USD in Hanoi: 1. Quoc Trinh Ha Trung Gold Shop - No. 27 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 2. Gold and Silver Fine Arts - No. 31 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 3. Minh Chien Gold and Silver Store - No. 119 Cau Giay, Cau Giay District, Hanoi 4. Thinh Quang Gold and Silver Company - No. 43 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 5. Toan Thuy Store - No. 455 Nguyen Trai, Thanh Xuan, Hanoi and No. 6 Nguyen Tuan, Thanh Xuan District, Hanoi 6. Bao Tin Minh Chau Gold, Silver and Gemstones - No. 19 Tran Nhan Tong, Hai Ba Trung District, Hanoi 7. Chinh Quang Store - No. 30 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 8. Kim Linh 3 Store - No. 47 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 9. Huy Khoi Store - No. 19 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 10. System of transaction offices at banks such as: Sacombank, VietinBank, Vietcombank, SHB Refer to the popular addresses for Foreign Currency Exchange - Buying and Selling USD in Ho Chi Minh City: 1. Minh Thu Currency Exchange - 22 Nguyen Thai Binh, District 1, HCMC 2. Kim Mai Gold Shop - 84 Cong Quynh, District 1, HCMC 3. Kim Chau Gold Shop - 784 Dien Bien Phu, Ward 10, District 10. Ho Chi Minh City 4. Saigon Jewelry Center - 40-42 Phan Boi Chau, District 1, HCMC 5. Kim Hung foreign currency exchange agency - No. 209 Pham Van Hai, Binh Chanh, Ho Chi Minh City 6. DOJI Jewelry Store - Diamond Plaza Le Duan, 34 Le Duan, Ben Nghe, District 1, HCMC 7. Kim Tam Hai Shop - No. 27 Truong Chinh, Tan Thoi Nhat Ward, District 12, HCMC 8. Bich Thuy Gold Shop - No. 39 Pham Van Hai Market, Ward 3, Tan Binh District, HCMC 9. Ha Tam Gold Shop - No. 2 Nguyen An Ninh, Ben Thanh Ward, District 1, HCMC 10. System of transaction offices at banks in Ho Chi Minh City such as: Sacombank, VietinBank, Vietcombank, SHB, Eximbank |

Source: https://congthuong.vn/ty-gia-usd-hom-nay-19022025-chi-so-usd-phuc-hoi-374498.html

Comment (0)