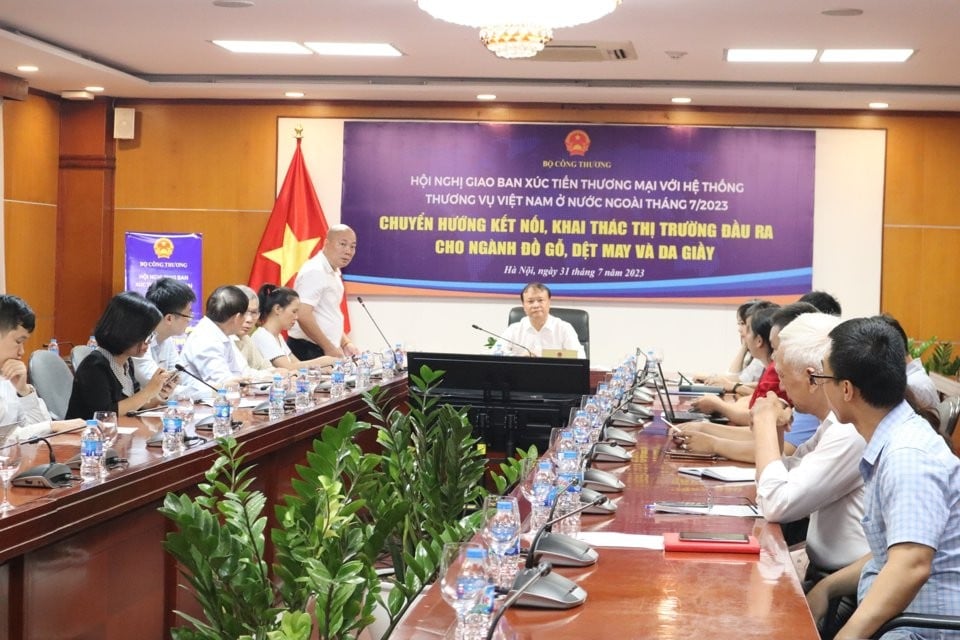

With the theme "Shifting connections and exploiting output markets for the wood, textile and footwear industries", the Conference took place in both direct and online formats, to facilitate the participation of a large number of delegates from Vietnamese Trade Offices abroad, relevant agencies and businesses from 63 provinces and cities across the country.

The conference focused on exchanging and updating information on the situation, developments, regulations on policies, new requirements for imports, assessing consumer tastes of the import market for goods and products in the wood, textile and footwear industries; discussing and assessing opportunities, proposing solutions to remove difficulties and obstacles in import and export activities, and requirements for trade promotion.

|

| Trade promotion conference with the Vietnamese Trade Office system abroad in July 2023. (Source: Investment Newspaper) |

Processing and manufacturing industry "out of breath"

Speaking at the Conference, Deputy Minister of Industry and Trade Do Thang Hai emphasized that the processing and manufacturing industry has always been considered one of the key economic sectors, playing the role of a driving force for economic growth, expanding production, business and promoting trade and export, especially some key processing and manufacturing industries such as textiles, footwear, wood products, etc. have always maintained high and stable growth rates.

However, in the recent period, the world and regional situation continued to have very complex and unpredictable developments, deeply affecting and influencing global stability, notably the armed conflict between Russia and Ukraine; meanwhile, the consequences of the prolonged Covid-19 pandemic led to consequences, disrupting and breaking supply chains, and reducing global aggregate demand.

High inflation in many countries, tight monetary policies, and prolonged interest rate increases have led to a decline in growth and a decline in consumer demand in many countries, especially in countries that are major trade partners of Vietnam such as the United States, the European Union (EU), Japan, etc., which have significantly affected domestic production in general and industrial production in particular because these are markets that import many key industrial products such as garments, footwear, and wooden furniture.

Since the end of 2022, affected by the global economic recession, these export industries have suffered a sharp decline in orders, leading to a decrease in export turnover, up to several billion USD compared to the same period.

According to the General Statistics Office, in the first 7 months of 2023, textile and garment exports reached nearly 19 billion USD, down 15.1% over the same period, wooden furniture reached 7.2 billion USD, down 26.2%, footwear nearly 11.7 billion USD, down 17.1%. In terms of trade overview, in the first 7 months of 2023, the country's total export turnover of goods only reached 194.73 billion USD, down 10.6% over the same period last year, equivalent to a decrease of more than 23 billion USD.

Deputy Minister Do Thang Hai emphasized: "The domestic and international situation is still difficult, but it is forecasted that from now until the end of the year, the demand for imported goods in the markets will gradually recover. Trade representatives in the markets will strengthen order connections and effectively promote trade for industries to accelerate exports.

Trade agencies need updated information on import-export markets, recommendations for businesses in market promotion activities, and receive opinions from associations and localities to have more practical market support plans, closer to the needs of the business community."

Make full use of FTAs

Updating on the EU market situation, Mr. Tran Ngoc Quan, Trade Counselor, Vietnam Trade Office in Belgium and the EU noted that consumer demand in the EU has decreased, but EU standards have been raised, forcing manufacturers to meet them. The EU has been preparing to issue many regulations related to the environment, sustainable development, carbon emissions, the right to repair and recycle, human rights, anti-deforestation laws, etc.

For example, in the textile sector, the EU has set out a strategy for the textile sector by introducing new legal measures to increase circularity in textiles. The EU is also considering the introduction of EU-wide EPR (Extended Producer Responsibility) for textiles...

"It should be added that the EU market is a huge export destination for our country's footwear industry. In 2022, footwear exports of all kinds to the EU will reach 5.8 billion USD, accounting for 24.5% of footwear exports," said Mr. Quan.

According to Mr. Quan, Vietnamese enterprises are enjoying certain advantages by taking advantage of the Vietnam-EU Free Trade Agreement (EVFTA). Last year, Vietnam exported goods worth more than 46 billion USD to the market of 27 EU countries, an increase of 15% compared to 2021. In the coming time, the Vietnam Trade Office will support domestic enterprises to participate in trade fairs, seek opportunities to connect trade, and expand export opportunities in the EU.

Ms. Tran Thu Quynh, Trade Counselor, Vietnam Trade Office in Canada, said that the growth rate of turnover and market share of Vietnam's leather and footwear industry in Canada shows the positive effects of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP).

“A recent study by the Trade Office shows that although leather and footwear are the products with the highest CPTPP preferential usage rate (72%) compared to other Vietnamese products, it is estimated that there are still over 230 million USD worth of our exports with MFN tax rates of 5-20%; while we should have enjoyed a 0% CPTTP tax; mainly sports shoes, soccer shoes (17.5%), low-value leather shoes (11%), fabric shoes (10%), and shoe accessories (5-8%),” Ms. Quynh informed.

To sustain the growth rate of turnover in the area and to expand market share, according to Ms. Quynh, Vietnamese enterprises need to soon transform towards building their own brands. Analysis of competitors in the Canadian market in the same segment as China, Indonesia, India, Bangladesh shows that Vietnam is quite weak in terms of complete supply chain for the industry.

Vietnam's own brand production needs to target the low-middle income segment of young people who are willing to change and are ready to consume because these are still potential niche markets with high profit margins.

“Vietnamese enterprises need to actively participate in international fairs and exhibitions because this is both an opportunity to work directly with wholesalers to seek processing orders, and an opportunity to expand their participation in the segments of fashion footwear, handbags, beachwear, children's footwear and indoor footwear…”, Ms. Quynh said.

As for the US, the largest export market for Vietnamese goods, including the three above-mentioned industries, Mr. Do Manh Quyen, Head of the Vietnam Trade Office in Houston, USA, noted that businesses need to invest more in production to have a green, clean production process, reducing emissions to keep up with the increasing demands from buyers.

Source

![[Photo] Prime Minister Pham Minh Chinh chairs conference on anti-smuggling, trade fraud, and counterfeit goods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/14/6cd67667e99e4248b7d4f587fd21e37c)

Comment (0)