Since taking over as CEO of Sacombank, Ms. Nguyen Duc Thach Diem has led the bank through a difficult period. Under her leadership, Sacombank has recorded continuous growth in business results.

Top 100 most powerful businesswomen in AsiaThe US magazine Fortune recently announced the list of 100 most powerful women in the Asia-Pacific region in 2024 with the participation of many female entrepreneurs from 11 countries, in many fields, from finance, energy, transportation, food, beverage, restaurants, hotels...

Among them were 3 Vietnamese representatives including Ms. Nguyen Thi Phuong Thao - Chairwoman of the Board of Directors of VietJet Air, Ms. Mai Kieu Lien, General Director of Vinamilk and Ms. Nguyen Duc Thach Diem - General Director of Saigon Thuong Tin Commercial Joint Stock Bank ( Sacombank ).

Ms. Nguyen Duc Thach Diem was born in 1973 and started working at Sacombank in 2002. According to the introduction on Sacombank's website, Ms. Diem has held positions in the fields of accounting, credit, customer service, corporate customers, internal control and debt settlement.

She has 11 years of experience in management and operations at Transaction Offices, Branch Operations Departments, Ho Chi Minh City Regional Office, the entire South Central and Central Highlands Region, and the entire Sacombank system.

Ms. Nguyen Duc Thach Diem - Vice Chairman of the Board of Directors and General Director of Sacombank.

Sacombank officially appointed Ms. Nguyen Duc Thach Diem as Acting General Director from July 3, 2017.

Before being appointed as Acting General Director, Ms. Diem was Deputy General Director in charge of debt settlement activities - one of the key activities that Sacombank is focusing on implementing according to the orientation of the post-merger bank restructuring project approved by the State Bank.

In 2022, she was reappointed to the above position for a period of 5 years. In addition, she has also held the role of Permanent Vice Chairwoman of the Board of Directors of Sacombank for the 2022-2026 term since April 2022.

Holding many important positions at Sacombank, however, Ms. Diem does not own many shares in this bank. According to the management report for the first 6 months of 2024, Ms. Diem currently owns 76,320 shares, equivalent to 0.004% of the bank's charter capital.

With the closing stock price on October 15 being 33,700 VND/share, the estimated assets of Sacombank CEO are around 2.6 billion VND.

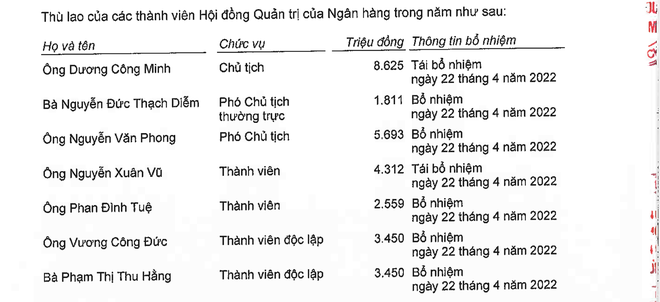

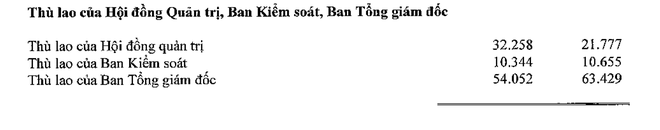

At Sacombank, the income of this female general is still a mystery. At the end of the first half of 2024, in the financial statement, Sacombank only provided general information about the remuneration of the Board of Directors as 54 billion VND.

In previous years, except for 2023, when Sacombank announced the remuneration of each member of the Board of Directors, the income of the members of the bank's Board of Directors has not been disclosed.

Steering the Sacombank ship "riding the wind, cutting through the waves"Regarding Sacombank's business situation, Ms. Nguyen Duc Thach Diem was assigned the responsibility of General Director at a time when the bank was gradually entering the post-merger restructuring phase with many internal difficulties.

In the five years since Ms. Diem became CEO, the bank has recovered and handled VND71,992 billion of bad debts and outstanding assets, of which VND58,306 billion are project items, reaching 67.9% of the overall plan until 2025. The bad debt ratio, including unprocessed debt sold to VAMC, is at 6.71%, down 15.06% compared to 2016.

At the 2024 Annual General Meeting of Shareholders, Sacombank's leaders informed that in 2023, the bank recovered and handled VND 7,941 billion in bad debts and outstanding assets, of which VND 4,487 billion was part of the Post-merger Restructuring Project. At the same time, the bank also successfully auctioned the debt of the Phong Phu Industrial Park project, successfully recovering 20% of the value.

At the end of June 2024, Sacombank's total bad debt was VND 12,548 billion, an increase of 14.2% compared to the end of 2023. As a result, the bad debt ratio increased from 2.28% last year to 2.43%.

From 2017 to present, the value of special bonds issued by VAMC by banks has also decreased sharply from VND 43,267 billion to VND 16,433 billion at the end of June 2024.

Under Ms. Nguyen Duc Thach Diem, Sacombank's total assets also increased sharply from more than VND 368,000 billion to VND 717,313 billion in the first 3 months of 2024. Of which, customer loans were VND 516,635 billion, up 7%. Customer deposits increased by 7.5% compared to 2023 to VND 549,184 billion.

Besides, the bank's profit also increased from VND 1,182 billion in 2017 to VND 7,719 billion by the end of 2023.

Over the past 6 years, the bank's net interest income has also increased from over VND 5,000 billion to over VND 11,000 billion in 2020.

After that, Sacombank always recorded net interest income of over 11,000 billion VND and in 2023 it was 22,072 billion VND.

In the first 6 months of 2024, Sacombank recorded a 4.1% increase in net interest income to VND 12,067 billion. The bank reported pre-tax net profit of VND 5,342 billion; after-tax profit of VND 4,288 billion, an increase of 12.1% compared to the first 6 months of 2023.

In 2024, Sacombank's annual general meeting of shareholders approved the business plan with expected pre-tax profit at VND 10,600 billion, an increase of 10% compared to 2023. Thus, by the end of the second quarter of 2024, the bank had completed 50% of its profit target.

Source: https://www.nguoiduatin.vn/chan-dung-ba-nguyen-duc-thach-diem-bong-hong-quyen-luc-sacombank-204241015165914047.htm

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

![[Photo] Prime Minister Pham Minh Chinh meets with the Policy Advisory Council on Private Economic Development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/387da60b85cc489ab2aed8442fc3b14a)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

![[Photo] General Secretary To Lam begins official visit to Russia and attends the 80th Anniversary of Victory over Fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/5d2566d7f67d4a1e9b88bc677831ec9d)

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)