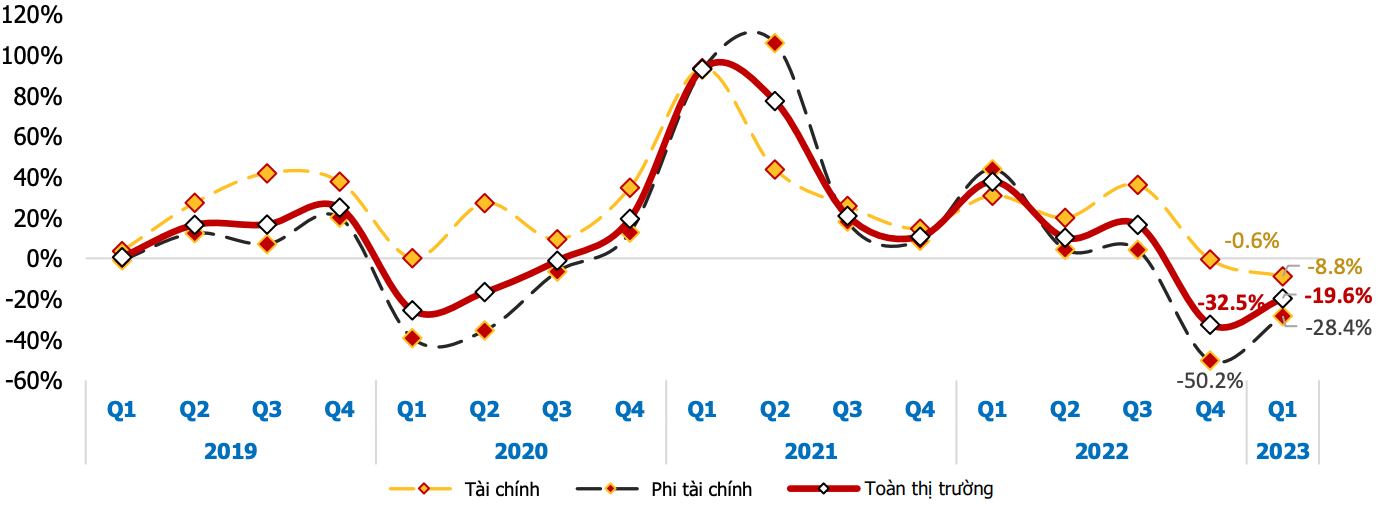

According to Agriseco Securities' report, in the first quarter of 2023, the total market profit decreased by about 20%, with a clear weakening of the non-financial sector when it decreased by nearly 30% compared to the same period.

This reflects the difficulties businesses are facing in the context of the world situation continuing to evolve complicatedly; low growth accompanied by recession risks in many major partner countries while domestic demand has not fully recovered.

In the second quarter of 2023, there will still be more difficulties than advantages, however, Agriseco Research expects that with support policies and capital flow unblocking, the economy will permeate and help businesses gradually overcome difficulties, before entering a new growth cycle in the coming quarters.

The stock market is also active with a 6% increase since the beginning of May, with active liquidity with trading sessions of over VND 20,000 billion.

Net profit growth of listed companies (Source: Agriseco Research).

Accordingly, Agriseco Research has suggested stocks that the analysis team expects to grow in this second quarter. The first is BMP stock of Binh Minh Plastics JSC with a target price of VND95,000/share.

Agriseco Research expects Q2/2023 profits to maintain positive growth momentum thanks to lower input resin prices. BMP's profit margin has continuously improved and reached a record high in Q1/2023 at 38.5% thanks to lower input resin prices. Agriseco Research assesses that the above trend will continue in Q2/2023 when PVC resin prices continue to decline and are about 27% lower than the same period.

In addition, demand may improve as the real estate market gradually recovers thanks to the Government 's support policies that can gradually penetrate and help the real estate market warm up again, thereby helping to improve output demand for BMP's products.

Regarding public investment enterprises, Agriseco Securities recommends C4G and CTD shares of Cienco 4 Group Corporation and Coteccons Construction Corporation; with target prices of VND15,000/share and VND75,000/share, respectively.

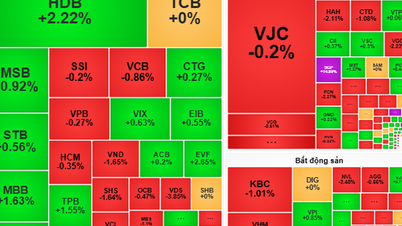

Businesses investors should pay attention to (Source: Agriseco Research).

Thanks to the profit factor in the second half of 2023, which is expected to recover, Cienco Group's semi-annual profit is positive thanks to accounting from projects: North-South Expressway, Cam Lo - La Son, Phan Thiet - Dau Giay; Phu Bai Airport... It is estimated that in the first 20 days of the second quarter, C4G's profit was almost equal to the first quarter of 2023.

In addition, Coteccons Construction is expected to account for key projects signed in 2022 this year as well as win additional key infrastructure projects. CTD's backlog for 2023 is relatively high, about VND 17,000 billion (excluding the Lego project).

Despite its alarming business results in recent years, Vietnam Airlines Corporation (HSX: HVN) continues to attract investors because the number of passengers passing through airports continues to recover strongly, helping HVN improve its revenue.

As of April, the number of passengers passing through airports reached 36.4 million. Of which, the number of international passengers has recovered to 77-78% compared to 2019 and helped HVN's passenger transport revenue more than double the same period.

Therefore, Agriseco expects the number of international visitors to Vietnam to continue to improve in the coming time, thereby improving air transport revenue. In addition, EIA forecasts that crude oil prices will decrease by 5-10% in the following months, so HVN's future profits will improve, especially when HVN reported its first pre-tax profit after Covid-19 in the first quarter of 2023.

In addition to the above stocks, Agriseco Research also recommends stocks of a number of other enterprises, including Kinh Bac Urban Development Corporation (HSX: KBC), Petroleum General Services Corporation (HSX: PET), Petroleum Drilling and Drilling Services Corporation (HSX: PVD), Quang Ngai Sugar Corporation (UPCoM: QNS), Binh Dinh Pharmaceutical - Medical Equipment Corporation (HSX: DBD), FPT Corporation (HSX: FPT).

The analysis team mostly based on forecasts that the economy will gradually recover by the end of 2023, liquidity in the stock market will improve and consumer demand will increase again in the market .

Source

![[Photo] More than 17,000 candidates participate in the 2025 SPT Competency Assessment Test of Hanoi National University of Education](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/e538d9a1636c407cbb211b314e6303fd)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on science and technology development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/ae80dd74c384439789b12013c738a045)

![[Photo] Readers line up to visit the photo exhibition and receive a special publication commemorating the 135th birthday of President Ho Chi Minh at Nhan Dan Newspaper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/85b3197fc6bd43e6a9ee4db15101005b)

![[Photo] Nearly 3,000 students moved by stories about soldiers](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/21da57c8241e42438b423eaa37215e0e)

Comment (0)