Bao Viet Commercial Joint Stock Bank (BVBank - HNX: BVB) has just sent a document to the State Securities Commission on the results of the first public bond offering in 2024 - 2025 from August 8 to September 10, 2024.

Accordingly, the bank has just finished offering 15 million bonds in the first phase with a term of 6 years, the first year interest rate is 7.9%/year. The offering price is 100,000 VND/bond.

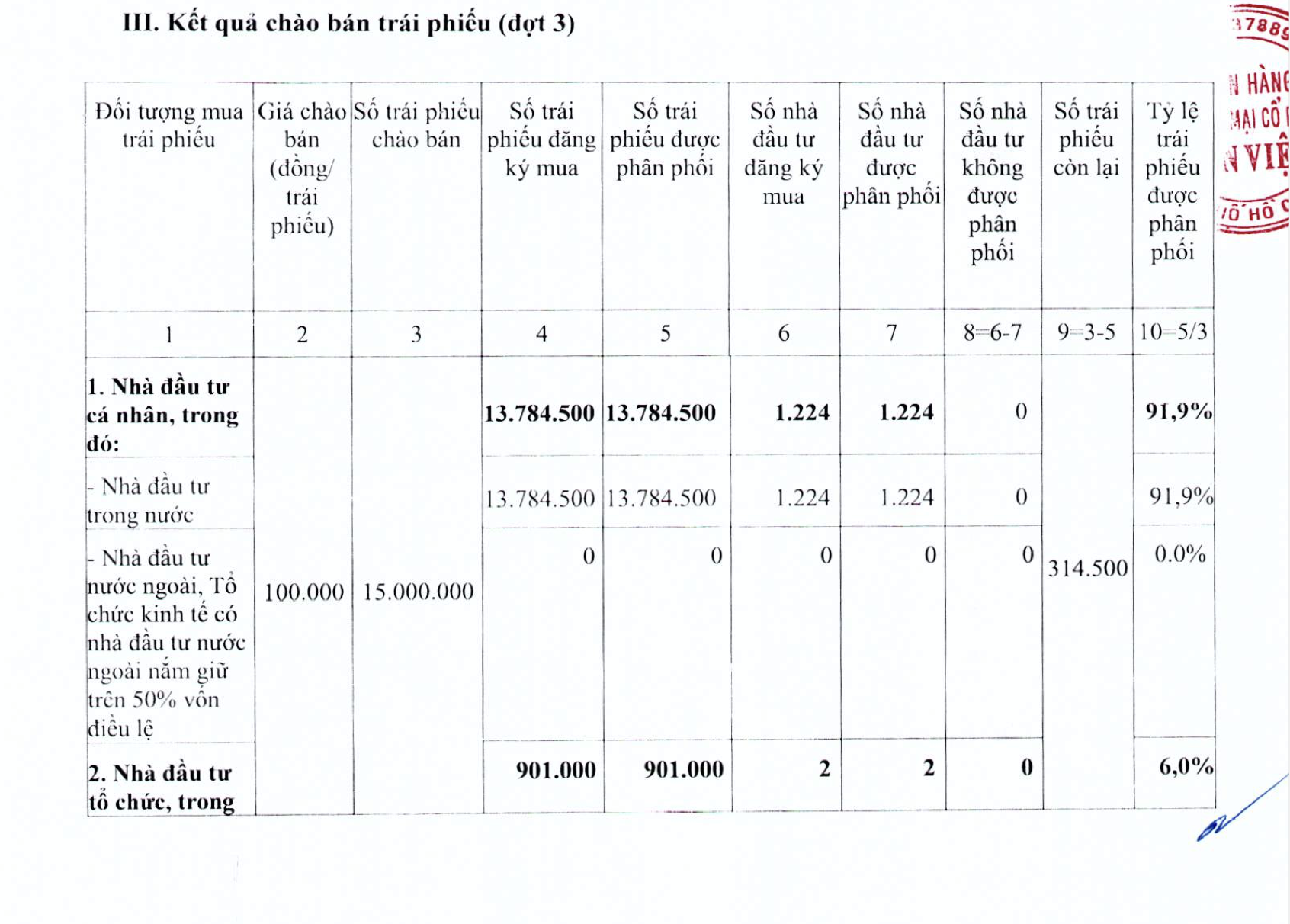

Specifically, BVBank distributed nearly 14.7 million bonds, equivalent to 97.9% of the total bonds offered to 1,226 investors.

BVBank bond offering results.

Of which, nearly 13.8 million bonds were distributed to 1,224 domestic individual investors, a distribution rate of 91.9%, and 901,000 bonds were distributed to 2 domestic institutional investors, a rate of 6%. The remaining bonds are 314,500 bonds.

The total amount of money BVBank collected from the bond offering was over VND1,468.5 billion. After deducting expenses, the total net revenue from the offering of the bank was VND1,468 billion. BVBank plans to transfer the bonds within 30 days from the end of the offering.

In early August, BVBank also announced its public bond offering in 2024 - 2025.

Accordingly, the bank plans to offer VND5,600 billion worth of bonds in 6 batches to the market between October 2024 and February 2026 with a maximum term of 8 years. The offering price is VND100,000/bond.

This is a non-convertible, unsecured bond, which is a secondary debt and meets the conditions to be included in Tier 2 capital according to current law.

The minimum subscription quantity for individual investors is 100 bonds or multiples of 100 bonds. For institutional investors, it is 1,000 bonds or multiples of 1,000 bonds.

According to BVBank, the purpose of issuing bonds is to increase medium-term capital to serve business activities, meet the operational safety ratio and credit needs of the economy .

Source: https://www.nguoiduatin.vn/bvbank-phan-phoi-gan-147-trieu-trai-phieu-cho-hon-1200-nha-dau-tu-204240917100636076.htm

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on science and technology development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/ae80dd74c384439789b12013c738a045)

![[Photo] Readers line up to visit the photo exhibition and receive a special publication commemorating the 135th birthday of President Ho Chi Minh at Nhan Dan Newspaper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/85b3197fc6bd43e6a9ee4db15101005b)

![[Photo] More than 17,000 candidates participate in the 2025 SPT Competency Assessment Test of Hanoi National University of Education](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/e538d9a1636c407cbb211b314e6303fd)

![[Photo] Nearly 3,000 students moved by stories about soldiers](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/21da57c8241e42438b423eaa37215e0e)

Comment (0)