Buy recommendation for PTB stock

BIDV Securities Company (BSC) upgraded its recommendation on PTB of Phu Tai Joint Stock Company from hold to buy with a 1-year target price of VND79,200/share (up 30% compared to the price on October 8, 2024). BSC used a target P/E of 9.5x and EPS of 2025 similar to previous recommendation reports in Q1/2024 and Q2/2024. The change in recommendation from hold to buy is mainly due to the fact that PTB's stock price has discounted 20% from the peak and returned to an attractive valuation for buying.

Investment thesis: BSC maintains its view that the wood export segment will record 19% growth in both 2024 and 2025 as our assumptions are still on track for wood exports to maintain their recovery trend in 2024/2025; Adjusting the growth of the stone segment in 2024 from 10% to 6% mainly due to domestic consumption of the stone segment being 10% lower than the initial expectation, while BSC maintains its view of recovery in 2025 in previous recommendations.

BSC maintains the view that Phu Tai Central Life project will be handed over in 2025 thanks to the project being built on schedule, most of PTB's first sales have been sold out; PTB is being traded at a reasonable valuation to buy, P/E FW 2025 is 7.4x.

In 2024, BSC forecasts that PTB will record net revenue and profit after tax - minority shareholders of VND 6,037 billion (up 7.5% year-on-year) and VND 383 billion (up 31% year-on-year), respectively, down 2%/down 2% compared to the previous forecast, equivalent to EPS FW 2024 reaching VND 5,723/share and P/E FW 2024 reaching 10.8 times.

In 2025, BSC maintains its forecast that PTB will record net revenue and profit after tax - minority shareholders of VND 7,512 billion (up 24.4%) and VND 556 billion (up 45%), respectively, equivalent to EPS FW 2025 reaching VND 8,314/share and P/E FW 2025 reaching 7.4 times.

Buy recommendation for HPG stock

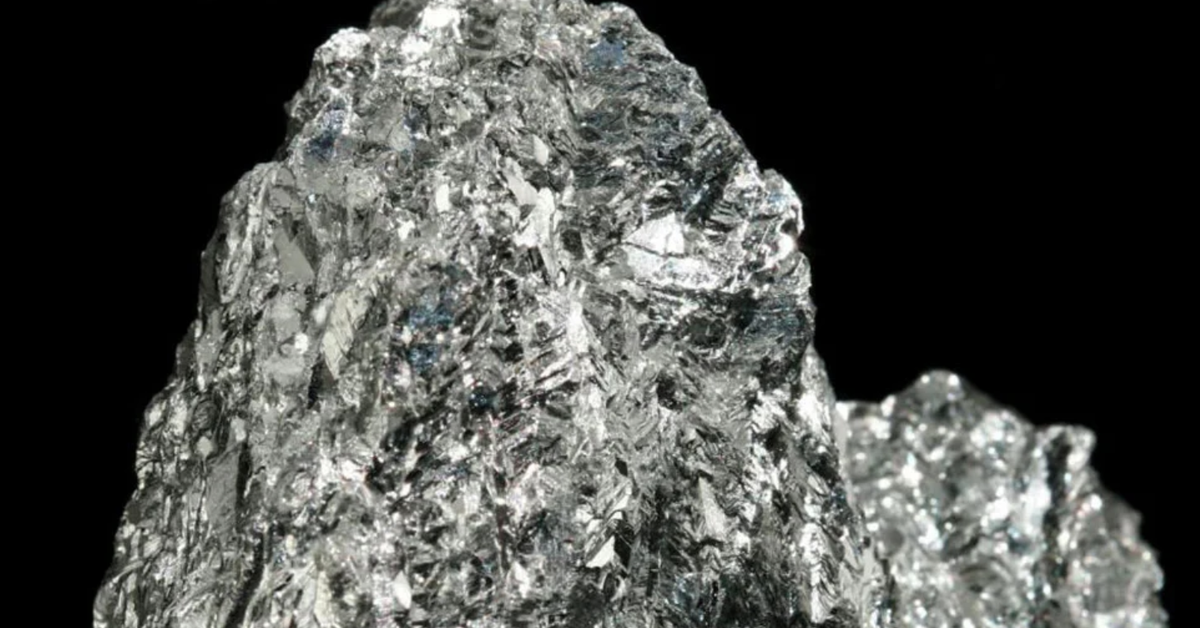

DSC Securities Company recommends Hoa Phat Group Joint Stock Company (HPG) shares positively, with a target price of VND 30,000/share according to the investment thesis: Input costs support medium-term profit margins: Coal and iron ore prices in 2024 are forecast by major organizations in the world (WorldBank, Fitch Ratings) to be lower than in 2023 and have been significantly adjusted compared to the beginning of the year. DSC expects that although output prices will not explode due to the gloomy Chinese market, they will not decrease sharply due to recovering demand in the domestic market. At the same time, according to the management board, HPG has released high-priced inventories in the first quarter to focus on stockpiling cheap goods, thereby helping the gross margin in 2024 to improve to 15%.

Demand for construction steel gradually returns: Construction steel consumption output may gradually recover with the return of real estate projects, especially the amount of goods that were still stuck in legal issues in the previous year, when the ability to approve legal issues from authorities is supported by the update of new laws regulating the real estate market that may simultaneously take effect from August 2024. Accordingly, HPG construction steel consumption output in 2024 may return to the historical level of 2022, about over 4.1 million tons (+10% over the same period).

Dung Quat 2 Complex is a long-term driving force: The key Dung Quat 2 project, phase 1, with a capacity of 2.8 million tons of HRC/year, is gradually taking shape, expected to contribute output from 2025. With more modern technology, HPG can produce high-quality HRC with diverse technical specifications, suitable for the automobile and ship industries, etc., with fuel consumption reduced by about 10%. DSC assesses that there is still room for HRC demand in both export and domestic markets, so phase 1 will be able to operate at full capacity by 2028.

Stock Market Commentary 10/9: The market may continue to recover

Source: https://vov.vn/thi-truong/chung-khoan/mot-so-co-phieu-can-quan-tam-ngay-910-post1127069.vov

Comment (0)