Domestic gold price today

The price of domestic gold bars continues to “plummet”. Currently, gold brands are buying at 97.1 million VND/tael and selling at 100.1 million VND/tael. Bao Tin Minh Chau Gold is buying at 100,000 VND higher than other brands.

Similarly, the price of gold rings of various brands was also adjusted down sharply. Specifically, the price of SJC 9999 gold rings was adjusted down by 1.7 million VND for the purchase price and 1.4 million VND for the sale price, down to 97 million VND/tael and 100 million VND/tael, respectively.

|

| Domestic gold prices drop sharply. Photo: dantri.com.vn |

DOJI in Hanoi and Ho Chi Minh City markets adjusted down 1.8 million VND for buying and 1.2 million VND for selling to 96.7 million VND/tael and 100.1 million VND/tael, respectively.

PNJ brand gold ring price is listed at 97.5 million VND/tael and 100.1 million VND/tael, down 1.2 million VND for both buying and selling.

Bao Tin Minh Chau listed the price of plain round gold rings at 97.5 million VND/tael for buying and 100.5 million VND/tael for selling, down 1.5 million VND for buying and 1.1 million VND for selling.

Phu Quy SJC is buying gold rings at 97.1 million VND/tael and selling at 100.3 million VND/tael, down 1.7 VND and 1.3 million VND respectively.

Domestic gold bar prices updated at 5:30 a.m. April 6 as follows:

Yellow | Area | Early morning 5-4 | Early morning 6-4 | Difference | ||||||

Buy | Sell | Buy | Sell | Buy | Sell | |||||

Unit of measure: Million VND/tael | Unit of measure: Thousand dong/tael | |||||||||

DOJI | Hanoi | 98.8 | 101.3 | 97.1 | 100.1 | -1700 | -1200 | |||

Ho Chi Minh City | 98.8 | 101.3 | 97.1 | 100.1 | -1700 | -1200 | ||||

SJC | Ho Chi Minh City | 98.8 | 101.3 | 97.1 | 100.1 | -1700 | -1200 | |||

Hanoi | 98.8 | 101.3 | 97.1 | 100.1 | -1700 | -1200 | ||||

Danang | 98.8 | 101.3 | 97.1 | 100.1 | -1700 | -1200 | ||||

PNJ | Ho Chi Minh City | 98.8 | 101.3 | 97.1 | 100.1 | -1700 | -1200 | |||

Hanoi | 98.8 | 101.3 | 97.1 | 100.1 | -1700 | -1200 | ||||

Bao Tin Minh Chau | Nationwide | 98.8 | 101.3 | 97.2 | 100.1 | -1600 | -1200 | |||

Phu Quy SJC | Nationwide | 98.6 | 101.3 | 97.1 | 100.1 | -1500 | -1200 | |||

World gold price today

The gold market witnessed strong fluctuations this week, with prices increasing and decreasing with large amplitudes. In particular, in the last trading sessions of the week, the price of this precious metal continuously "plummeted" and ended the week with a decrease of 46.9 USD compared to the closing price of the previous week.

On Wednesday, President Donald Trump’s announcement of tariffs sent markets into turmoil the likes of which he has not seen in decades. Despite the uncertainty that has prevailed in the past few weeks and months, many investors had hoped that the tariffs would be targeted and not too onerous. But things have not gone as planned.

Escalating tariffs and trade wars have created the biggest disruption to global supply chains since the world was forced into lockdown due to the Covid-19 pandemic.

Stock markets have taken a hit amid concerns about slowing economic activity and rising inflation. The S&P 500 ended the week down 9%, its biggest weekly decline since May 2020.

Gold, however, has shown its strength. Despite falling nearly 3% and ending a five-week winning streak, the precious metal is still considered to be much better than the stock market.

|

| World gold price anchored above 3,000 USD/ounce. Photo: Getty Images |

Experts warn that gold prices could fall further and could test support as low as $2,800 an ounce, although spot gold is holding support above $3,000 an ounce. Experts advise investors not to jump into the market right now, likening buying now to “trying to catch a falling knife.” However, they also say that such a correction will attract new investors.

Specifically, CPM Group analysts recommend that gold investors maintain their long positions but stay out of the market and be ready to buy gold when the pullback is complete.

Now, many believe that if the global trade war escalates, central banks will diversify away from the US dollar at a much faster pace. As a monetary metal, gold continues to be the biggest beneficiary.

With the domestic gold bar price falling sharply and the world gold price listed at Kitco at 3,038.8 USD/ounce (equivalent to about 95.1 million VND/tael converted according to Vietcombank exchange rate, excluding taxes and fees), the difference between domestic and world gold prices is about 6.2 million VND/tael.

TRAN HO HOAI

* Please visit the Economics section to see related news and articles .

Source: https://baodaknong.vn/gia-vang-hom-nay-6-4-chuyen-gia-khuyen-cao-nha-dau-tu-dung-ngoai-cuoc-248439.html

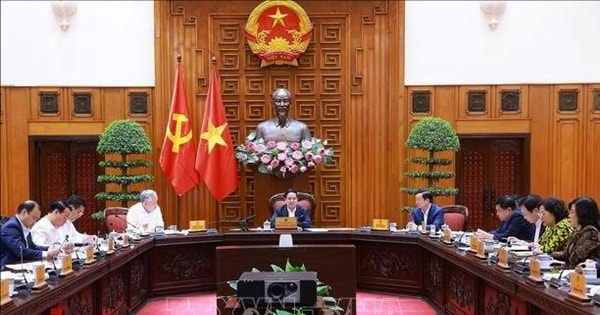

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to discuss tax solutions for Vietnam's import and export goods](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/19b9ed81ca2940b79fb8a0b9ccef539a)

![[Photo] Unique folk games at Chuong Village Festival](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/cff805a06fdd443b9474c017f98075a4)

Comment (0)