After only half a year of achieving 1% of the target, Fecon (FCN) is at risk of breaking the annual plan.

Fecon's (FCN) business performance in the first half of 2023 has shown some positive signs, but overall it is still showing great disappointment.

The company's net revenue reached VND1,282.7 billion. Most of the revenue came from the construction and installation sector with VND1,121.1 billion. This was followed by revenue from electricity sales with VND86 billion, and revenue from finished goods sales with VND57.1 billion.

Fecon (FCN) business cash flow is continuously negative, only completing 1% of the 2023 plan even though half a year has passed (Photo TL)

Cost of goods sold currently accounts for VND 1,034.7 billion, the company's gross profit reaches VND 248 billion, much higher than the same period despite a decrease in revenue.

However, the sharp increase in financial expenses during the period eroded almost all of the increased gross profit. Financial expenses increased from VND100.6 billion to VND140.9 billion. Of which, interest expenses increased from VND98.8 billion to VND137.1 billion. This is a sign that the pressure on interest is increasing, making it difficult for the company to make a profit.

Selling expenses and administrative expenses during the period accounted for VND9.6 billion and VND95.9 billion, respectively. Profit after tax reached VND1.3 billion.

Compared to the target set at the beginning of the year with revenue of 3,800 billion VND, after-tax profit of 125 billion VND, Fecon has only completed 33.8% of the revenue plan and 1% of the annual profit plan. Thus, if there is no positive change from now until the end of the year, Fecon will likely fail the set plan.

7 years in business, 6 years of negative cash flow, revenue not enough to cover expenses

At the end of the second quarter of 2023, Fecon's operating cash flow was negative VND 101.9 billion. Of which, the highest recorded cash outflow came from interest payable of VND 137.1 billion. Once again, interest expenses have become a burden not only on the business results but also on the cash flow of this unit.

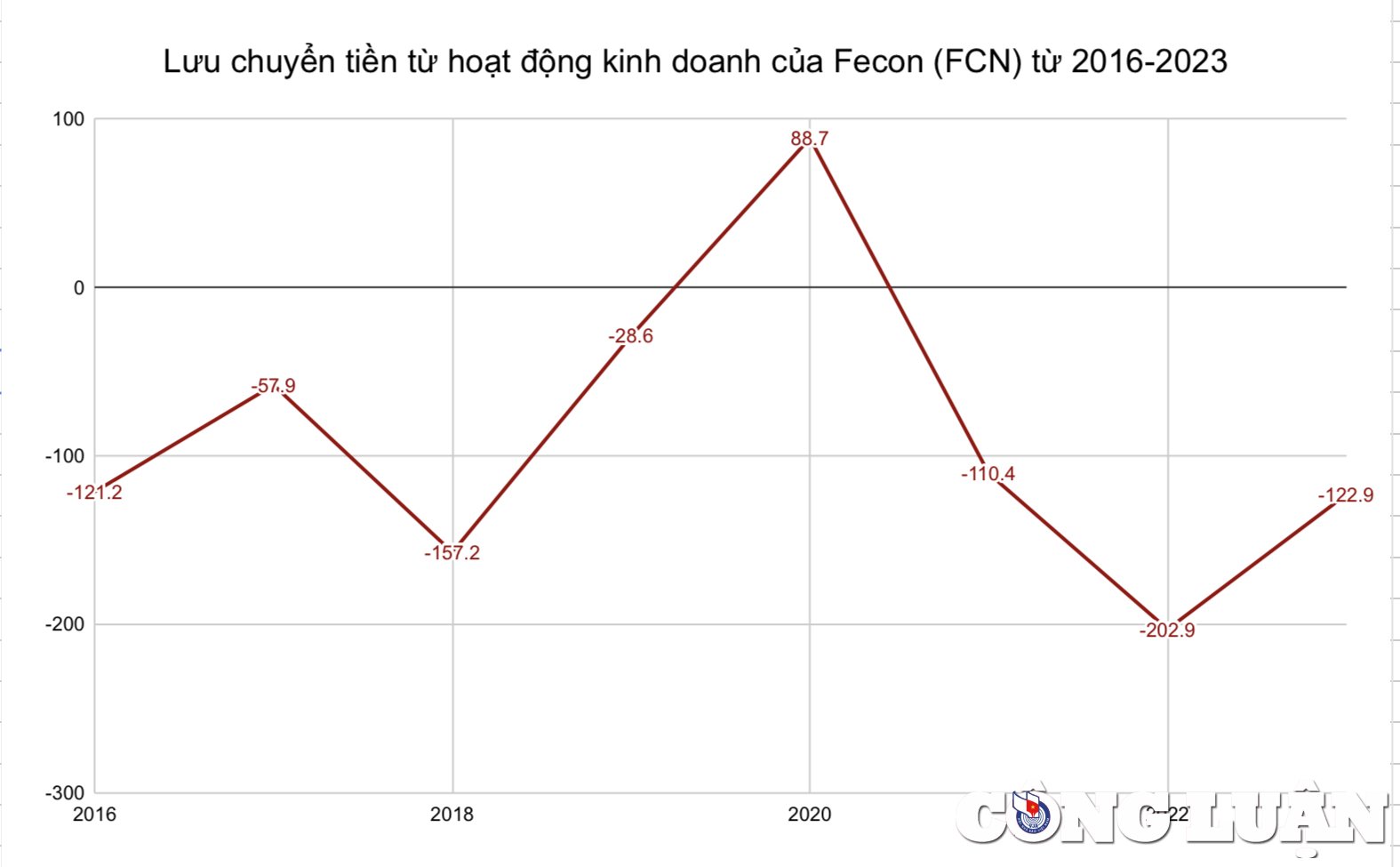

Another point worth noting is that during the 7 years of business since 2016, Fecon has rarely recorded positive operating cash flow.

In 7 years of business, Fecon (FCN) had negative cash flow for 6 years.

This means that during all those years, Fecon almost only spent money, the amount of money earned was not enough to cover the expenses, leading to a shortage of money.

2020 was the only year Fecon's operating cash flow was positive at VND88.7 billion. On the contrary, in 2016, 2018, 2021 and 2022, the operating cash flow of this unit was consecutively negative by hundreds of billions of VND. The peak was in 2021, when Fecon's operating cash flow was negative by VND202.9 billion.

As mentioned above, by the first half of 2023, Fecon's cash flow still showed no signs of improvement and continued to be negative by another VND 101.9 billion.

With a heavy negative business cash flow, Fecon and a series of subsidiaries have just been named for social insurance debt.

Recently, Hanoi Social Insurance announced a list of companies that owed social insurance payments as of the end of August. Notably, Fecon and a series of its companies were named due to late social insurance payments.

Specifically, Fecon Joint Stock Company is 681 million VND late in paying insurance; Fecon Pile and Construction Joint Stock Company is 1.1 billion VND late in paying; Fecon Infrastructure Construction Joint Stock Company is 563 million VND late in paying; Fecon Ratio Underground Construction Joint Stock Company is 504 million VND late in paying; Fecon Investment Joint Stock Company is 123 million VND late in paying.

It is not uncommon for a company to owe social insurance money, but this story happened in the context of Fecon facing great debt pressure. The amount of interest paid in the first 6 months of the year was 137.1 billion, an increase of nearly 40 billion compared to the same period.

In addition, Fecon's equity is 3,407.9 billion VND. The company's liabilities are 4,278.3 billion VND. Of which, short-term loans alone have increased from 1,766.7 billion to 2,091 billion VND, equivalent to an increase of 18.4%. Long-term loans are also 871.2 billion VND.

Fecon's total short-term and long-term debt has reached VND2,962.2 billion, almost as high as equity, not to mention other debt sources.

Source

![[Photo] Prime Minister Pham Minh Chinh receives Ambassador of the French Republic to Vietnam Olivier Brochet](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/f5441496fa4a456abf47c8c747d2fe92)

![[Photo] Prime Minister Pham Minh Chinh meets with US business representatives](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/5bf2bff8977041adab2baf9944e547b5)

![[Photo] President Luong Cuong attends the inauguration of the international container port in Hai Phong](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/9544c01a03e241fdadb6f9708e1c0b65)

Comment (0)