Russia has been hit with the most comprehensive sanctions in modern history, as the war in Ukraine enters its second year, alongside an ongoing economic war with Western countries over their sanctions against Moscow.

Since the start of the Russia-Ukraine war in February 2022, Western countries have imposed numerous sanctions on the Russian economy and its international trade.

The sanctions target the energy, financial, defense, logistics and aviation sectors, all of which are cornerstones of the Russian economy, as well as trade between Russia and Europe, which grew rapidly after World War II.

More than $300 billion in assets belonging to the Central Bank of Russia (CBR) and the country's major banks have been frozen and harsh restrictions have been placed on the export of vital products such as spare parts and technology.

Officials and experts alike predicted the Russian economy would collapse, but it is actually outperforming Europe and the US in 2023, growing at 3.6% despite setbacks.

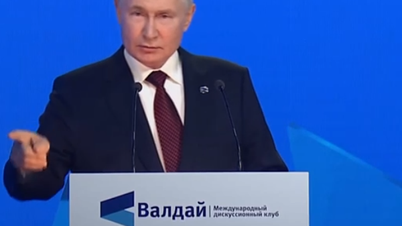

Russian President Vladimir Putin and Governor of the Central Bank of Russia (CBR) Elvira Nabiullina. Photo: WSJ

In fact, since being sanctioned by the West after annexing Crimea in 2014, Russia has been preparing to restructure its economy in a more resilient direction.

Direct imports into Russia from Europe and the US have fallen significantly, but Russia has found new suppliers mainly from Asia and the Middle East to fill the import gap.

The Eurasian giant is also actively exploring new markets, such as India, for oil and natural gas, which form the backbone of Russia's exports.

After all, much has emerged from the West's heavy sanctions on Russia.

Russia becomes the most sanctioned country in the world

According to data from Castellum.AI, an online sanctions tracking platform, the total number of sanctions imposed by Western countries on individuals and organizations in Russia since the start of the war in Ukraine has reached 18,772 as of December 15, 2023.

The US imposed the most sanctions on Russia with 3,500 sanctions, followed by Canada with 2,700 sanctions, Switzerland with 2,400 sanctions, the EU with 1,700 sanctions and the UK with 1,700 sanctions.

The EU has announced its 13th package of sanctions against Russia, while the US has imposed 500 new sanctions on the country on the second anniversary of Russian President Vladimir Putin's launch of a "special military operation" in the Eastern European country (February 24, 2022 - February 24, 2024).

Over the past period, many Western companies have also left the Russian market, suspending or significantly reducing their operations in the country.

Major Western companies that have left the Russian market so far include US-based iPhone maker Apple, Dutch aircraft manufacturer Airbus, US-based airline Boeing, global fast-food chain McDonald's, US-based coffee company Starbucks, Swedish furniture maker IKEA, UK-based oil companies BP and Shell, US-based oil company ExxonMobil, German automakers Mercedes-Benz, Japan's Nissan and France's Renault, as well as US-based F&B giant Coca-Cola.

The impact of the sanctions has been most evident in the auto market, where Chinese brands Haval, Geely and Chery have replaced the popular Toyota, Mercedes-Benz, Volkswagen and Audi brands that were the best-selling foreign brands in Russia before the conflict.

Russia sees sales of 119,000 Chery-branded cars, 112,000 Haval, 94,000 Geely, 48,000 Changan and 42,000 Omoda by 2023.

SWIFT messaging network blocked in Russia

As Moscow continues to adapt to new conditions imposed by various sanctions, issues in the banking and international payments sector are among the biggest headaches for the Russian government.

Western countries decided to block Russian banks from the SWIFT messaging system, which is used to send and receive money internationally. The sanctions were imposed on Russia from the first days of the war.

Russia continues to face various difficulties in the banking sector after two years of being besieged by sanctions, with restrictions on the use of euros and dollars by the Central Bank and other banks in Russia.

Like banks in India and the United Arab Emirates (UAE), China's top banks have recently imposed payment restrictions with Russia over concerns about secondary sanctions.

Russia developed SPFS (System for Financial Message Transfer) as an alternative to SWIFT and with its increasing use, the authorities continue to look for additional solutions to overcome the problems in the banking system, as SPFS is still not internationally accepted.

Despite various statements by the Russian authorities regarding the use of cryptocurrencies in international payments, no official decision has been made, while the use of the national currency in trade remains on the agenda.

Red Square seen from the GUM store (right) and the Historical Museum (left). Photo: Russia Beyond

Russia and China have managed to increase the share of the Chinese yuan and the Russian ruble in their trade to as high as 90%, while a similar trend is observed in trade with India. But the potential threat of secondary sanctions does not help to solve the problems in the banking sector.

Central Bank of Russia (CBR) Governor Elvira Nabiullina said on February 16 that the CBR is aware of the recent increase in problems related to international payments and is holding consultations with all parties to find a solution.

Ms. Nabiullina noted that no specific solution has been found yet as they believe that digital financial assets as well as independent infrastructure for money transfers are promising options to solve problems in the banking sector.

The female governor also warned Russia not to underestimate the pressure from Western sanctions because sanctions against Russia could be strengthened when the economy is at risk of overheating.

The process of “de-dollarization” continues.

The issue of trade in national currencies, which seems to be one of the most important ways to minimize the risk of sanctions, is currently a hot topic on Russia's agenda.

The share of the Russian ruble in the country's trade with Europe increased from 43.6% to 49% compared to 2022, while it increased from 20.5% to 24% in trade with Asia, and from 21.9% to 48.1% in trade with Africa, according to data from CBR.

The share of the US dollar and the euro in Russia's total exports fell from 86.9% to 26.7%, while the share of the ruble increased from 12.2% to 36.1%, and the share of currencies of “friendly countries” increased from 0.9% to 37.2% over the same period.

The share of the US dollar in national reserves is set to reach zero in 2021, the shares of the British pound and the Japanese yen will also reach zero in 2022, and the share of the euro will do the same by the end of 2023.

The liquid assets of Russia’s National Wealth Fund (NWF) have fallen by $58 billion, or more than half, since Mr Putin ordered troops into Ukraine two years ago. The fund no longer has any US dollars, but instead only Russian rubles, Chinese yuan and gold.

As of February 16, Russia's total international reserves stood at $574 billion.

Gas pipelines from Russia to China, of which Power of Siberia is operating and Power of Siberia 2 is still in the process of negotiating prices. Photo: Table Media

Asia becomes new destination for Russian energy

As one of the world's largest exporters of natural gas, Russia has had the largest energy market since World War II, but it has lost significant market share in Europe following the war in Ukraine.

As Russia's energy market share in important markets such as Germany, Italy and the UK has been zero or has fallen significantly, the country has turned to Asian markets, especially China and India, to continue investing to make up for the losses.

In 2023, 22.7 billion cubic meters of Russian gas were transported via the Power of Siberia pipeline. The pipeline currently transports gas to China, and its capacity is expected to increase to 38 billion cubic meters by 2025.

Russia is also ramping up investment in liquefied natural gas (LNG), which has more flexibility in accessing export markets than pipeline gas, as its planning continues for the Power of Siberia 2 pipeline running from Russia through Mongolia to China.

Russian Deputy Prime Minister Alexander Novak said the country will produce 33 million tonnes of LNG by 2023 and aims to expand capacity to 110 million tonnes per year by 2030.

Meanwhile, the EU's import of 17.8 billion m3 of LNG from Russia in 2023, an increase of 31.9% compared to 2021, is noteworthy.

Russia accounted for 2% of India's oil imports before the Ukraine conflict, but its share reached 30% by 2023, making Russia India's largest oil supplier.

Whether the transition in Russia's energy sector will be successful in the medium and long term depends on a number of factors, such as the global economy, sanctions and infrastructure investments, experts say.

Since Russia needs time and investment to expand pipelines and infrastructure to increase trade with Asia, the possibility of a global economic downturn could reduce overall demand for Russian exports.

According to data released by the Russian government on February 6, the country's oil exports fell 3.3% compared to the same period in 2023, while natural gas exports via pipeline also fell 29.9% .

Minh Duc (According to Anadolu, Eurasia Review)

Source

![[Photo] General Secretary To Lam visits exhibition of achievements in private economic development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/1809dc545f214a86911fe2d2d0fde2e8)

![[Photo] National conference to disseminate and implement Resolution No. 66-NQ/TW and Resolution No. 68-NQ/TW of the Politburo](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/adf666b9303a4213998b395b05234b6a)

![[Photo] More than 17,000 candidates participate in the 2025 SPT Competency Assessment Test of Hanoi National University of Education](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/e538d9a1636c407cbb211b314e6303fd)

Comment (0)