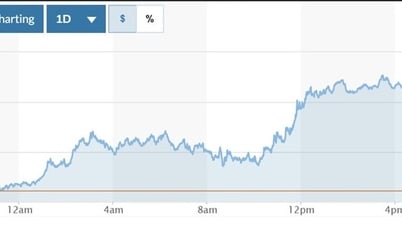

After a period of ups and downs, the Vietnamese stock market has returned in the second quarter with improvements in both scores and liquidity, even in some sessions, the liquidity level can reach "billions of dollars".

The recent improvement in liquidity has been largely contributed by the return of cash flow from new investors, especially individuals. According to data from the Vietnam Securities Depository (VSD), in June, domestic investors opened 145,864 new accounts, an increase of more than 45,000 accounts compared to the previous month, the highest level in 10 months since September 2022.

From the beginning of 2023 to the end of June, domestic investors opened a total of more than 2.3 million new accounts. By June 31, 2023, the number of domestic individual investor accounts reached 7.25 million accounts, equivalent to about more than 7.2% of the population.

Along with that, external factors also support liquidity such as the trend of interest rates cooling down, policies to remove difficulties for the corporate bond market and real estate market being issued, and the fundamental macroeconomic factors and major balances being basically maintained.

The State Bank of Vietnam (SBV) has recently reduced interest rates three times, with deposit interest rates now down 2.5-3 percentage points compared to the beginning of the year. The agency also requires commercial banks to reduce output interest rates to support businesses in the difficult business environment.

Despite the limited outlook for listed corporate earnings, the interest rate outlook continues to be a supportive driver for the stock market.

As of June 30, 2023, outstanding loans of securities companies in the market reached about VND 143,500 billion, an increase of 20.5% over the previous quarter and an increase of 0.9% over the same period in 2022. Compared to the time when the margin debt peaked, the amount of deposits at securities companies at the end of June 2023 was only about VND 41,000 billion lower.

In the top 10 securities companies with the largest margin lending scale, the champion of both quarters is still Mirae Asset Vietnam Securities JSC with VND 13,502 billion, up 10.6% compared to the second quarter of 2022.

In second place is also SSI Securities with outstanding margin loans of up to VND 13,104 billion, down slightly by 10% over the same period.

However, from sixth place, VPS Securities rose to fourth place with a margin loan of VND 10,220 billion, a sharp increase of 16.8%, despite leading in brokerage market share on all three exchanges.

Meanwhile, Techcom Securities (TCBS) has outstanding debt of VND 9,809 billion, down 30% compared to the previous quarter. Many units also recorded margin debt in the second quarter of 2023 down compared to the previous quarter such as: VNDirect Securities (down 20%), Ho Chi Minh City Securities (down 21%), VIETCAP Securities (down 16%),...

In the top 10 companies with the largest outstanding loans, only VPS Securities and KIS Securities recorded a rapid increase in margin lending compared to the high base level of the same period .

Source

![[Photo] Magical moment of double five-colored clouds on Ba Den mountain on the day of the Buddha's relic procession](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/7a710556965c413397f9e38ac9708d2f)

![[Photo] General Secretary To Lam begins official visit to Russia and attends the 80th Anniversary of Victory over Fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/5d2566d7f67d4a1e9b88bc677831ec9d)

![[Photo] Prime Minister Pham Minh Chinh meets with the Policy Advisory Council on Private Economic Development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/387da60b85cc489ab2aed8442fc3b14a)

Comment (0)