(Dan Tri) - People who withdraw social insurance (SI) one time before February 28 will receive inflation compensation when Circular 01/2025/TT-BLDTBXH regulating the adjustment of salary and monthly income for SI contributions takes effect.

Who gets the inflation compensation?

The level of one-time social insurance benefits for employees is determined based on the period of social insurance contribution and the average monthly salary/income of the employee for social insurance contribution.

The monthly salary/income for social insurance contributions of employees is an absolute amount but is multiplied by the adjustment rate of monthly salary and income for which social insurance contributions have been made (also known as the inflation coefficient) to compensate for the depreciation rate of money over time.

When calculating the inflation coefficient at the time of one-time social insurance withdrawal procedures, the average monthly salary/income for social insurance contributions of employees will be higher than the actual amount used as the basis for social insurance participation that they have paid.

When enjoying the regime, the amount of social insurance paid by employees will be adjusted to increase by the inflation coefficient (Illustration: Social Insurance of Ho Chi Minh City).

Every year, the Ministry of Labor, War Invalids and Social Affairs issues a circular regulating the adjustment of salary and monthly income for which social insurance has been paid.

The adjustment level of salary and monthly income for social insurance contributions in 2025 is stipulated in Circular No. 01/2025/TT-BLDTBXH issued on January 10, 2025.

The above adjustment level is applied to cases of calculating pensions, receiving one-time social insurance benefits, one-time death benefits... in the period from January 1, 2025 to December 31, 2025.

However, Circular No. 01 will not take effect until February 28. Therefore, cases of processing one-time social insurance benefit applications from January 1 to before February 28 will not have the price index added.

Since Circular No. 01/2025/TT-BLDTBXH takes effect, the Social Insurance agency will pay an additional difference after calculating the inflation coefficient for one-time social insurance beneficiaries from January 1 to before February 28. This amount is often called inflation compensation by employees.

For employees who complete procedures to receive one-time social insurance benefits from February 28, the amount of one-time social insurance withdrawal will be calculated with an additional inflation coefficient, and there is no need to pay additional inflation compensation as in cases of withdrawal from January 1 to before February 28.

The highest adjustment increase is 5.63 times

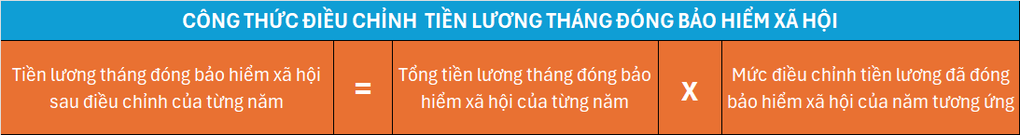

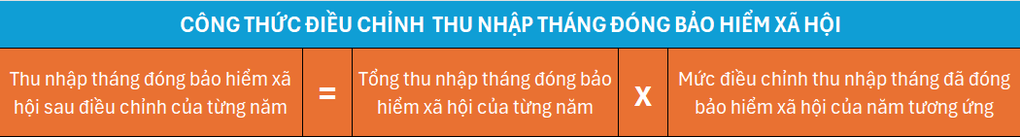

According to Circular No. 01/2025/TT-BLDTBXH, monthly salary for which social insurance has been paid is adjusted according to the following formula:

In 2025, the monthly salary adjustment level for social insurance contributions will be adjusted to increase from 1 to 5.63 times according to the corresponding year of social insurance contributions. Specifically according to the following table:

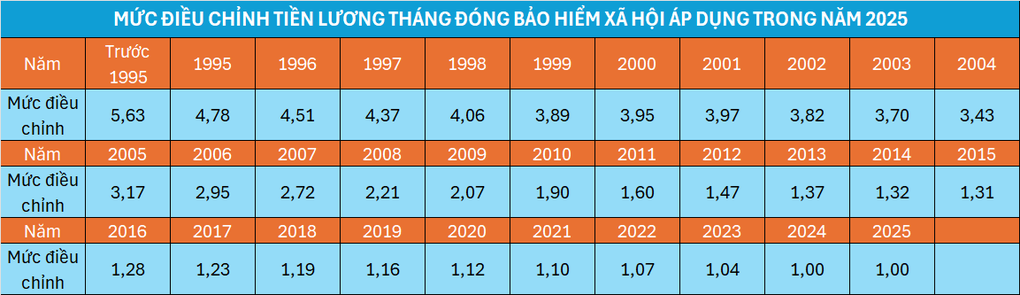

For voluntary social insurance participants, monthly income for which social insurance has been paid is adjusted according to the following formula:

In 2025, the monthly income adjustment for social insurance contributions will be adjusted to increase from 1 to 2.21 times according to the corresponding year of social insurance contributions. Specifically, according to the following table:

Readers can follow the detailed adjustment of salary and monthly income for social insurance contributions in 2025 HERE.

Source: https://dantri.com.vn/an-sinh/nguoi-rut-bhxh-mot-lan-duoc-nhan-tien-bu-truot-gia-tu-ngay-282-20250130071528957.htm

![[Photo] More than 17,000 candidates participate in the 2025 SPT Competency Assessment Test of Hanoi National University of Education](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/e538d9a1636c407cbb211b314e6303fd)

![[Photo] Readers line up to visit the photo exhibition and receive a special publication commemorating the 135th birthday of President Ho Chi Minh at Nhan Dan Newspaper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/85b3197fc6bd43e6a9ee4db15101005b)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on science and technology development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/ae80dd74c384439789b12013c738a045)

![[Photo] Nearly 3,000 students moved by stories about soldiers](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/21da57c8241e42438b423eaa37215e0e)

Comment (0)