Fecon suffered losses in its core business in the third quarter.

Fecon Corporation (Code FCN) has just announced its Q3 financial report. Of which, net revenue from sales and service provision reached VND547.6 billion, down 17.6% over the same period. Cost of goods sold accounted for VND467.5 billion, gross profit reached VND80.1 billion, down 21.4%. Gross profit margin decreased from 15.3% to only 14.6%.

During the period, financial revenue decreased by 25.7% to only VND12.4 billion. Although financial expenses also decreased, interest expenses remained high, accounting for VND43.7 billion.

Fecon (FCN) suffered a loss in business operations in the third quarter, high interest expenses put great pressure on the company (Photo TL)

Fecon's selling expenses and administrative expenses in Q3 also decreased compared to the same period last year, accounting for VND3.5 billion and VND44.8 billion, respectively. However, it should be noted that interest expenses alone were almost as large as administrative expenses and accounted for 54.5% of gross profit.

This shows that the interest burden is putting great pressure on Fecon's gross profit from its core business. As a result, Fecon lost VND 655 million from its core business in the third quarter of 2023.

In addition, the company recorded other profits of VND1.7 billion, corporate income tax expenses of more than VND900 million. After deducting all expenses and taxes, Fecon recorded after-tax profits of only VND213 million.

As of September 30, 2023, Fecon's accumulated revenue reached VND 1,830.3 billion, and its after-tax profit was only VND 1.6 billion. Compared to the 2023 target of VND 3,800 billion in revenue and VND 125 billion in after-tax profit, Fecon has only completed 48.2% of the revenue plan and 1.2% of the annual profit plan.

If there are no major changes in Q4, FCN will almost certainly fail its 2023 business plan. Fecon's profit decline actually started many years ago, especially after the company began listing its shares with the code FCN on the HoSE.

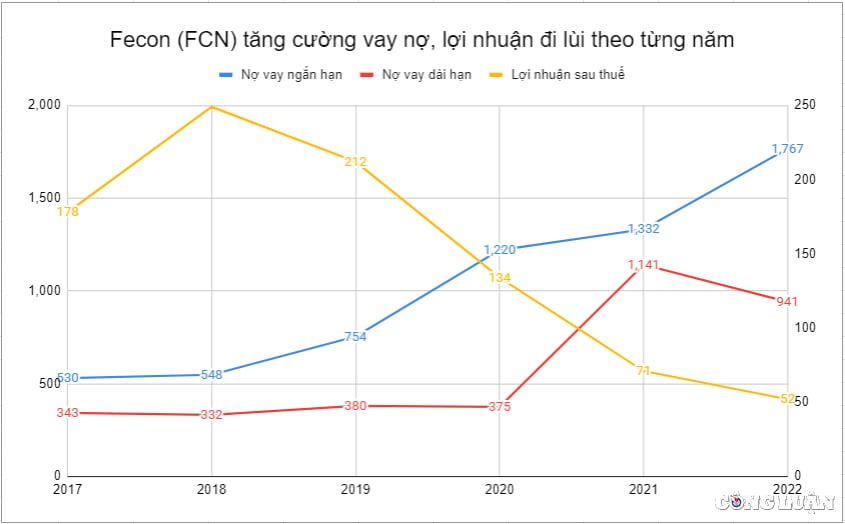

Fecon's profits have continuously declined for 5 years since listing.

Operating in the field of construction foundations, Fecon started to be listed on the stock exchange in mid-2016. Since the code FCN was listed on the HoSE, Fecon's business results have continuously declined year by year.

In 2017, the company achieved revenue of VND 2,320 billion, profit after tax of VND 178 billion. By 2018, revenue increased to VND 2,846 billion, profit after tax increased to VND 249 billion. Also from this year, FCN's 5-year slide began.

Fecon's (FCN) profits have continuously decreased in the past 5 years since its listing. Meanwhile, debt has been increasing.

During the 2018-2022 period, Fecon's revenue continued to grow, peaking at VND 3,484 billion in 2021, then slightly decreasing to VND 3,046 billion in 2022.

However, in contrast to the increase in revenue, after-tax profit has continuously decreased. From 249 billion VND in 2018 to only nearly 52 billion VND in 2022. Thus, in just 5 years, Fecon's after-tax profit has decreased by nearly 80%.

And as mentioned above, even though it has passed the third quarter, Fecon's accumulated profit after tax for the whole year of 2023 has only reached 1.6 billion VND, equivalent to 1.2% of the annual plan. If there is no breakthrough, Fecon will enter the 6th consecutive year of profit decline.

Debt is growing bigger and bigger, interest expenses increase every year

Another notable point is that in contrast to the decline in profits, the debt in Fecon's asset structure is increasingly expanding. Fecon's short-term debt has been on an upward trend, from just over VND 530 billion in 2017 to VND 1,767 billion in 2022. Long-term debt has also increased from VND 343 billion in 2017 to VND 941 billion in 2022.

At the end of Q3/2023, Fecon's debt situation has changed but in general, it still tends to increase. Specifically, short-term debt has increased to VND 1,971.2 billion, up 11.6% compared to the beginning of the year. Long-term debt decreased slightly to VND 904 billion. Total long-term and short-term debt is VND 2,875.2 billion, up VND 467 billion compared to the beginning of the year.

The sharp increase in debt also led to an increase in interest expenses, putting pressure on Fecon's gross profit. From 2017 to 2020, the company's interest expenses did not fluctuate much, only at 80-90 billion VND/year. However, from 2020 to 2022, interest expenses continuously increased, reaching 212 billion VND in 2022.

By the end of Q3/2023, interest expenses had reached VND 180.7 billion, an increase of 17.6% over the same period. This means that Fecon's interest expenses will continue to increase further in 2023.

Source

![[Photo] General Secretary To Lam arrives in Minsk, begins state visit to Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/76602f587468437f8b5b7104495f444d)

![[Photo] General Secretary To Lam meets and expresses gratitude to Vietnam's Belarusian friends](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c515ee2054c54a87aa8a7cb520f2fa6e)

![[Photo] General Secretary To Lam concludes visit to Russia, departs for Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/0acf1081a95e4b1d9886c67fdafd95ed)

![[Photo] National Assembly Chairman Tran Thanh Man attends the Party Congress of the Committee for Culture and Social Affairs](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/f5ed02beb9404bca998a08b34ef255a6)

Comment (0)