Commodity market on January 2, soybean prices recorded the second consecutive increase in the last trading session of 2024.

The world raw material market was temporarily suspended yesterday due to the Tet holiday. According to the Vietnam Commodity Exchange (MXV), investment cash flow had slowed down in the market during the last trading session of the year. Notably, the energy market had mixed developments as two crude oil products recorded their third consecutive increase, while natural gas prices plunged nearly 8% after soaring more than 16% in the first session of the week. In addition, contrary to the general trend, all 7 agricultural products simultaneously improved.

Crude oil receives positive signals from China's economy

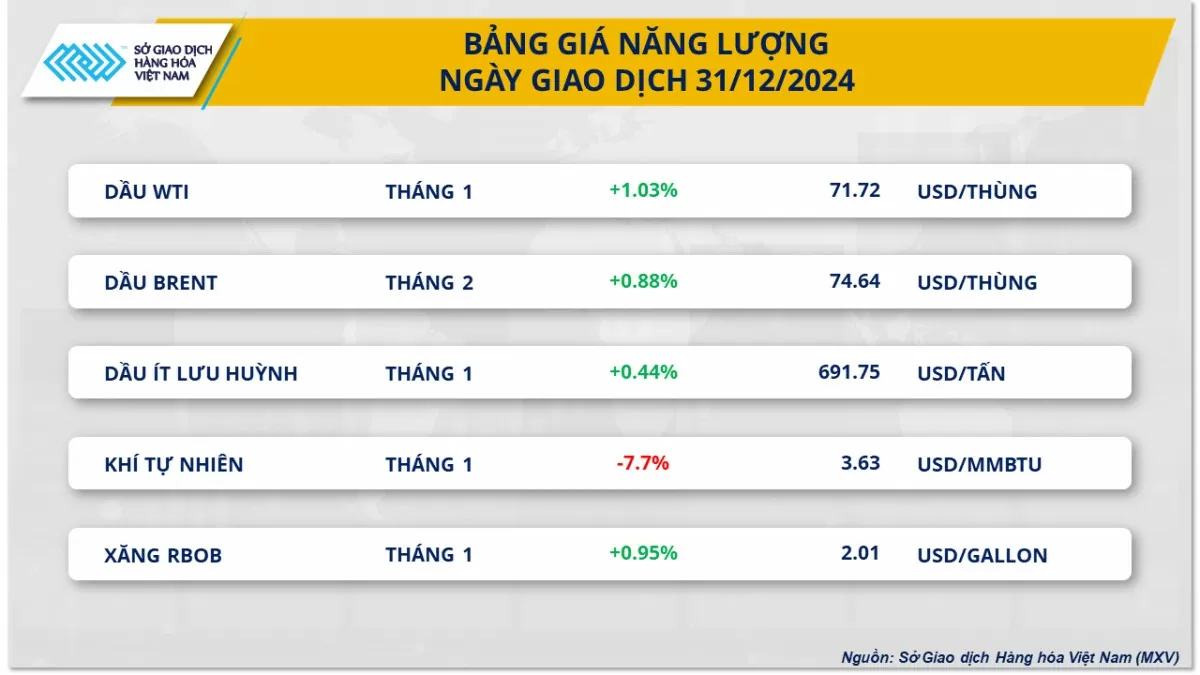

The energy market recorded mixed developments with low liquidity in the last session of 2024. The two crude oil products continued to increase while natural gas adjusted sharply down.

Specifically, WTI crude oil prices increased by 1.03% to 71.72 USD/barrel and Brent crude oil prices increased by 0.88% to 74.64 USD/barrel, marking the third consecutive session of increase for both commodities. In contrast, natural gas prices fell nearly 8% due to profit-taking pressure after soaring more than 16% in the first session of the week.

|

| Energy price list |

Oil prices received support from positive manufacturing activity in China in December. According to the National Bureau of Statistics of China, the manufacturing purchasing managers' index (PMI) reached 50.1, the third consecutive month above the 50-point mark, reflecting an expansionary trend in production. Meanwhile, the non-manufacturing PMI rose to 52.2, beating expectations of 50.2 and reaching its highest level since March 2024. These data show that China's economy is improving after stimulus measures since September, positively supporting the outlook for crude oil demand.

Expectations that U.S. crude inventories will continue to decline for a sixth straight week also boosted buying. According to a Reuters survey, analysts forecast U.S. commercial crude inventories to fall by 2.8 million barrels in the week ending December 27, following a decline of 4.24 million barrels the previous week. Distillate inventories are expected to fall by 100,000 barrels, less than the 313,000-barrel decline the previous week.

Additionally, data from Vortexa showed that oil storage on tankers anchored for at least seven days in the week ending December 27 fell 16% from the previous week, to 60.27 million barrels.

Soybeans lead the price increase of agricultural products

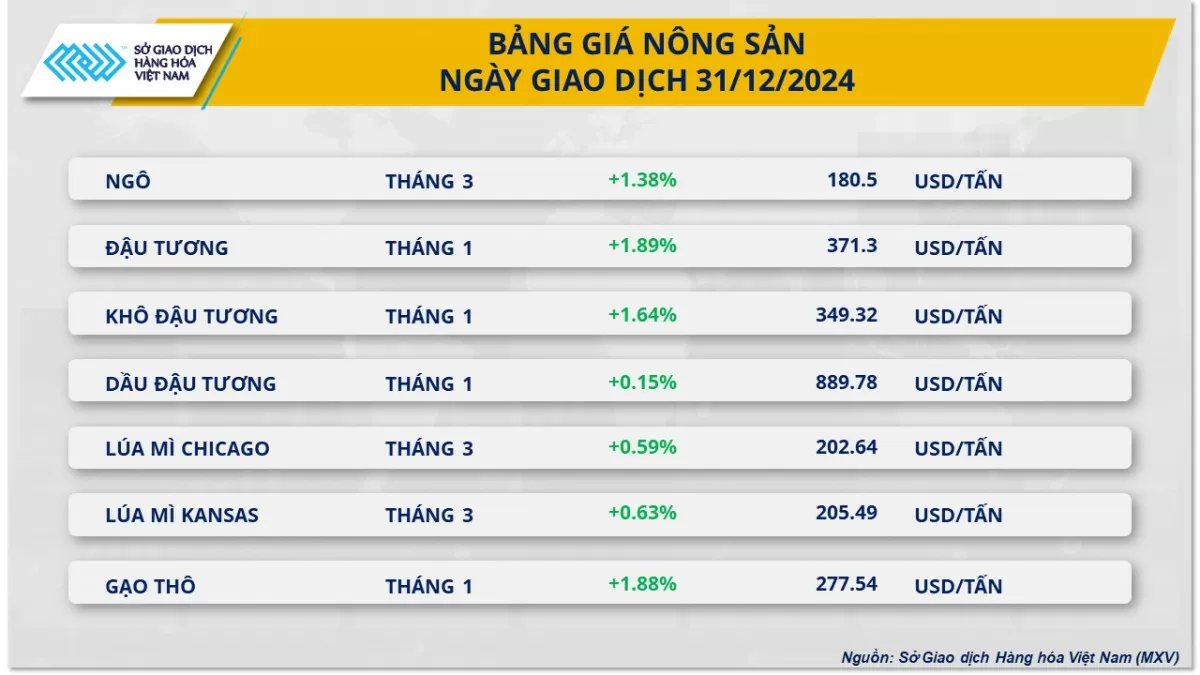

According to MXV, at the end of the last session of 2024, the agricultural market recorded a positive growth momentum with all 7 commodities simultaneously improving, in which soybeans continued the recovery trend.

Specifically, soybean prices recorded the second consecutive increase in the last trading session of 2024. However, selling pressure appeared when prices approached the psychological zone of 1,000, causing the increase to narrow despite strong market fluctuations.

|

| Agricultural product price list |

Argentine farmers have cut soybean plantings from their initial expectations, while increasing corn plantings, according to the Buenos Aires Grains Exchange. The agency revised Argentina's soybean plantings for the 2024-25 crop year down to 18.4 million hectares, 200,000 hectares lower than previously expected, due to lower prices. The report said Argentine farmers have completed planting 84.6% of their planned soybean plantings. With the reduced acreage and the risk of prolonged dry weather in the next two weeks, supplies from Argentina may fall short of market expectations, supporting prices in the short term.

Meanwhile, according to the Export Inspections report, the US Department of Agriculture (USDA) said that US soybean deliveries in the week ending December 26 reached 1.57 million tons, down from 1.77 million tons last week due to the impact of the Christmas holiday. However, this information did not put much pressure on the market.

For corn, the only commodity in the group to see prices weaken, the market is under profit-taking pressure after four consecutive sessions of gains and positive supply prospects from Argentina. The Buenos Aires Grain Exchange raised its forecast for Argentina's 2024-25 corn acreage to 6.6 million hectares, up from 3 million hectares previously estimated.

Source: https://congthuong.vn/thi-truong-hang-hoa-21-gia-dau-tuong-phuc-hoi-367450.html

![[Photo] Discover Vietnam's leading aircraft maintenance workshop at Noi Bai airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/23/b12dde66f5374591b818f103e052cce5)

![[Photo] Prime Minister Pham Minh Chinh receives Chairman of Syre Group (Sweden)](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/23/1f541ee01d164844934756c413467634)

![[Photo] General Secretary To Lam receives CEO of Rosen Partners Group (USA)](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/23/2537171fceee43b19a8eec00d22823ff)

![[Photo] Many groups of students enjoyed exploring the Interactive Exhibition at Nhan Dan Newspaper](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/23/29184831b77143e0b9acdd71a05a40c2)

Comment (0)