The Hindu reported on May 31 that according to its annual report for fiscal year 2024, as of the end of March, the RBI held 822.1 tonnes of gold, with 413.8 tonnes stored overseas. The withdrawal of more than 100 tonnes of gold from the UK has balanced India's domestic and foreign gold reserves.

The Times of India on May 31 quoted Indian officials as saying that the country will withdraw more gold from foreign reserves in the coming months, citing reasons such as ensuring logistics and diversifying storage sources.

Gold bars at a jewelry store in Chandigarh, India

The Reserve Bank of India is among the world's central banks that have been active gold buyers in recent years, with the agency set to buy an additional 27.5 tonnes of gold by fiscal 2024. For many countries, the UK is considered a traditional gold reserve.

According to Reuters, central banks around the world are increasing their gold reserves, which are seen as a commodity that can keep prices stable in the face of currency fluctuations and geopolitical risks.

Gold is a sensitive issue for many Indians, especially after the government of the late Prime Minister Chandra Shekhar had to pledge part of its gold reserves to deal with the 1991 foreign exchange crisis, forcing the country to transfer gold to foreign reserves. Currently, domestic gold is stored in vaults in the cities of Mumbai and Nagpur.

In 2009, India bought 200 tonnes of gold from the International Monetary Fund (IMF), and then continued to buy gold from the secondary market to diversify its foreign exchange holdings. "This shows the strength of the Indian economy and its confidence, in stark contrast to the situation in 1991," a source told the Times of India .

Source: https://thanhnien.vn/an-do-rut-100-tan-vang-tu-anh-ve-kho-du-tru-trong-nuoc-185240601192729633.htm

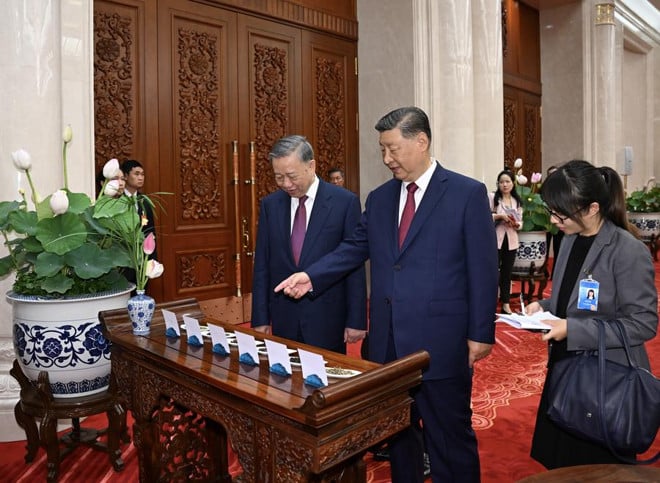

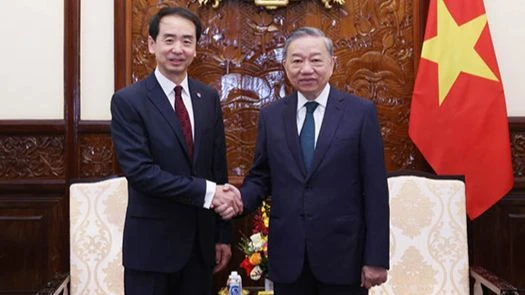

![[Photo] General Secretary To Lam holds talks with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/b3d07714dc6b4831833b48e0385d75c1)

![[Photo] Prime Minister Pham Minh Chinh meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/893f1141468a49e29fb42607a670b174)

![[Photo] National Assembly Chairman Tran Thanh Man meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/4e8fab54da744230b54598eff0070485)

![[Photo] Reception to welcome General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9afa04a20e6441ca971f6f6b0c904ec2)

Comment (0)