Fecon (FCN) profit has declined continuously for 5 years since listing

Fecon Joint Stock Company (FCN) is a well-known company in the field of construction foundations and has been listed since mid-2016. However, since its shares were listed on HoSE, Fecon has continuously recorded declining business results every year.

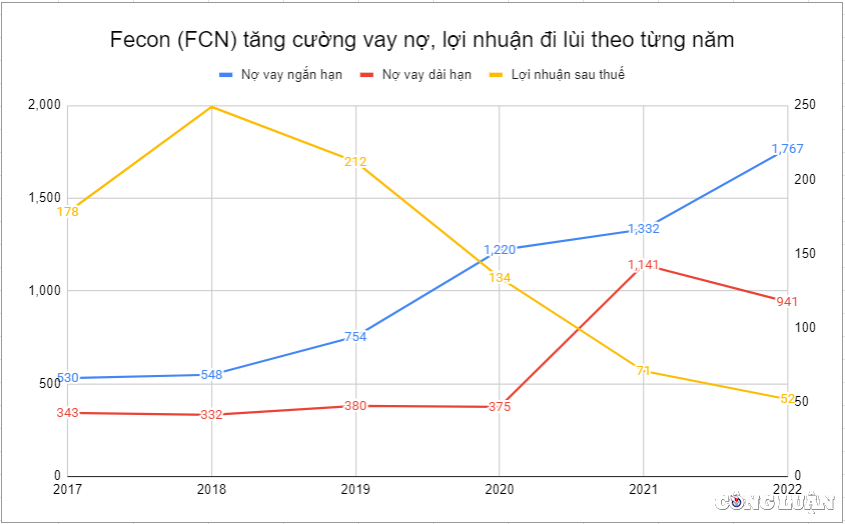

In 2017, the company's revenue reached VND2,320 billion, with after-tax profit reaching VND178 billion. In 2018, revenue increased to VND2,846 billion, with after-tax profit increasing to VND249 billion. From here, FCN's 5-year long slide began.

Fecon's revenue in the following period from 2018-2022 continued to grow, peaking at VND 3,484 billion in 2021, slightly decreasing to VND 3,046 billion in 2022.

Profits have continuously decreased, while Fecon's debt has increased.

In contrast to the increase in revenue, Fecon's after-tax profit has decreased steadily every year. From 249 billion VND in 2018 to only nearly 52 billion VND in 2022. Thus, in just 5 years, Fecon's after-tax profit has decreased by nearly 80%.

Currently, after the first half of 2023, Fecon's accumulated revenue has reached 1,283 billion VND, equivalent to 33% of the yearly plan. It is worth noting that after-tax profit has only reached 1.3 billion VND, equivalent to 1% of the plan. If nothing changes in the second half of 2023, this will be the 6th consecutive year that Fecon's profit has decreased.

Debt size 'bloats' every year

Contrary to the decline in profits, Fecon's debt has been increasing every year. In the period from 2017 to 2022, Fecon's short-term debt only increased, not decreased. From 530 billion VND in 2017 to 1,767 billion VND in 2022.

Long-term debt also tends to increase, from VND 343 billion in 2017 to a peak of VND 1,141 billion in 2021 and slightly decrease to VND 941 billion in 2022.

Profits continue to decline, Fecon (FCN) maintains operations thanks to debt (Photo TL)

Entering the first half of 2023, Fecon's debt continued to increase sharply in the short-term debt index, up to VND 2,091 billion. In contrast, long-term debt decreased slightly to VND 882 billion, but in general, total debt still increased from VND 2,908 billion at the end of 2022 to VND 2,973 billion at the end of the second quarter of 2023.

Another sign that Fecon’s debt pressure is increasing year by year is interest expense. From 2017-2020, Fecon’s interest expense did not fluctuate much, always at 80-90 billion VND/year.

Since 2021, interest expenses have increased to nearly 146 billion VND and reached 212 billion VND in 2022. And now, just after half of 2023, Fecon's interest expenses have been recorded at 137 billion VND.

6 consecutive years of negative business cash flow, Fecon still wins bids for 4 new projects

Another notable point about Fecon's operations is that in the 7 years of listing from 2016-2023, this unit had 6 years of negative operating cash flow. Only in 2020 did it record a positive operating cash flow of 89 billion VND, in the remaining 6 years Fecon had negative cash flow, at least a few tens of billions, up to 203 billion VND as in 2021.

Continuously negative cash flow from operations and declining profits year after year further prove that Fecon maintains operations through debt.

In August, Fecon and its subsidiaries in the ecosystem were also warned for owing social insurance. Of which: Fecon JSC was 681 million VND late in paying insurance; Fecon Pile and Construction JSC was 1.1 billion VND late in paying; Fecon Infrastructure Construction JSC was 563 million VND late in paying; Fecon Ratio Underground Construction JSC was 504 million VND late in paying; Fecon Investment JSC was 123 million VND late in paying.

In another development, Fecon has just won bids for 4 new projects with a total value of up to 500 billion VND including:

The package "providing, constructing mass piles and testing piles" at Nhon Trach 3&4 power plant project with a total value of 179 billion VND; The package "constructing the southern diaphragm wall of station 11" worth more than 62 billion VND under the pilot urban railway project (metro line 3) of Hanoi City; The contract worth 75 billion VND at Vung Ang II thermal power plant project (Ha Tinh); The package "constructing the section Km91+800 - Km114+200" worth 147 billion VND.

The fact that a company with continuously declining business results for many years, maintaining operations thanks to debt, has consecutively won bids for 4 large projects has made investors really have to raise a big question mark.

Source

![[Photo] National Assembly Chairman Tran Thanh Man meets with Thai Prime Minister Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/e71160b1572a457395f2816d84a18b45)

![[Photo] Prime Ministers of Vietnam and Thailand visit the Exhibition of traditional handicraft products](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/6cfcd1c23b3e4a238b7fcf93c91a65dd)

Comment (0)