Germany's growing budget crisis is hitting Europe's top economy where it hurts the most: Germany's reputation as a reliable partner for industry.

Some businesses are now concerned that Berlin may not deliver on its commitment to finance green and other projects.

"Shocking" verdict

Germany's Federal Constitutional Court ruled on November 15 that Chancellor Olaf Scholz's government's decision to reallocate 60 billion euros in unused Covid-19 pandemic credits in 2021 was unconstitutional, leaving the German government's climate action budget short of the funds.

As well as pointing to a €60bn financial hole in the government’s 2024 spending plan, the “shocking” ruling by the Constitutional Court in Karlsruhe also raises wider questions about the financing of major industrial projects that should be supported by public funds.

Among these projects are plans by Luxembourg-based multinational steelmaker ArcelorMittal to spend €2.5 billion to decarbonize its German steel plants, parts of which now depend on government support in doubt.

“We are disappointed and above all concerned that we still lack financing decisions and therefore prospects for our industrial production in Germany,” said Reiner Blaschek, head of the German arm of ArcelorMittal, the world’s second-largest steelmaker.

Mr Blaschek called the German government's failure to come up with a quick solution to the budget impasse "extremely irresponsible", highlighting the potential consequences for the western European country struggling to retain its position as a leading industrial location.

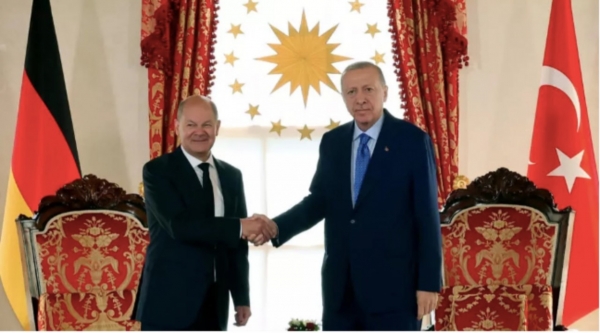

German Chancellor Olaf Scholz and Finance Minister Christian Lindner were forced to suspend the "debt brake" following the Federal Constitutional Court's shocking ruling on the budget. Lindner will present a revised budget on December 1, 2023. Photo: Bloomberg

ArcelorMittal's rival, Germany's SHS Stahl-Holding-Saar, has also yet to receive a formal commitment from Berlin to support a €3.5 billion investment project to significantly cut CO2 emissions at its furnaces.

Stefan Rauber, CEO of SHS Stahl-Holding-Saar, said a solution had to be found within days, not weeks, and he needed to make a decision by the end of the year to get the project off the ground.

“What we are seeing here is devastating for Germany as a global business location. And the longer this goes on, the worse it will get,” Mr. Rauber said.

In addition to the two investments worth a total of 6 billion euros in the steel industry, other sectors likely to be affected by the Constitutional Court ruling include 4 billion euros in microelectronics and 20 billion euros in battery production, according to a German Economy Ministry document seen by Reuters.

It also includes a climate protection agreement to help the industry protect itself from fluctuations in electricity prices, the document said. These were previously estimated at €68 billion.

Following the court ruling, lawmaker Katja Mast of the center-left Social Democrats (SPD), the largest party in German Chancellor Olaf Scholz 's ruling coalition , said the government's budget plan for 2024 would go ahead.

“We are prepared for all scenarios,” she said. “As it stands, we will still pass the budget on December 1. The Constitutional Court’s decision will not affect the governing coalition’s climate goals.”

She said the government would now carefully consider the court's ruling and she would be prepared to argue for a federal "debt brake."

Chancellor Scholz said in a video message on November 24 that the government was quickly reworking the 2024 budget and that all necessary decisions would be made this year.

No competitiveness

Germany has long been criticized for underinvesting in critical economic infrastructure. Earlier this year, the International Monetary Fund (IMF) reiterated its call for Berlin to create more fiscal space to invest in the country's future.

Critics say the debt restrictions – known as the “debt brake,” which places very strict limits on how much new debt can be taken on – are a somewhat arbitrary political tool that limits the space for such investments.

The Constitutional Court ruling blocking the reuse of unused pandemic money for green investment has raised doubts about the fate of other off-budget funding vehicles and casts a shadow over future spending plans in 2024 and beyond.

Comments from industry reflect widespread concerns that it would limit Germany’s ability to meet funding commitments for major projects, including a new chip manufacturing joint venture outside Dresden between Taiwan’s TSMC and European chip companies NXP (Netherlands) and Infineon and Bosch (Germany). The total cost of the venture is expected to be €10 billion, with subsidies accounting for about half that amount.

A new chip manufacturing joint venture outside Dresden between Taiwan's TSMC and European chip companies NXP (Netherlands) and Infineon and Bosch (Germany) is at risk of losing funding after a €60 billion "hole" appeared in the German government's budget. Photo: Techspot

Worse, the budget uncertainty creates a new layer of problems as Germany struggles to win investment in locations in Asia and the US, and faces the risk of major industrial companies relocating abroad.

The US Inflation Reduction Act (IRA) has provided companies with clear regulatory frameworks, including for the nascent hydrogen sector, which is key to Germany’s efforts to make the Western European nation’s industry carbon neutral.

“If there is an impression… that it is not safe to go down this path with German companies… then producers will look to IRAs and other projects in the US, simply because there is investment security there,” said Bernhard Osburg, CEO of Thyssenkrupp Steel Europe.

While there are concerns about what the budget gap means for projects in the short term, there are growing concerns that it could undermine Germany's ability to co-finance the long-term transformation of its industries.

Some fear that plans to reduce electricity prices for industry, a key effort to maintain competitiveness for big chemical companies like BASF and Wacker Chemie, could also be derailed.

“Key industries in Germany, such as chemicals or steel production, need competitive prices for energy consumption,” Oliver Blume, CEO of Europe’s leading carmaker Volkswagen, told the German newspaper Frankfurter Allgemeine Zeitung. “We are currently not competitive on a global scale . ”

Minh Duc (According to Reuters, DW)

Source

Comment (0)