Home loans sluggish, slow growth

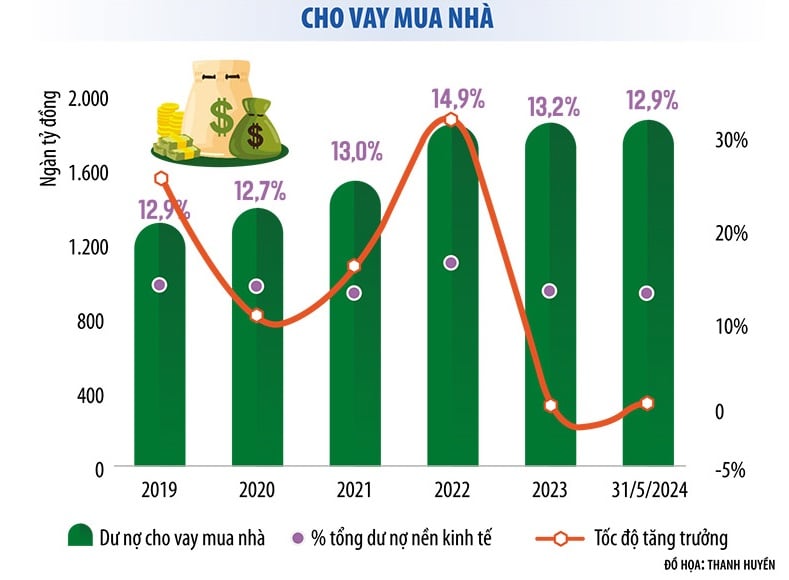

Expected to be the driving force to help bank credit accelerate in the last months of the year, home credit is sluggish and recovering more slowly than expected.

Housing prices are too high, while liquidity is low, plus lending interest rates are rising, making investors and home buyers cautious and not daring to put down money.

Ms. Nguyen Duc Thach Diem, General Director of Sacombank, said that bank credit in the first 9 months of the year did not meet expectations. One of the reasons for this situation is that the income of real estate buyers has decreased, while the supply of housing at reasonable prices has not met the demand, according to Dau Tu newspaper.

According to analysts at VCBS Securities Company, demand for home purchases has not recovered due to limited housing supply. In addition, housing prices (especially apartments in central areas) have increased sharply in recent times, causing investors and borrowers to worry about buying houses for their own use. In the first half of this year, real estate business credit increased by more than 10%, while consumer home loan credit increased by only more than 1%.

Weak demand for home loans causes credit growth across the system to slow down

Home loans are expected to be the main growth driver of retail credit in the coming time, in the context of low interest rates and high demand for housing and investment.

“We believe that real estate and construction credit will continue to increase rapidly in the coming time when supply is more positive, with projects continuing to be accelerated after efforts to support interest rates and legal issues, especially after new real estate laws take effect. At the same time, low lending interest rates stimulate borrowing demand from real estate businesses as well as home buyers,” said VCBS analysts.

However, Mr. Phan Le Thanh Long, CEO of AFA Group, shared on Vnexpress that the reality is not as predicted. “Many real estate brokers believe that low interest rates will stimulate cash flow into real estate, but in reality, idle cash is not flowing into real estate, but instead flowing back into bank savings. Housing prices are too high, the market is in a situation of 'hard to buy, hard to sell' causing real estate transactions to decrease, not attracting cash flow,” said Mr. Long.

Personal home loans are one of the most profitable segments for banks today. This is also the sector that accounts for a large proportion of outstanding loans in banks' credit portfolios. Therefore, banks are eager for credit to recover soon.

However, according to Mr. Pham Duc Toan, General Director of EZ Real Estate Investment and Development Joint Stock Company (EZ Property), currently, many home buyers are "afraid" to borrow money from banks, partly because they have experienced the pain of being stuck in real estate in 2023.

People find it difficult to realize their "homestead dream"

Home loans increased sharply in 2021 and 2022, partly due to banks applying cheap lending rates during the Covid-19 pandemic. However, floating interest rates increased sharply afterwards, combined with the real estate market falling into a liquidity crisis, forcing many investors to sell off and cut losses to reduce the burden of interest rates.

Real estate in the West of Ho Chi Minh City with resettlement areas, apartments, townhouses, and land in Binh Chanh district, August 2024. Photo: Quynh Tran

Currently, although home loan interest rates have decreased, home buyers are still concerned about floating interest rates after the incentive ends. In addition, home prices are too high compared to income, making people still cautious and not daring to borrow money to buy a house.

According to Ms. Phuong (head nurse at a hospital in District 1, Ho Chi Minh City), her budget for buying a house is about 3 billion VND, of which about 2 billion is saved and 1 billion VND is borrowed from the bank. She wants to buy a 2-bedroom apartment in the area around District 7. After a week of surveying, she found a few apartments that met the criteria, but she was hesitant because she thought the price was still high compared to the real value of the apartment.

"Maybe because of the current shortage of supply, house prices are being pushed up. I want to wait for the market to improve and for more diverse supply to have more options," she said about the reason for not closing the purchase at this time, according to Vnexpress .

In fact, housing prices have been increasing continuously in recent times, especially in the apartment segment. The Vietnam Association of Realtors (VARS) said that the apartment price index in Hanoi and Ho Chi Minh City in the second quarter increased by 58% and 27% respectively compared to 2019. More than 80% of the supply opened for sale this year is priced from 50 million VND per square meter or more. Real estate prices in suburban areas range from 40-80 million VND per square meter, while in the center they are up to more than 100 million VND per square meter.

To borrow to buy an apartment in the affordable segment under 2 billion VND, according to VARS, each family must have an income of at least 35-40 million VND per month to ensure debt repayment and monthly living expenses. Meanwhile, the current income of urban families is only 10-20 million VND per month. Low prices and liquidity are barriers that prevent cash flow from flowing into real estate as expected.

Mr. Nguyen Van Dinh, Chairman of VARS, further analyzed that the driving force of credit growth depends on real estate, especially the demand for home loans. Therefore, to stimulate loan demand in this field, there must be policies to regulate real estate prices to suit people's income levels. In addition, it is necessary to remove legal barriers so that businesses can reduce costs and be more flexible in terms of credit granting conditions to stimulate capital flows back to real estate.

On the borrower side, economic experts also recommend careful calculation when spending money to buy real estate at this stage. According to personal real estate expert Le Quoc Kien, when borrowing money to buy a house, first of all, the borrower must have a stable income from salary and have at least 40-50% of their own capital, the rest must rely on financial support from the bank to maintain the ability to repay the debt and avoid bad debt.

Mr. Kien shared that normally, home buyers should only spend a maximum of 40% of their total monthly income on housing, to be able to cover the costs of other basic needs in daily life. Therefore, in addition to comparing home loan interest rates between banks to choose a suitable loan package, home buyers need to carefully consider their cash flow and repayment ability. If monthly interest and principal payments are not carefully and reasonably planned, they can create a financial burden and great pressure on life.

Real estate valuations that are too high while liquidity is low not only prevent buyers from being able to trade and have to bury their capital for a long time, but also make it difficult for buyers to accumulate and expect high profit margins. High housing prices also reduce profits from real estate rentals (accounting for only about 3% of the total investment value, much lower than bank interest rates). This is also the reason why money flows into savings, instead of real estate, according to Dau Tu newspaper.

Analysts at VPBank Securities Company said that the ratio of housing prices to income of Vietnamese people has increased and is about 4-5 times higher than the recommended ratio. Therefore, although interest rates for home loans have decreased significantly in the past year, housing prices remain high, making it difficult for many people to realize their "home ownership dream".

KHANH LINH (t/h)

Source: https://www.nguoiduatin.vn/vi-sao-nguoi-mua-nha-than-trong-chua-dam-xuong-tien-trong-khi-lai-ngan-hang-da-giam-dang-ke-204241008145745643.htm

![[Photo] Prime Minister Pham Minh Chinh and Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra attend the Vietnam-Thailand Business Forum 2025](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/1cdfce54d25c48a68ae6fb9204f2171a)

![[Photo] President Luong Cuong receives Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/52c73b27198a4e12bd6a903d1c218846)

Comment (0)