Amending special consumption tax: Comprehensive review, ensuring the interests of the State and enterprises

The Ministry of Finance is proposing to increase excise tax on alcohol and beer and add tax on sugary soft drinks. These are controversial proposals.

Alcoholic beverage industry and supply chain are struggling

Sharing at the workshop "Tax amendment to promote business activities" organized by Dau Tu Newspaper on August 14, Ms. Chu Thi Van Anh, Vice President and General Secretary of the Vietnam Beer - Alcohol - Beverage Association (VBA) said that the alcoholic beverage industry, especially beer, not only has a long history but also plays an important role in global economic development.

However, the emergence of the Covid-19 pandemic and proposed changes to excise tax policies are putting the industry in a difficult position.

|

| Ms. Chu Thi Van Anh, Vice President and General Secretary of the Vietnam Beer - Alcohol - Beverage Association (VBA). (Photo: Chi Cuong) |

According to Oxford research, the beer industry contributes $555 billion to global GDP, employs 23 million people and contributes $66 billion in tax revenue. Famous beer brands and multinational corporations have made this product an indispensable part of culinary culture and social communication.

“In Vietnam, beer and other alcoholic beverages are not only consumer products but also associated with beliefs, festivals, and social events. For example, Hanoi beer - a cultural symbol, is often used in international events when Vietnam welcomes international guests,” said the VBA Vice President.

The alcoholic beverage industry in Vietnam is not only culturally significant but also contributes greatly to the economy. According to statistics, this industry brings in about 60,000 billion VND each year to the state budget, of which more than 40,000 billion VND is from special consumption tax. Beer and wine factories are distributed throughout the country, creating millions of jobs, meeting domestic consumption needs and promoting service and tourism development.

In addition, the consumption of beer, wine and soft drinks also creates other values such as supporting health when used in moderation and properly. Many studies have shown that beer can help reduce stress, support cardiovascular health, while soft drinks provide vitamins and electrolytes, helping the body recover after sports activities.

Over the past 30 years, the domestic beverage industry has grown strongly, especially when the Government had policies to promote domestic production. The development of domestic beer brands has helped reduce dependence on imported beer, retain economic value for the country and open up investment opportunities for foreign corporations.

However, Ms. Van Anh said that in recent years, the alcoholic beverage industry has faced many difficulties. First of all, the Covid-19 pandemic has caused serious disruptions to the supply and consumption chain, leading to an increase in the price of raw materials, increasing production costs. Next, war conflicts and administrative sanctions related to alcohol concentration have also had a strong impact on the industry.

In addition, people's consumption behavior has also changed after the pandemic, causing a sharp decrease in demand for beer and alcohol. "According to the Vietnam Beer - Alcohol - Beverage Association (VBA), consumption and production output in the industry have continuously decreased, sometimes by double digits. This not only affects the revenue and profits of large enterprises but also leads to restructuring of production facilities and labor cuts, directly affecting local and national budgets, as well as social issues related to employment," said the VBA Vice President.

Regarding alcohol and beer, the Ministry of Finance is considering two options to continuously increase taxes, which could increase to 100% by 2030. For sugary soft drinks, the Ministry proposes applying a tax rate of 10% to products with a sugar content of over 5g/100ml.

In response to these tax increase proposals, the Vice President of VBA also expressed concerns about the possible negative impacts. Firstly, businesses are concerned that sudden and continuous tax increases will sharply reduce consumer demand, leading to reduced output and profits. This will lead to job cuts, affecting social life and local budgets.

Second, the increase in alcohol prices due to high taxes can lead to a large gap between legal products and unofficial products (home-made or smuggled alcohol). This not only reduces the effectiveness of budget collection but also causes great health risks when people switch to consuming products of unknown origin and poor quality.

As for sugary drinks, scientists are still debating the link between sugary drinks and overweight and obesity. However, according to preliminary studies, imposing a 10% tax on this product could reduce GDP growth by 0.5% - a significant number in the current economic context.

“With the two proposals of the Ministry of Finance, from the perspective of businesses in the industry, I see this as the highest proposed tax rate in history, which could cause negative impacts on the economy, especially in the context that this industry has not yet fully recovered from the difficulties of the pandemic,” Ms. Van Anh frankly said.

Industry proposals for tax policy changes

The alcoholic beverage and soft drink industry has always accompanied the Government in protecting public health and developing the economy. However, in the current context, when the industry is still facing many difficulties, businesses suggest that tax increases need to be carefully considered, both in terms of roadmap and increase level.

|

| Workshop "Tax reform to promote business activities" organized by Investment Newspaper on August 14. (Photo: Chi Cuong) |

“Specifically, for the alcohol industry, businesses propose that the tax should only be increased by 5% per year in the first few years, and then continue to adjust depending on the actual situation. This will give businesses time to prepare, transform their business and avoid major disruptions in the industry.

"Regarding sugary soft drinks, businesses believe that there should be no rush to add this product to the list of products subject to special consumption tax. Instead, more comprehensive and scientific research is needed to assess the impact of this product on health and the economy before making a final decision," Ms. Van Anh shared.

The alcoholic beverages and soft drinks industry makes an important contribution to the economy and society. However, the current challenges require a careful and considered approach from both Government and business.

The VBA Vice President emphasized that the increase in special consumption tax needs to be carefully considered to ensure that it both protects public health and does not cause negative impacts on the economy and social life.

Source: https://baodautu.vn/sua-doi-thue-tieu-thu-dac-biet-xem-xet-toan-dien-dam-bao-loi-ich-nha-nuoc-va-doanh-nghiep-d222387.html

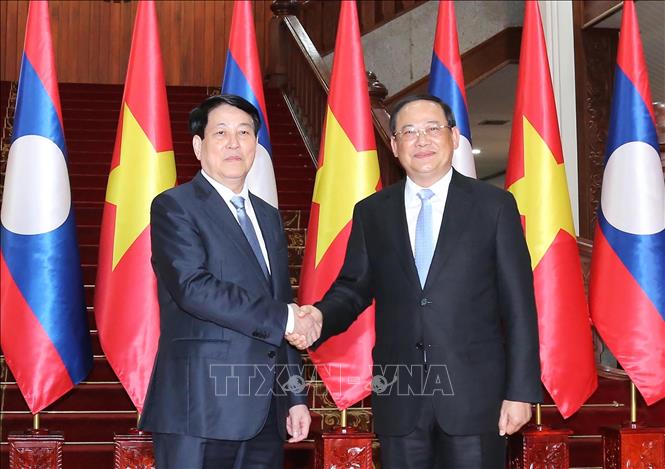

![[Photo] President Luong Cuong meets with Lao Prime Minister Sonexay Siphandone](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/25/3d70fe28a71c4031b03cd141cb1ed3b1)

![[Photo] Ho Chi Minh City welcomes a sudden increase in tourists](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/25/dd8c289579e64fccb12c1a50b1f59971)

![[Photo] Liberation of Truong Sa archipelago - A strategic feat in liberating the South and unifying the country](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/25/d5d3f0607a6a4156807161f0f7f92362)

Comment (0)