Mr. Vinh quit his job at the beginning of 2023. On February 5, he received a decision to receive a one-time social insurance payment of more than 28 million VND for 34 months of social insurance participation with an average social insurance salary of nearly 4.8 million VND/month.

Looking at the table of one-time social insurance benefits, Mr. Vinh saw that all the months of his social insurance participation had a coefficient of 1, so he wondered: "Has this amount of money of mine been calculated with a price inflation coefficient? If not, when will I receive it?".

People who receive one-time social insurance benefits from January 1 to before February 15 will receive additional inflation compensation (Illustration: Manh Quan).

According to Ho Chi Minh City Social Insurance, the one-time social insurance payment is determined based on the social insurance payment period and the average monthly salary/income for social insurance payment of the employee. The monthly salary/income for social insurance payment of the employee is an absolute amount but is multiplied by the adjustment rate of monthly salary and income for social insurance payment (also known as the inflation coefficient) to compensate for the depreciation rate of the currency over time.

When calculating the inflation coefficient at the time of one-time social insurance withdrawal procedures, the average monthly salary/income for social insurance contributions of employees will be higher than the actual amount used as the basis for social insurance participation that they have paid.

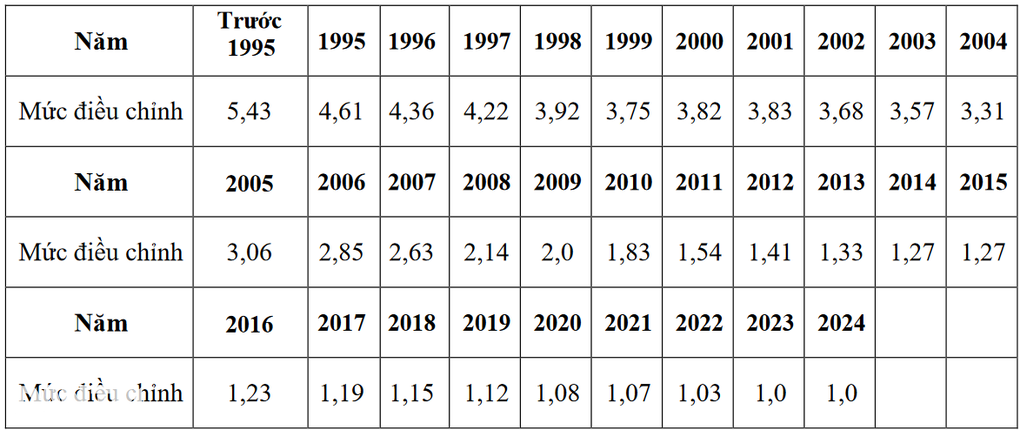

Every year, the Ministry of Labor, War Invalids and Social Affairs issues a new circular regulating the adjustment of salary and monthly income for which social insurance has been paid.

The adjustment level of salary and monthly income for social insurance contributions in 2024 is stipulated in Circular 20/2023/TT-BLDTBXH issued on December 29, 2023.

The above adjustment level is applied to cases of calculating pensions, receiving one-time social insurance benefits, one-time death benefits... in the period from January 1, 2024 to December 31, 2024.

However, Circular 20/2023/TT-BLDTBXH takes effect from February 15. Therefore, cases of processing one-time social insurance benefit applications from January 1 to before February 15 will not have the price index added because the 2023 adjustment level has expired, and the 2024 adjustment level stipulated in Circular 20/2023/TT-BLDTBXH has not yet taken effect.

From February 15, when Circular 20/2023/TT-BLDTBXH takes effect, the Social Insurance agency will pay an additional difference after calculating the inflation coefficient for one-time social insurance beneficiaries from January 1 to before February 15. This amount is often called inflation compensation by employees.

For employees who complete procedures to receive one-time social insurance benefits from February 15, after the social insurance agency receives the official dispatch guiding the application of the 2024 inflation coefficient, the one-time social insurance withdrawal amount will be calculated with the inflation coefficient, and there is no need to pay additional inflation as in cases of withdrawal from January 1, 2024 to December 31, 2024.

Thus, Mr. Vinh's case has not been calculated with the additional inflation coefficient. After the official dispatch guiding the application of the inflation coefficient in 2024, the Social Insurance agency will pay the additional difference after calculating the inflation coefficient for Mr. Vinh.

According to Circular 20/2023/TT-BLDTBXH, the adjustment level of social insurance contribution salary as the basis for calculating pension for compulsory social insurance participants is as follows.

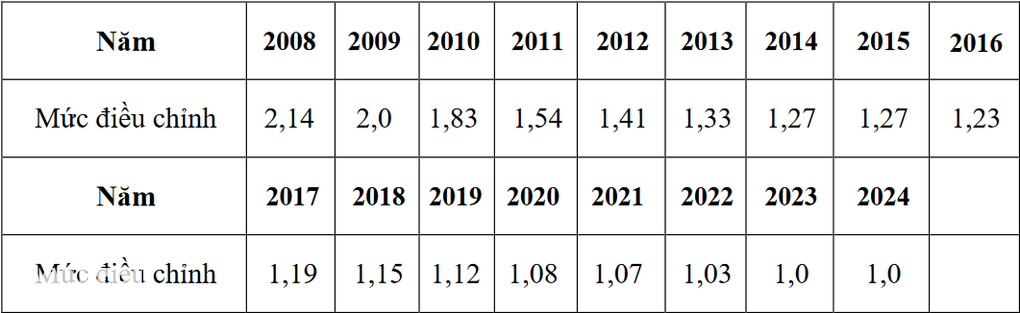

For voluntary social insurance participants, the monthly income adjustment level for social insurance contributions as the basis for calculating pension is as follows.

Interested readers can follow the details of the adjustment of salary and monthly income for which social insurance has been paid as prescribed in Circular 20/2023/TT-BLDTBXH HERE.

Source

![[Photo] Prime Minister Pham Minh Chinh chairs conference on anti-smuggling, trade fraud, and counterfeit goods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/14/6cd67667e99e4248b7d4f587fd21e37c)

Comment (0)