| World oil market continues to be affected by tensions in the Middle East Oil market last week: Prices increased for the second consecutive week |

The pressure on oil prices comes amid market doubts that global economic growth is putting the Organization of the Petroleum Exporting Countries and its allies (OPEC+) in a difficult position. It is almost certain that the group’s production cuts will have to be maintained until the end of this year or possibly even extended until the end of the first quarter of 2025.

World oil prices continue to fall under macroeconomic pressure

According to the Vietnam Commodity Exchange (MXV), at the end of the trading session on September 10, WTI crude oil price was trading at 65.75 USD/barrel, while Brent crude oil fell below 70 USD/barrel for the first time in nearly 3 years. Previously, in the first trading week of September alone, with 5 consecutive sessions of decline, world oil prices lost more than 7% of their value.

MXV said that global economic growth pressures, especially in China and the United States, the world’s two largest energy consumers, are reflecting the gray areas in the picture of crude oil consumption growth. In recent weeks, dismal data, especially on the labor market, have raised concerns about the health of the economy and raised questions about whether a recession is coming to the United States.

In its August jobs report, the U.S. Labor Department said the country's nonfarm payrolls sector added just 142,000 jobs last month, far fewer than the 164,000 economists polled by Dow Jones expected. July's figure was also revised down sharply to 89,000 from the previous estimate of 114,000.

|

| WTI oil price developments |

As for China, the world’s number one crude oil importer, this country is also having a headache finding a solution to the problem of fighting deflationary pressure. According to data from the General Statistics Office of this country, China’s consumer price index (CPI) in August increased by 0.6% compared to the same period last year, lower than the market forecast of 0.7%. The gradual loss of growth momentum for the Chinese economy has created a “gloomy” atmosphere covering the world energy market.

In the first 7 months of this year alone, although China's crude oil imports decreased by 320,000 barrels/day compared to the same period in 2023, reaching an average of 10.9 million barrels/day, inventories still increased by more than 800,000 barrels/day. According to MXV, in the context of continuous inventory additions, China's crude oil imports are expected to continue to face pressure in the final months of the year.

So, it can be seen that most factors in the market are currently working against OPEC+. So global crude oil demand growth this year may not reach the more than 2 million barrels as forecast by the group.

The “door” for OPEC+ to increase production is gradually closing

With demand growth falling short of expectations, OPEC+ appears to be using its production policy as a tool to gauge market reaction. This is evident in the way OPEC+ has repeatedly pivoted its decisions. For example, when Libya’s production was frozen by nearly 1 million barrels per day in early September due to internal problems, there was a flurry of news that OPEC+ would gradually ease production cuts from October.

The market reacted immediately when crude oil prices fell for many consecutive sessions despite the existing supply risks. Immediately after that, OPEC+ had to announce an extension of the voluntary cut policy of more than 2.6 million barrels/day in October and November as a move to calm the market.

|

| Mr. Duong Duc Quang, Deputy General Director of MXV |

Mr. Duong Duc Quang, Deputy General Director of MXV, said that in the context of concerns about slowing demand growth as it is now, OPEC+ will not have much room to restore production. In addition, the fourth quarter will usually be a period of slowing demand growth as the peak consumption and driving season gradually passes.

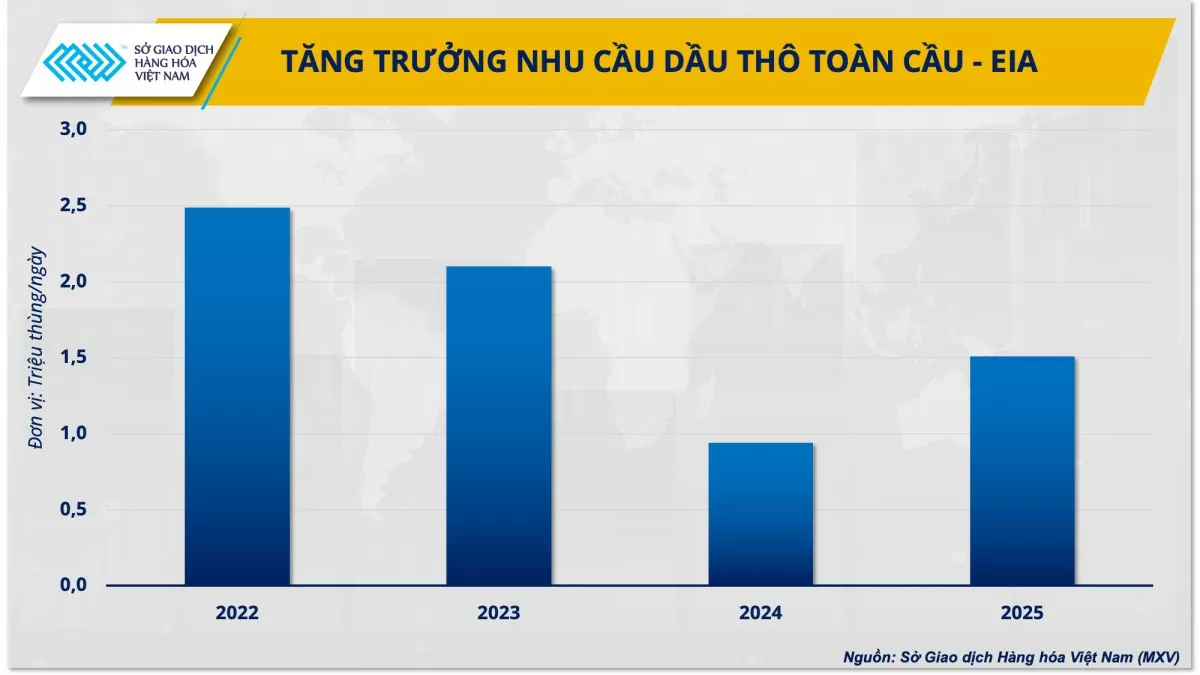

Recently, in its September Short-Term Energy Outlook, the US Energy Information Administration (EIA) took a more cautious view when it said that demand growth had slowed since the third quarter. Specifically, EIA said that oil demand growth reached 400,000 barrels/day and 300,000 barrels/day in the third and fourth quarters, respectively, less than half of the average growth for the entire year.

|

| Global Oil Demand Growth – EIA |

As demand slows, weakening refining margins have been weighing on the market. LSEG data shows that Singapore’s complex refining margins are currently around $2.30 a barrel, down 68% from the same period in 2023 in the first week of September. Asian refineries have cut 400,000-500,000 barrels a day of capacity since May, according to Energy Aspects. The erosion of margins will directly lead to a decline in demand for crude oil for refining operations.

While China’s economy is not very bright, the Fed’s rate cut is basically the only reason for OPEC+ to hold on to in order to realize its ambition of bringing supply back to the market soon. However, it should be noted that the Fed usually starts cutting rates when the economy is clearly weakening, and this has been partly shown after a series of data on the labor market. The Fed lowers interest rates, thereby promoting economic recovery and stimulating oil demand, so this will be a story further in the future and will also need time to prove.

The question mark over global crude oil demand remains a major obstacle to OPEC+’s production policy. According to Duong Duc Quang, in order to support oil prices around the $70/barrel range as expected by the group, the end of the year is too early for OPEC+ to lift the cuts, and this time may even have to be extended at least until the end of the first quarter of next year when demand pressure eases.

Source: https://congthuong.vn/thi-truong-dau-gap-ap-luc-co-hoi-nao-cho-opec-tang-san-luong-345324.html

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to review preparations for trade negotiations with the United States](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/6/1edc3a9bab5e48db95318758f019b99b)

![[Photo] Prime Minister Pham Minh Chinh chairs the regular Government meeting in April 2025](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/6/48eb0c5318914cc49ff858e81c924e65)

![[Photo] Prime Minister Pham Minh Chinh receives Mr. Tomas Heidar, Chief Justice of the International Tribunal for the Law of the Sea (ITLOS)](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/6/58ba7a6773444e17bd987187397e4a1b)

Comment (0)