According to the newly announced business results of SSI Securities Corporation (HoSE: SSI), the company's operating revenue reached VND1,941 billion, up 44% over the same period.

In particular, the proprietary trading segment has improved with the largest source of revenue coming from interest arising from FVTPL financial assets, increasing sharply by 73% compared to Q3/2022, reaching VND 765 billion. FVTPL asset loss decreased slightly by 3% to VND 162 billion. Minus the proprietary trading cost of VND 12 billion in this quarter, SSI recorded a proprietary trading profit of VND 590 billion, more than 2.2 times higher than the same period.

Along with self-trading, the brokerage segment also brought in VND535 billion in revenue, up 58% and accounting for the second largest proportion in the revenue structure. SSI's interest from loans and receivables also increased slightly compared to the same period last year to VND431 billion.

In addition, the profit from financial assets available for sale had a clear difference of VND 847 million in this third quarter, while in the same period last year it was only VND 75 million. Although operating expenses increased by 18%, reaching VND 653 billion (mostly brokerage costs), SSI still reported a profit after tax that doubled in the third quarter of 2022 to VND 710 billion.

Accumulated in the first 9 months of 2023, The company brought in VND5,111 billion in revenue and VND1,780 billion in profit after tax, up 3% and 22% respectively over the same period last year.

Compared to the results achieved in the past, SSI has completed 73% of the revenue target and 87% of the profit target for the whole year.

As of September 30, 2023, SSI's total assets reached VND 55,282 billion, an increase of more than VND 3,000 billion compared to the beginning of the year. Margin lending balance reached more than VND 14,713 billion, an increase of VND 1,600 billion compared to the end of the previous quarter and an increase of 35% compared to the beginning of the period.

Of which, the proprietary trading segment accounts for the largest proportion in the asset structure, more than 53% with VND 29,600 billion, including VND 475 billion of listed stocks (HPG, SGN, VPB, STB...); nearly VND 729 billion of risk-hedging securities, more than VND 10,530 billion of unlisted bonds and about VND 16,000 billion of deposit certificates.

Currently, SSI is recording a loss on its investment in HPG with an original value of VND 26.9 billion and a current fair value of only VND 25.8 billion. The same is true for STB shares, which were purchased at an original price of VND 57 billion but have a current fair value of only VND 54 billion. However, VPB and SGN stocks have improved and recorded a slight profit.

SSI's available-for-sale (AFS) financial assets reached VND860 billion, 2.2 times higher than the figure at the beginning of the year. SSI is holding VND325 billion in shares on the UPCoM floor and VND198 billion in unlisted shares and fund certificates, of which the company is holding a large number of shares of OPC, PAN Farm and ConCung .

Source

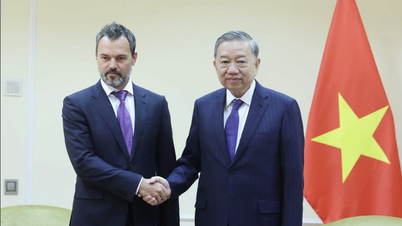

![[Photo] General Secretary To Lam concludes visit to Russia, departs for Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/0acf1081a95e4b1d9886c67fdafd95ed)

![[Photo] General Secretary To Lam arrives in Minsk, begins state visit to Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/76602f587468437f8b5b7104495f444d)

![[Photo] General Secretary To Lam meets and expresses gratitude to Vietnam's Belarusian friends](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c515ee2054c54a87aa8a7cb520f2fa6e)

![[Photo] National Assembly Chairman Tran Thanh Man attends the Party Congress of the Committee for Culture and Social Affairs](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/f5ed02beb9404bca998a08b34ef255a6)

Comment (0)