Recently, the State Bank announced customer deposit data at the credit institution system up to the end of June 2023, showing that the amount of deposits from residents and economic organizations in banks has reached the highest level ever with more than 12.3 million billion VND despite increasingly low mobilization interest rates.

Notably, the growth momentum in June, instead of coming from the population like in previous months, this time came mainly from economic organizations.

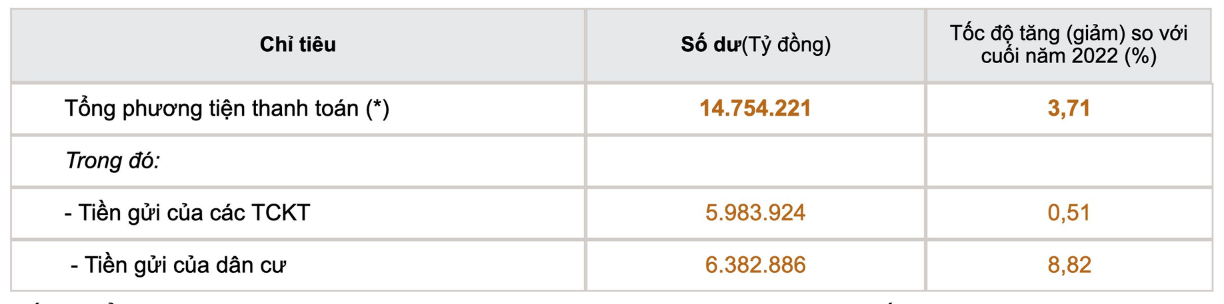

Specifically, the balance of deposits of enterprises in the banking system as of the end of June reached more than VND 5.98 million billion, an increase of more than VND 235,000 billion compared to the end of May and an increase of 0.51% compared to the end of 2022.

This is also the strongest month of growth in the past 18 months. This development also helped this group of customers' deposits change from negative growth in the first 5 months of the year to positive growth in the first 6 months.

As for residents' savings deposits by the end of June, they reached 6.38 million billion VND, an increase of 8.82% compared to the end of 2022. Thus, residents' deposits have increased continuously since October 2022.

Compared to May, people's deposits in the banking system increased by 35,341 billion VND. Compared to the end of 2022, the amount of savings deposits in banks increased by more than 429,000 billion VND.

Amount of deposits at banks in June 2023 (Source: SBV).

Although the stock market has been vibrant again in the first 6 months of the year and deposit interest rates have been continuously reduced to support businesses, the amount of residential deposits in June continued to increase, which shows that a large number of people still choose to deposit money in the banking system to earn interest instead of investing money for higher profits.

Recently, four state-owned banks, Agribank, BIDV, Vietcombank, and VietinBank, have simultaneously sharply reduced their savings interest rates for the fifth time since the beginning of the year. Accordingly, the interest rates in this group have dropped to below 6%/year for a 12-month term, while at the beginning of this year they were listed at 7.5-8.2%/year.

In the private banking group, Eximbank also reduced the mobilization interest rate for terms under 6 months from 4.75% to 4.25%; terms of 6-12 months decreased from 5.8% to 5.6 - 5.7%; terms of 13-36 months remained the same as before, at 5.8%.

ACB is also applying a deeply reduced interest rate schedule. Currently, deposits for 6-month - 12-month terms using this bank's form are only up to 5.8%/year instead of 6.2-6.4%/year as before. To get this interest rate, customers need to deposit an amount of 5 billion VND or more.

Since the beginning of August, about 30 banks have reduced their deposit interest rates. The interest rates have decreased rapidly and strongly, but this is the basis for reducing output lending interest rates.

Thus, after a period of "hot" increase at the end of 2022, savings interest rates have begun to cool down at the beginning of this year. Compared to the peak period at the end of last year, savings interest rates have decreased by 3-4.5 percentage points with terms of 6-12 months .

Source

![[Photo] Prime Minister Pham Minh Chinh meets with US business representatives](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/5bf2bff8977041adab2baf9944e547b5)

![[Photo] President Luong Cuong attends the inauguration of the international container port in Hai Phong](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/9544c01a03e241fdadb6f9708e1c0b65)

Comment (0)