AI will change the banking and finance industry in the direction of optimizing costs and improving customer experience, according to experts at the AI Workshop on September 21.

The discussion took place within the framework of the first AI Workshop with the theme "AI Applications in the Financial Sector". The Workshop is the kick-off program for the Vietnam Artificial Intelligence Day (AI4VN 2023).

Discussing the impact of AI in the financial sector, Mr. Le Dang Ngoc - Deputy Director of Artificial Intelligence Platform, Viettel Cyberspace Center and Dr. Nguyen Huu Huan - Head of Financial Market Department, Ho Chi Minh City University of Economics (UEH) answered many questions from the audience.

Mr. Le Dang Ngoc (middle) and Dr. Nguyen Huu Huan (right) at the discussion of the first AI Workshop. Photo: Ha An

The first question discussed the practical application of AI in the financial sector. Mr. Le Dang Ngoc said that AI helps improve the core competencies of units. With many years of working in foreign markets such as Laos, Peru..., he saw that major Vietnamese banks are present here with a high level of competition. From his assessment, most domestic banks are racing in the field of AI to increase competitiveness, solve problems of improving experience from registration to use and cancellation of services - how to attract them to come back, optimize business processes.

Agreeing with Mr. Ngoc, Dr. Huan analyzed that banks are the leading economic sectors, so they quickly approach new technology. AI is currently creating waves globally. When this wave started to explode domestically, banks immediately jumped in. Banks all have digital transformation departments - digital banking, in which there is an AI department. "Banks compete with each other in technology because being the leader in AI means that unit has a certain competitive advantage," he emphasized.

Along with that, the models that Vietnamese banks apply are also global trends. Viettel Cyberspace leaders gave an example, in increasing the experience, Vietnam has eKYC, which means users can sit at home without having to go to the counter to do procedures. Or another application such as chatbots that automate customer consultation, so smart that users cannot distinguish whether it is AI or human. In addition, there are models that aggregate data into potential groups, optimize business processes, and OCR to request insurance compensation. Previously, signing documents required a signature on a hard copy, now banks automate on digital channels, all business processes are more optimized.

Mr. Le Dang Ngoc analyzed that AI will enhance the core competencies of units. Photo: Ha An

Dr. Huan added that AI helps increase the experience and satisfaction. Previously, calling the hotline and waiting to meet a consultant made many users frustrated. For example, when they lost their bank card, they called to block it, but the operator was busy and it took 30 minutes to connect. When AI is applied, these pains will no longer exist, the system can chat and handle problems for dozens of people at the same time.

AI also tracks customer behavior, knows their spending habits, and what they interact with to suggest corresponding services. For example, when customers are short of money, the system suggests preferential interest rate loans. Personalized products for each user, increasing the rate of cross-selling products.

From those benefits, both experts pointed out many practical experiences for businesses to strive for innovation. The most optimal is to combine internal resources and hire consultants.

Specifically, according to Mr. Ngoc, to increase competitiveness, businesses should hire consultants from the beginning to optimize and build models. Units such as Viettel, FPT, VNPT all have a team of experts with many years of experience to map out the right roadmap from the beginning.

Technology companies have experienced human resources and infrastructure. For example, to train AI, you need a system, have high-value GPUs, and need to invest a lot of financial resources. Collecting and labeling data is very expensive. For example, when optimizing facial recognition, you also need to train on data of millions of users. Mr. Ngoc gave an example in the African market, their faces have differences in hair and skin color, so they have to optimize everything and prepare the data.

Dr. Huan analyzed that financial enterprises will not have a deep technology foundation like technology giants. However, their advantage is huge data and they want to exploit it, taking care of each customer. A concern from financial units is that hiring a third party can lead to a state of dependence, unable to update the model as desired. To reconcile, banks should hire a consulting unit that has core technology, and develop internally so as not to be too dependent on a third party.

Dr. Nguyen Huu Huan advises businesses to combine internal capacity and advice from experts. Photo: Ha An

When asked about the difficulties in applying AI, experts emphasized the management and the current proliferation of deepface fraud. Mr. Ngoc said that in the past, AI was just a function, a simple regression model that gave answers from available scenarios. But now, AI is not like that, it does not answer according to the scenario. Therefore, it needs to be controlled very tightly because the bank is related to the accuracy of the numbers, an interest rate of 8% cannot be said to be 9%.

"Viettel will limit AI to learning only from clean data and only responding within that data set to ensure accuracy. In addition, there needs to be technology to prevent fraud," Mr. Ngoc emphasized.

Predicting the future, Dr. Huan believes: "AI will change the face of banking and finance in the next 5-10 years for the better, meaning lower costs, higher efficiency, and improved customer experience."

AI4VN will continue on September 22 with AI Summit and CTO Summit forums. Throughout the two days, there will be an AI Expo exhibition space with 30 booths displaying outstanding technology products.

The workshop attracted many attendees. Photo: Ha An

AI4VN 2023, with the theme "Power for Life", will take place at Riverside Palace, 360D Ben Van Don, District 4, Ho Chi Minh City. The festival is directed by the Ministry of Science and Technology, organized by VnExpress newspaper in coordination with the Club of Faculties - Institutes - Schools of Information and Communication Technology (FISU).

Minh Tu

Source link

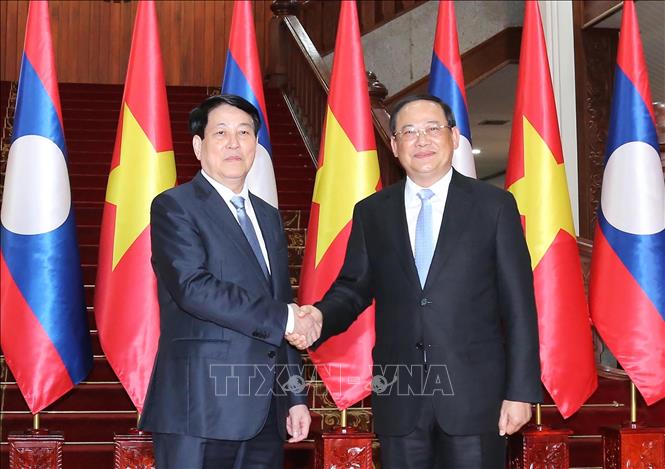

![[Photo] President Luong Cuong meets with Lao Prime Minister Sonexay Siphandone](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/25/3d70fe28a71c4031b03cd141cb1ed3b1)

![[Photo] Liberation of Truong Sa archipelago - A strategic feat in liberating the South and unifying the country](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/25/d5d3f0607a6a4156807161f0f7f92362)

![[Photo] Ho Chi Minh City welcomes a sudden increase in tourists](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/25/dd8c289579e64fccb12c1a50b1f59971)

Comment (0)