Shares of many coffee companies are being continuously sought after by investors, with some codes increasing a total of more than 43% in just a few sessions.

Sharp increase in coffee prices helps farmers make big profits, but also poses many challenges for businesses - Photo: BONG MAI

Domestic coffee prices in the Central Highlands provinces such as Gia Lai, Dak Lak, and Lam Dong are still high today, fluctuating between 130,300 - 132,000 VND/kg, equivalent to a 10% increase compared to the beginning of the year and an increase of 65% compared to the same period last year.

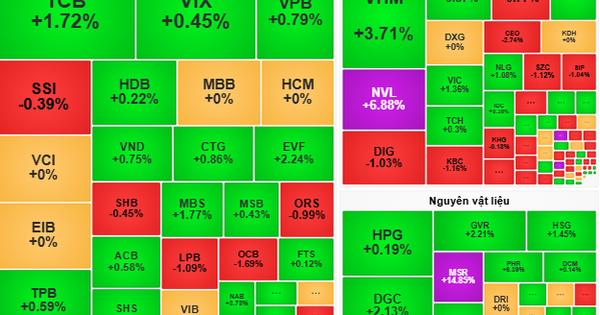

Currently, the stock prices of many coffee companies are also skyrocketing, surrounded by green growth and purple ceiling growth on the UPCoM floor.

Coffee stock price increased by 15%/session

As soon as the trading session opened today (February 18), the stock code CFV of Thang Loi Coffee Joint Stock Company immediately received attention, then increased by nearly 15% to the price of 33,800 VND/share.

While at the beginning of the week, the company's stock also received purple. Thus, in just the last three sessions, CFV code has increased by a total of nearly 35%, despite being in the warning zone.

Joy also came to investors in shares of PETEC Coffee Joint Stock Company (code PCF), when today's price also increased by approximately 15%, reaching VND7,100/share. This contributed to the PCF code increasing by a total of about 43% in the past four sessions.

As a prominent enterprise in Dak Lak, Ea Pok Coffee Joint Stock Company specializes in planting, producing and processing coffee for export, producing and consuming organic microbial fertilizers, purchasing and processing coffee for export...

On the stock exchange, in contrast to the developments at the beginning of the week, today the company's EPC code reversed and increased by a full 15%, reaching the price of 11,500 VND/share.

Losses before big fluctuations, expectations for a more stable 2025

Coffee prices have suddenly increased sharply in the past two years, helping many farmers to prosper, pay off debts and become rich. However, with unpredictable market developments, many businesses that purchase raw materials to process and export coffee have fallen into difficult situations, even suffering losses.

Being in the top 10 leading coffee exporting enterprises in the country, PETEC Coffee Joint Stock Company commented: The coffee industry in particular has always been a strategy of Vietnam for many years, the planting area continues to increase, the demand is high and continues to increase.

Regarding business performance, last year the company brought in nearly 27 billion VND in revenue (-87% compared to the same period last year), while after-tax profit was only nearly 61 billion VND (-71%). In addition to coffee trading, the company also trades in pepper, cashew nuts, gasoline, etc.

As of the end of last year, PETEC Coffee's assets had decreased to 24.5 billion VND, liabilities had also decreased to 3.2 billion VND, while equity reached more than 21.2 billion VND.

With nearly 50 activities in the field of coffee planting, processing, purchasing and exporting, in 2024 Phuoc An Coffee Joint Stock Company (stock code CPA) recorded revenue of more than 30.3 billion VND (+34%). However, after deducting cost of goods sold and expenses, the company suffered a net loss after tax of nearly 17 billion VND, mostly due to the loss in the last quarter of the year.

According to the explanation of Ms. Nguyen Huyen Tram - General Director of Phuoc An Coffee - sent to the securities market management agency in early 2025, the reason for the loss in the last quarter of last year was due to increased provisions for bad debts for households with contract deficits in previous coffee crops. In addition, other incomes also decreased.

At the end of last year, the company had assets of more than 107 billion VND, liabilities of more than 66 billion VND, and equity of nearly 41 billion VND.

At the beginning of 2025, Mr. Nguyen Cong Tien - General Director of Gia Lai Coffee Joint Stock Company (code FGL) - also had to explain to the stock market management agency.

Specifically, the company said that in the last quarter of last year, the price of green coffee beans increased dramatically, reaching 131,000 VND, a record price in the past 27 years.

Therefore, after deducting management costs, financial costs, etc., the company still retains nearly 4 billion VND in after-tax profit, an improvement compared to the previous negative level.

At the end of the year, Gia Lai Coffee Joint Stock Company achieved revenue of nearly 16 billion VND (+40%). However, after deducting the cost of goods sold and expenses, the company suffered a net loss after tax of more than 18 billion VND. By the end of the most recent year, this company had assets of approximately 118 billion VND, liabilities of about 94 billion VND, while equity was 24 billion VND.

In the first month of 2025, coffee export value increased

According to data from the Vietnam Coffee - Cocoa Association, coffee bean exports in the first month of 2025 reached nearly 137,600 tons, with a value of nearly 695 million USD.

Although down about 38% in volume, it increased approximately 9% in value compared to the same period last year. Vietnamese coffee is mainly exported to Germany, Italy, Spain...

Source: https://tuoitre.vn/ca-phe-cao-gia-keo-dai-co-phieu-cong-ty-cung-tang-dinh-noc-kich-tran-20250218165311659.htm

Comment (0)