People and businesses have to pay more than 1.1 million billion VND in interest

That is the figure that the Vietnam Institute for Economic and Policy Research (VEPR) has calculated in 2022. Specifically, according to VEPR, lending interest rates have increased since July 2022 and will continue to remain high until February 2023. The average lending interest rate of about 9 - 10.7% has weakened the competitiveness of Vietnamese enterprises. In 2022 alone, the interest expense that enterprises and people have to bear is at least 1,135 trillion VND, equivalent to 12% of the country's GDP. It is worth noting that while domestic people and enterprises have to bear high interest rates, in countries in the region, interest rates have decreased very quickly. For example, China reduced lending interest rates by the end of 2022 to about 4%, helping Chinese enterprises recover strongly. According to VEPR analysis, the high interest rate environment affects the competitiveness of enterprises and also affects the demand for starting and establishing enterprises.

Loan interest rates need to be reduced sharply to support businesses

Mr. Tran Van Duc, Chairman of the Board of Directors of Ben Tre Coconut Processing Investment Joint Stock Company, said that the State Bank (SBV) explained that high interest rates are to fight inflation and stabilize exchange rates, but inflation in recent years has only been about 4 - 4.5%/year, but interest rates have increased by 40 - 50% compared to before, which is very unreasonable. Some businesses are currently able to access interest rates of 9 - 10%/year, but some businesses are having to pay interest rates of 11 - 13%/year. "Countries in the region such as Thailand are also under pressure from external inflation, but why are their interest rates lower? Their businesses have access to low capital costs and low financial costs, so they can improve their competitiveness when entering the export market. Vietnamese businesses have a hundred difficulties," Mr. Duc compared and said that with a loan interest rate of 10%/year, the profit rate must be 15% or more to compensate, otherwise it will only be enough to support bank interest. This level of profitability is not easy in the current economic context, so in reality, businesses that can still borrow capital are lucky to only be able to make enough to pay the bank interest.

Loan interest rates are high, but according to Ms. Anh Thu, director of a seafood export company based in Ho Chi Minh City, from the end of 2022 to the beginning of 2023, it will not be easy for businesses to access bank capital. Not to mention that the credit limit is sometimes used up, sometimes it is still available, leading to loan interest rates increasing, making borrowers very afraid because of the high risk. "Now, large commercial banks are still lending, but accessing it is not easy. Somewhere they say lending interest rates are 7-8%/year and I don't know how many businesses can borrow at this rate, but the businesses I know borrow at the cheapest rate of 9%/year, for individuals it is from 12-16%/year. High loan interest rates, unstable market, so businesses have to stand still and do not dare to do anything," Ms. Anh Thu said.

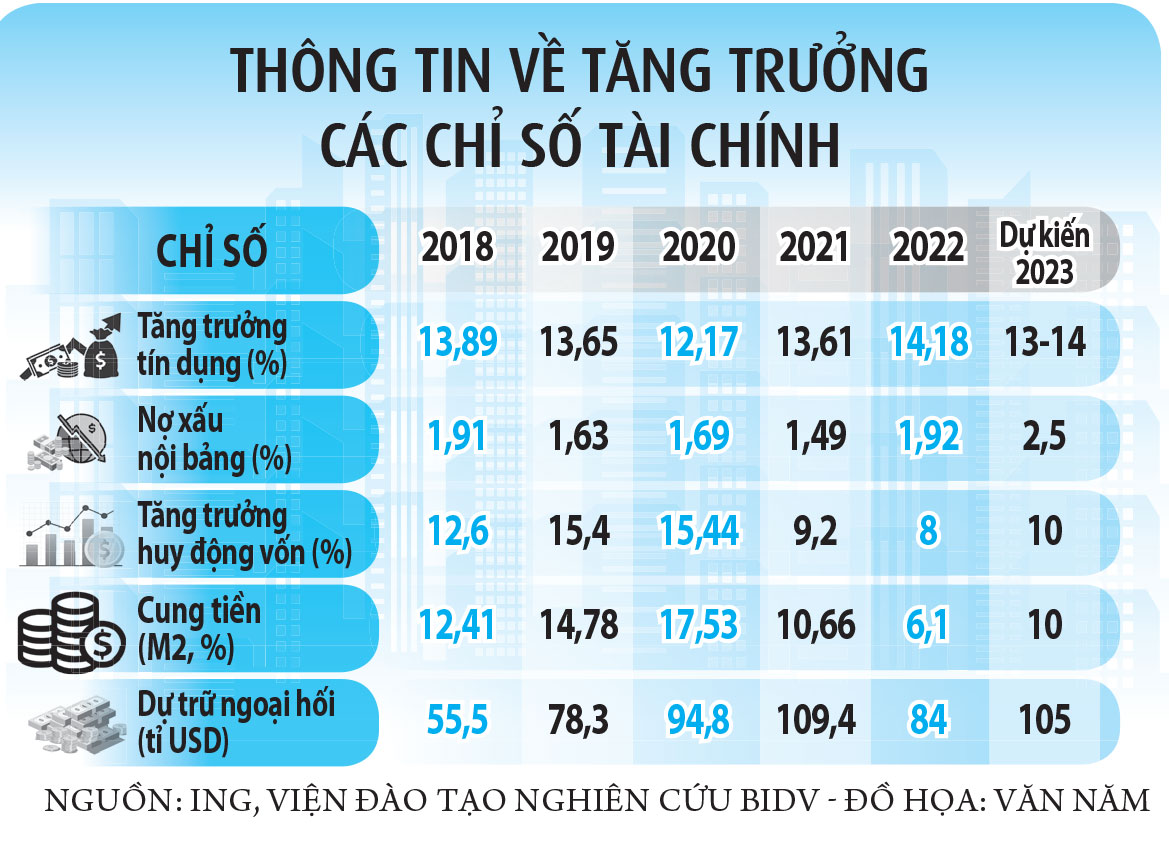

According to VEPR, credit growth and capital mobilization decreased sharply in the first 3 months of 2023 due to weak demand and high interest rates. Capital mobilization of economic organizations decreased sharply and the capital mobilization speed of the banking industry was also much lower than the average speed in the past 10 years. Meanwhile, deposits in the residential sector increased sharply, showing an increase in investment risk perception, reducing the need to establish businesses.

Money supply is shrinking

To reduce lending interest rates, the State Bank of Vietnam has adjusted the operating interest rate twice. However, in reality, lending interest rates in the market, as mentioned above, are still high regardless. The shrinking money supply is assessed by experts as one of the main reasons why the economy lacks liquidity and interest rates have increased sharply in recent times and cannot be reduced. Data shows that money supply has been slowing down over the years. Specifically, GDP growth in 2020 was 2.91% with money supply (M2) increasing by over 14.5%; in 2021, GDP increased by 2.58%, with money supply at 10.66%; by 2022, GDP increased by 8.02% but money supply was only 6.15%. By the end of March 2023, the economy's money supply only increased by 0.57%. Low money supply makes liquidity in the market more difficult and loan interest rates even more difficult to reduce. A recent survey by Thanh Nien also shows that except for the big 4 (4 State-owned banks holding controlling shares), most small banks have hit the credit room ceiling.

Looking at the credit room that banks are allocated as well as the growth of outstanding loans, we can see that many banks have run out of credit quotas. Specifically, at the end of February, the State Bank allocated credit limits to each bank. According to statistics from VNDirect Securities Company, a series of commercial banks were granted room such as HDBank at 11%, ACB at 9.8%, Vietcombank at 9.6%, TPBank at 9.1%, VPBank and MBBank at 9%, BIDV at 8.3%, MSB at the highest credit room of 13.5%... However, in just the first 3 months of the year, the credit growth rate of some banks has increased rapidly such as MSB increased by 13%, Techcombank increased by nearly 10.7%, HDBank increased by 9%, 3 banks TPBank, Nam A Bank and VietABank increased by 7%... Enterprises are hungry for capital, need capital while credit room is limited, high interest rates are also inevitable.

According to Dr. Le Dat Chi, Deputy Head of the Finance Department of Ho Chi Minh City University of Economics, banks with rapid credit growth and no room for growth will have high interest rates and will be difficult to reduce. Therefore, to reduce interest rates, the State Bank of Vietnam must consider expanding room for them.

More importantly, Dr. Le Dat Chi said that the mechanism of managing credit limits for each bank that has existed for many years has distorted the credit market and made it difficult for interest rates to decrease. In fact, the granting of credit limits to some banks is only enough to meet the needs of their "backyard" enterprises. Therefore, lending interest rates to other customers will be very high to compensate for the losses of loans from "favorite" customers. This partly explains the current credit growth situation in the banking system, which is that some banks have quite fast credit growth, but others have slow growth. When banks reach the credit room, it means that the lending interest rates are very high. "The common experience in other countries is to loosen or eliminate credit ceilings. Because the effectiveness of credit ceilings is only effective in the short term or in the early stages. However, in Vietnam, the imposition of credit ceilings on banks has existed for about ten years but is still maintained. In the long term, the imposition of credit ceilings will reduce banking competition and the efficiency of capital allocation in the economy, not to mention that short-term credit demand from enterprises may be affected, especially enterprises that are using large loans from banks," said Mr. Chi.

Mr. Le Dat Chi raised the question of why some banks now announce that their risk management meets Basel II standards, some banks are moving towards Basel III, but the State still applies intervention measures to grant credit limits to each bank to control risks? If banks really meet these international risk management criteria, they must stop granting credit limits. When they are allowed to grow credit freely but ensure safe operating standards, interest rates can compete and be reduced.

Credit room is a stop valve that makes it difficult for interest rates to decrease.

If Vietnam wants to increase its GDP growth by about 6.5% this year, it must also open up more credit so that capital flows can reach many businesses. However, lending by commercial banks still depends on credit growth targets (room), and when the room for credit is about to run out, banks will naturally lend less. Meanwhile, if business demand remains high, banks will take advantage of this opportunity so that customers who receive loans must accept high interest rates. It is difficult for interest rates to be low when banks tighten lending. The room for credit is a stop valve that makes it difficult for interest rates in the market to go down.

Financial expert, Dr. Nguyen Tri Hieu

Source link

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)