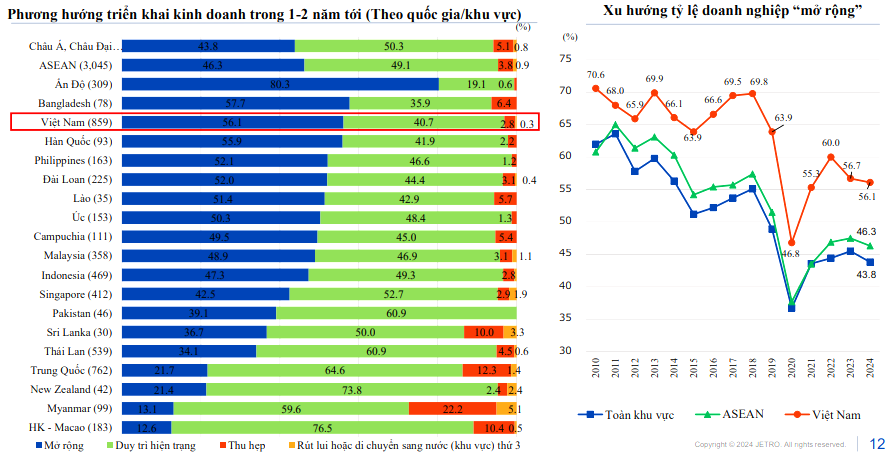

Over 56% of Japanese enterprises will expand business in Vietnam in the next 1-2 years.

This ratio remains the highest in the ASEAN region, according to Jetro's survey of the status of Japanese enterprises investing abroad in fiscal year 2024.

|

| On December 9, 2024, AEON MALL Thanh Hoa - the 8th shopping center of AEON MALL in Vietnam was started. |

As usual, the Japan External Trade Organization (Jetro) announced the results of a survey on the actual operations of Japanese enterprises in Asia and Oceania. This year, in the 38th survey of this organization, more than 5,000 enterprises participated in this survey. Of these, 804 enterprises are investing in Vietnam.

50.4% of these businesses forecast that the business situation in 2025 will “improve”. Many businesses continue to expect positive business results in 2024.

|

| Jetro's survey results on the actual operating situation of Japanese enterprises in Asia and Oceania in 2024 |

In more detail, when asked about the direction of business implementation in the next 1-2 years, 56.1% of Japanese enterprises in Vietnam chose to expand. Although it decreased by 0.6 points compared to the previous year, meaning that the expansion ambitions of enterprises are almost stable, Vietnam still leads the countries in the ASEAN region.

Of these, the proportion of enterprises in the manufacturing industry answering that they will “expand” is 48.1% (up 1.0 points compared to last year), while enterprises in the non-manufacturing industry is 63.2% (down 2.3 points).

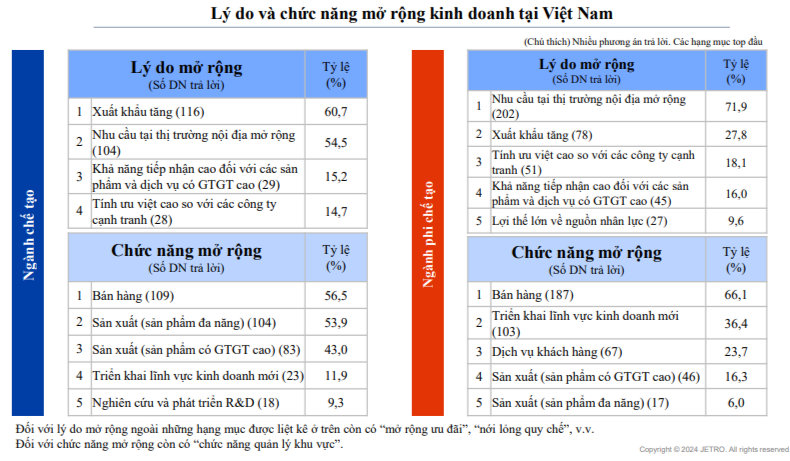

The reason for the improvement given by manufacturing enterprises was “increased demand in the export market”, while non-manufacturing enterprises said it was “increased demand in the domestic market”.

This shows that the recovery of both domestic and foreign demand in Vietnam continues to attract Japanese investors.

|

| Jetro's survey results on the actual operating situation of Japanese enterprises in Asia and Oceania in 2024 |

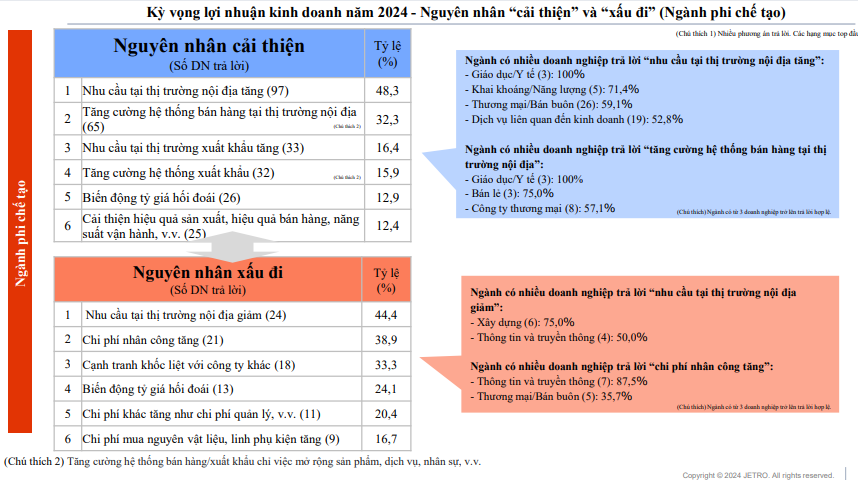

Jetro's survey showed that 46.7% of manufacturing enterprises and 51% of non-manufacturing enterprises responded that the situation would improve. Notably, compared to last year, expectations in specific industries and sectors have changed significantly.

In the manufacturing industry, the group of businesses with the most positive outlook is food, with 60.9% of businesses, pushing the first place last year, transportation equipment, down to fourth place, after rubber processing, ceramics, stone and other manufacturing industries, along with wood and wood products, with 50% expecting improvement.

At the bottom of the manufacturing industry group is transportation equipment components, with 23.7% positive expectations about business prospects in 2025.

Notably, in the non-manufacturing sector, no enterprises in the education, healthcare, retail and finance/insurance sectors had pessimistic assessments. The majority of enterprises said that the situation would improve, at 60-62.5-58.3%, respectively. The rest said that the situation would be the same as in 2024.

Perhaps this is the reason why 100% of Japanese businesses in the retail and restaurant sectors choose to expand their business in the next 2 years.

|

| Jetro's survey results on the actual operating situation of Japanese enterprises in Asia and Oceania in 2024 |

Regarding business results in 2024, 64.1% of Japanese enterprises in Vietnam expect to make a profit, up 9.8 points compared to the previous year. This is the first time in 5 years since before the Covid-19 pandemic that this rate has exceeded 60%.

However, the profit rate is lower than the ASEAN average (65.2%). This is the fourth consecutive year that Japanese enterprises in Vietnam have not achieved this average profit level, but the gap has narrowed, from 6.3 points in fiscal year 2023 to 1.1 points.

The rate of profitable enterprises in the manufacturing industry was 70.2% (up 8.7 points compared to the previous year). The rate of enterprises reporting losses was 17.4% (down 4.6 points compared to the previous year). In most industries, the rate of profitable enterprises increased compared to the previous year. The rate of profitable enterprises exceeded 80% in 4 industry groups: transportation machinery components, medical/precision equipment, plastic products and chemicals/pharmaceuticals.

The rate of profitable enterprises in the non-manufacturing sector was 57.9% (up 11.2 points compared to the previous year). The rate of enterprises reporting losses was 21.2% (down 5.8 points compared to the previous year). The rate of profitable enterprises in the trade/wholesale, mining/energy, business-related services, etc. sectors increased by more than 15 points compared to the previous year. However, the rate of profitable enterprises in the education/healthcare and construction sectors continued to remain below 50%.

![[Photo] General Secretary To Lam concludes visit to Russia, departs for Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/0acf1081a95e4b1d9886c67fdafd95ed)

![[Photo] General Secretary To Lam meets and expresses gratitude to Vietnam's Belarusian friends](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c515ee2054c54a87aa8a7cb520f2fa6e)

![[Photo] General Secretary To Lam arrives in Minsk, begins state visit to Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/76602f587468437f8b5b7104495f444d)

![[Photo] National Assembly Chairman Tran Thanh Man attends the Party Congress of the Committee for Culture and Social Affairs](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/f5ed02beb9404bca998a08b34ef255a6)

Comment (0)