Thailand's second-largest bank Kasikornbank (KBank) is in talks to acquire Vietnamese consumer finance provider Home Credit in a deal worth up to $1 billion, Reuters reported on August 22.

KBank has been in discussions with financial advisers to explore the possibility of acquiring Home Credit and no final decision has been made, Reuters reported.

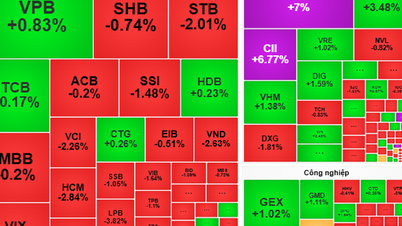

The deal between KBank and Home Credit, if successful, would become the second-largest M&A deal in Vietnam’s financial sector this year, following the $1.5 billion sale of 15% of Vietnam Prosperity Joint Stock Commercial Bank ( VPBank ) to Japan’s Sumitomo Mitsui Bank in March, according to Refinitiv.

Kasikornbank, headquartered in Bangkok, has total assets of $119.7 billion, second only to Bangkok Bank in Thailand, according to Refinitiv data.

The bank has made its mark in Vietnam by opening its first branch in Ho Chi Minh City in November 2021 and is aiming to become one of the top 20 banks in the Vietnamese market, in terms of asset size, by 2027.

In June, KBank Ho Chi Minh City branch was allowed by the State Bank to increase its charter capital from 80 million USD to 285 million USD, becoming the second largest foreign bank in Vietnam.

“To become one of the top 20 banks in Vietnam by 2027 in terms of assets, income and customer base, KBank will provide comprehensive financial services in a transaction ecosystem to meet the diverse needs of local customers,” said Mr. Chat Luangarpa, Executive Vice President of KBank. Photo: nationalthailand.com

“KBank currently operates KBank Biz Loan, a credit service for small-scale retail stores. The potential agreement with Home Credit will allow the bank to increase access to financial services for small business customers,” Reuters said.

In addition, KBank's parent company Kasikorn Vision (KVision) has also invested in a number of companies in Vietnam such as e-commerce company Sendo, cloud-based POS/store management software provider KiotViet, venture capital firm Seedcom, digital healthcare service provider Jio Health, and social commerce platform Selly.

The bank targets net income of $400 million, outstanding loans of $5.13 billion and a customer base of 8.4 million people in Vietnam by 2027.

Home Credit Vietnam, a subsidiary of the Netherlands-based non-bank financial institution Home Credit Group, began operating in Vietnam in 2008. The company currently has 6,000 employees, serving 12 million customers.

In addition to cash loans, the company also offers installment loans for motorbikes and consumer goods through 9,000 stores in Vietnam.

Home Credit Group is controlled by the Czech Republic's largest investment group PPF, founded by the late billionaire Petr Kellner. PPF reported a larger loss in the first half of 2022, mainly due to the impact of its withdrawal from the Russian market .

Nguyen Tuyet (According to Reuters, The Business Times, FinTech Singapore)

Source

![[Photo] General Secretary To Lam attends the conference to review 10 years of implementing Directive No. 05 of the Politburo and evaluate the results of implementing Regulation No. 09 of the Central Public Security Party Committee.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/2f44458c655a4403acd7929dbbfa5039)

![[Photo] Close-up of Tang Long Bridge, Thu Duc City after repairing rutting](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/086736d9d11f43198f5bd8d78df9bd41)

![[Photo] Panorama of the Opening Ceremony of the 43rd Nhan Dan Newspaper National Table Tennis Championship](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/5e22950340b941309280448198bcf1d9)

![[Photo] President Luong Cuong presents the 40-year Party membership badge to Chief of the Office of the President Le Khanh Hai](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/a22bc55dd7bf4a2ab7e3958d32282c15)

![[Photo] Prime Minister Pham Minh Chinh inspects the progress of the National Exhibition and Fair Center project](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/35189ac8807140d897ad2b7d2583fbae)

![[VIDEO] - Enhancing the value of Quang Nam OCOP products through trade connections](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/17/5be5b5fff1f14914986fad159097a677)

Comment (0)