Maintain a positive market outlook

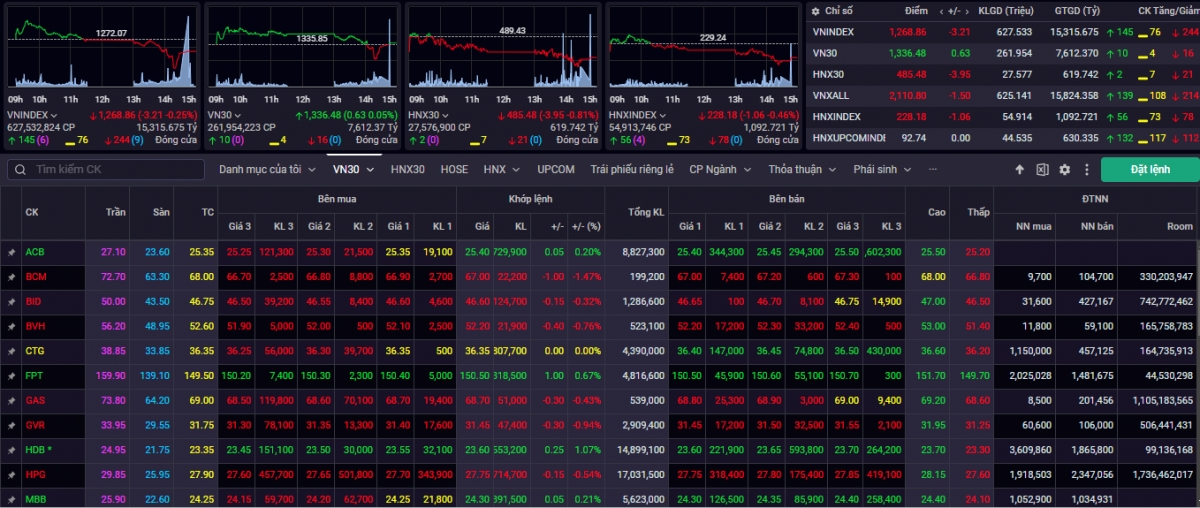

The sideways process to "get used to" the new price level has not ended yet, the stock market continued to have the 4th consecutive sideways session. The fluctuation range of the VN-Index is somewhat wider than the previous sessions and the selling pressure is also more obvious. Liquidity remains at a low base level, making the market not too exciting. Trading is slowing down and the pressure is gradually spreading to the group of small and medium-sized stocks. After a good increase a few sessions ago, this group was quickly under profit-taking pressure. However, the decrease range is insignificant, most stocks only fluctuate normally. In return, the large-cap group moved relatively positively and kept a good rhythm for the index. At the end of the trading session on December 11, the VN-Index closed at 1,268.86 points -3.21 points (-0.25%).

Market order matching liquidity was almost flat and only approached the average level of 20 trading sessions. At the end of the trading session, liquidity on the HSX floor reached 598 million shares (+0.75%), equivalent to VND 15,276 billion (+6%) in trading value.

Market openness partly reflects the increased pressure with 15/21 industry groups adjusting. Putting great pressure on the market and trading sentiment in today's session are industry groups such as: Industrial Park Real Estate (-0.90%), Retail (-0.88%), Fertilizer (-0.82%),... On the contrary, some industry groups still go against the trend to maintain the increase including: Pharmaceuticals (+0.44%), Chemicals (+0.41%), Seafood (+0.28%),...

According to experts from the Construction Securities Company (CSI), the VN-Index had its second consecutive decline with matching volume falling below the 20-session average. Compared to the three previous sessions of gains with volume exceeding the 20-session average, the two recent declines did not have enough momentum to change the previously formed trend.

“We still maintain a positive view of the market and prioritize holding positions in the portfolio. The correction in the last two sessions tends to retest the support zone around 1,260 points, corresponding to the 200-day MA line. At this support level, investors can open new buying positions as well as increase the proportion of stocks they are holding,” said CSI experts.

VN-Index may retest the resistance level of 1,278 points

According to the analysis team of Agribank Securities Company (Agriseco), on the technical chart, VN-Index had another accumulation session after a steep increase of nearly 70 points in the past time. Selling pressure increased at the end of the day but there was no active demand to absorb it like in previous sessions, making it difficult for the market to maintain the upward trend. Agriseco Research believes that the above-mentioned test shaking phase is relatively necessary after the period of rapid increase in the index.

“VN-Index may move Sideway Up with alternating up and down sessions and gradually move up to the 1,280-1,300 point range in the coming sessions. Investors should continue to hold their portfolios. The support level of 1,260 points, corresponding to the intersection of MA50 and MA200 days, is a reliable support for the short-term trend. Investors should prioritize further disbursement in this area,” said Agriseco experts.

Meanwhile, experts from Yuanta Vietnam Securities Company (YSVN) believe that the market may soon return to an upward trend in today's trading session, December 12, and the VN-Index may retest the resistance level of 1,278 points. At the same time, the market may quickly end the correction and soon return to an upward trend because the market is still in a period of strong fluctuations in a positive direction and short-term risks remain low. In addition, the continued increase in sentiment indicators shows that investors are still optimistic about the current market developments and new buying opportunities continue to increase.

“The short-term trend of the general market remains bullish. Therefore, investors can take advantage of the correction to increase the proportion of stocks to a high level,” YSVN experts recommended.

► Some stocks to watch on December 12

Source: https://vov.vn/thi-truong/chung-khoan/nhan-dinh-chung-khoan-1212-vn-index-co-the-thu-thach-lai-nguong-khang-cu-1278-post1141427.vov

![[Photo] Children's smiles - hope after the earthquake disaster in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9fc59328310d43839c4d369d08421cf3)

![[Photo] General Secretary To Lam chairs the third meeting to review the implementation of Resolution No. 18-NQ/TW](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/10f646e55e8e4f3b8c9ae2e35705481d)

![[Photo] Opening of the 44th session of the National Assembly Standing Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/03a1687d4f584352a4b7aa6aa0f73792)

![[Photo] Touching images recreated at the program "Resources for Victory"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/99863147ad274f01a9b208519ebc0dd2)

Comment (0)