At the end of yesterday's session, two crude oil products had their fourth session of increase. WTI oil price increased by 1.97% to 73.13 USD/barrel and Brent oil price increased by 1.73% to 75.93 USD/barrel.

According to the Vietnam Commodity Exchange (MXV), returning to trading after the Tet holiday, the world raw material market closed in the green. Notably, all 5 energy products increased in price, notably crude oil with 4 consecutive sessions of increase leading the trend of the entire market. Meanwhile, the metal market had mixed developments, notably the precious metal group with silver and platinum prices increasing sharply. At the end of the session, the MXV-Index increased by 0.62% to 2,225 points.

|

| MXV-Index |

Energy leads the market rally

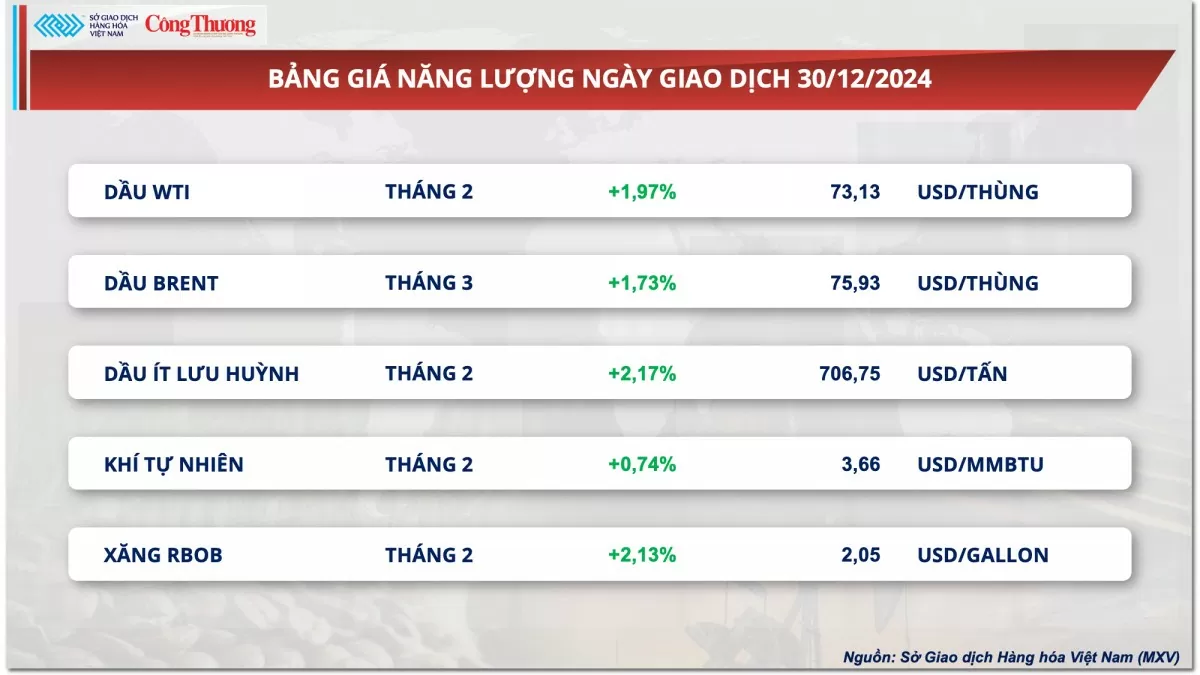

Buying power was strong in the energy market yesterday. All five commodities increased in price. Of which, two crude oil commodities increased for the fourth consecutive session. The driving force came from data on continued declines in US oil inventories and expectations of demand from China.

|

| Energy price list |

At the close of yesterday's session, WTI crude oil prices increased by 1.97% to 73.13 USD/barrel and Brent crude oil prices increased by 1.73% to 75.93 USD/barrel. Meanwhile, natural gas prices fluctuated and closed with a slight increase.

According to the weekly report of the US Energy Information Administration (EIA), US crude oil inventories in the week ending December 27 reached 415.6 million barrels, down 1.18 million barrels compared to the previous week. This decrease is lower than the 1.44 million barrel decrease reported by the American Petroleum Institute and the 2.4 million barrel decrease expected by analysts. However, this is the 6th consecutive week of decline in US crude oil inventories, reflecting the high demand and positive support for prices.

In addition, Chinese President Xi Jinping said in his New Year's speech that the country's GDP growth in 2025 is expected to reach the target of 5%. He also emphasized that China will implement more proactive policies to boost the economy in 2025, in the context that the country has been applying timely measures to ensure the goal of high-quality development. In response to this information, investors are cautiously observing and assessing the recovery of the Chinese economy and fuel demand after China's commitment to boost economic growth.

In addition, the US labor market also sent a positive signal when the number of initial unemployment claims was 211,000, down 9,000 compared to the previous week and lower than the 221,000 expected by analysts, and at the same time the lowest level in 8 months. This is a positive signal for the US economy because over the past three years, the labor market has been a factor promoting consumption, and strong consumption has kept the growth pace for the country's economy.

Metal market fluctuates after New Year holiday

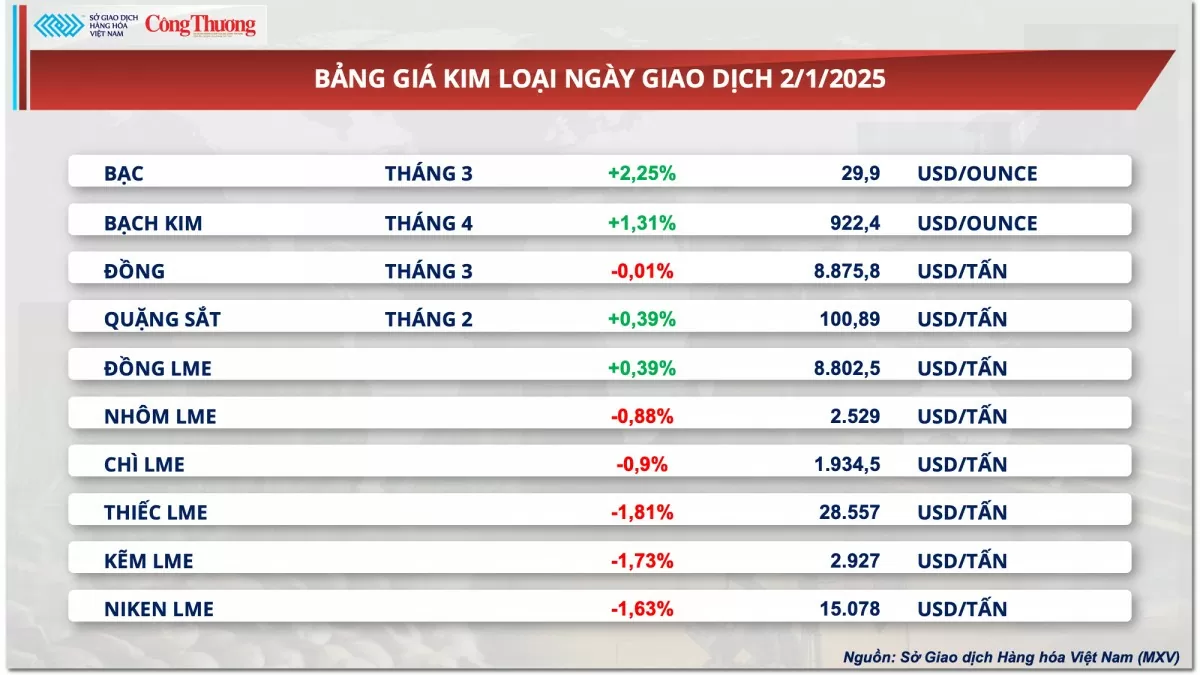

According to MXV, returning after the New Year holiday, metal commodities are clearly differentiated, with the price list divided into green and red halves. Specifically, in the precious metal group, silver and platinum prices increased impressively to 29.9 USD/ounce and 922.4 USD/ounce.

|

| Metal price list |

The precious metals market is seeing positive buying pressure. In addition, the easing of US monetary policy, along with persistent geopolitical tensions in many regions, including yesterday's Russian drone attacks on Kyiv, have boosted demand for safe-haven assets in the short term.

In base metals, COMEX copper was almost flat after a relatively choppy session. Iron ore, on the other hand, rose about 0.4% to nearly $101 a tonne as the market reacted positively to economic data from China, the world’s top consumer.

Specifically, according to the results of a private survey Caixin, China's manufacturing purchasing managers' index (PMI) reached 50.5 points in December, marking the third consecutive month of expansion. Previously, official figures from the country's General Statistics Office also gave similarly optimistic results, with the PMI reaching 50.1 points.

Iron ore buying has also been boosted by optimistic forecasts for consumption prospects. Exporters and analysts say iron ore imports in China, which imports about 70% of the world’s iron ore, could hit a new high in 2025 as traders stock up on cheap ore, despite a protracted property crisis that continues to weigh on steel demand in the country.

China's imports of the key steelmaking raw material are likely to rise by 10 million to 40 million tonnes to 1.27 billion tonnes this year, exceeding previous forecasts, according to a Reuters survey. Earlier data showed the country imported 1.12 billion tonnes of iron ore in the first 11 months of 2024, up 4.3% from the same period last year.

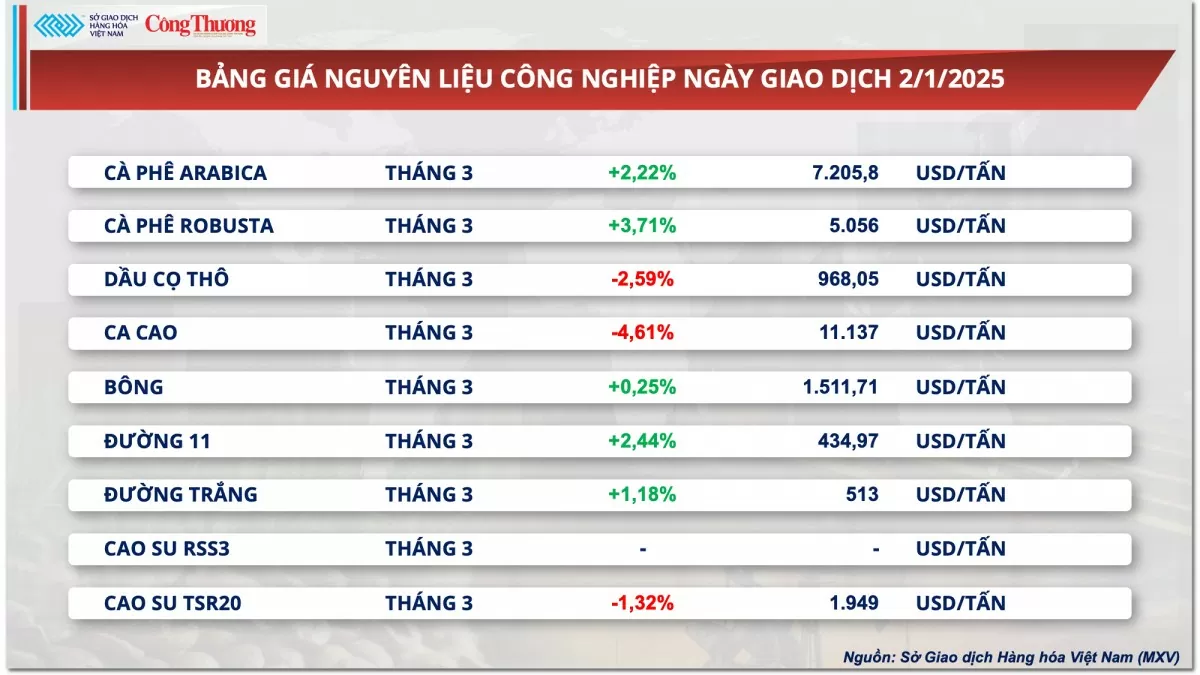

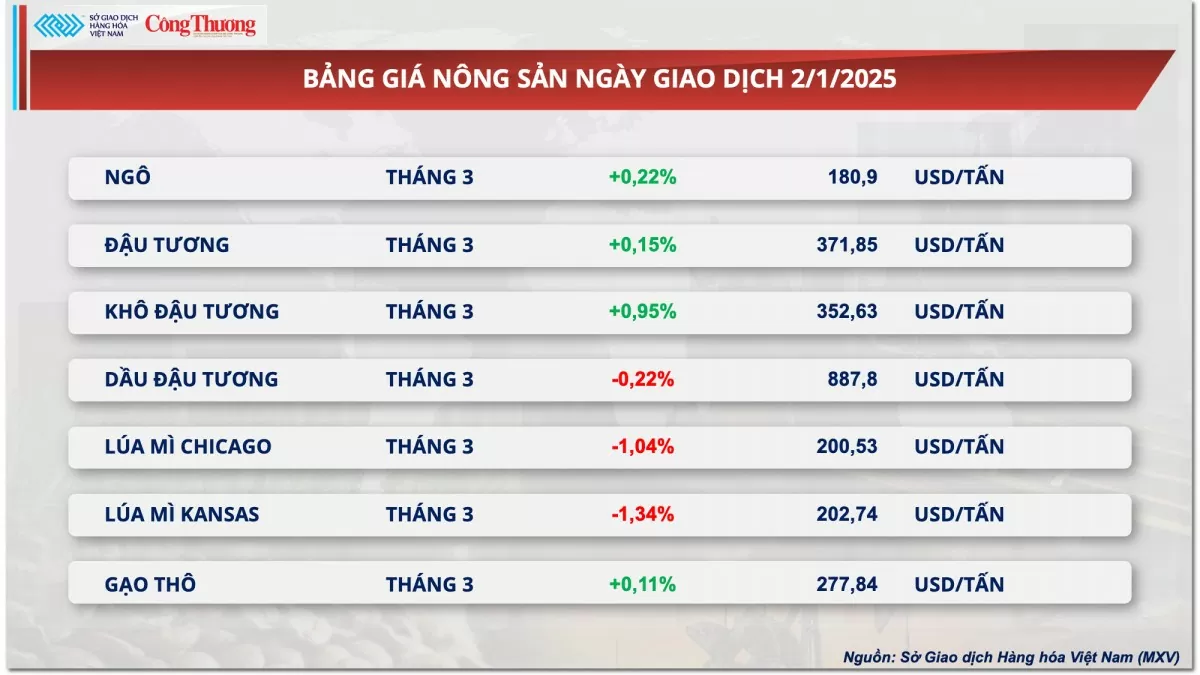

Prices of some other goods

|

| Industrial raw material price list |

|

| Agricultural product price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-31-gia-dau-tho-tang-lien-tiep-367658.html

![[Photo] Many young people patiently lined up under the hot sun to receive a special supplement from Nhan Dan Newspaper.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6f19d322f9364f0ebb6fbfe9377842d3)

![[Photo] Party and State leaders attend the special art program "You are Ho Chi Minh"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6895913f94fd4c51aa4564ab14c3f250)

![[Photo] Ready for the top competitions of Vietnamese table tennis](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/9c547c497c5a4ade8f98c8e7d44f5a41)

Comment (0)