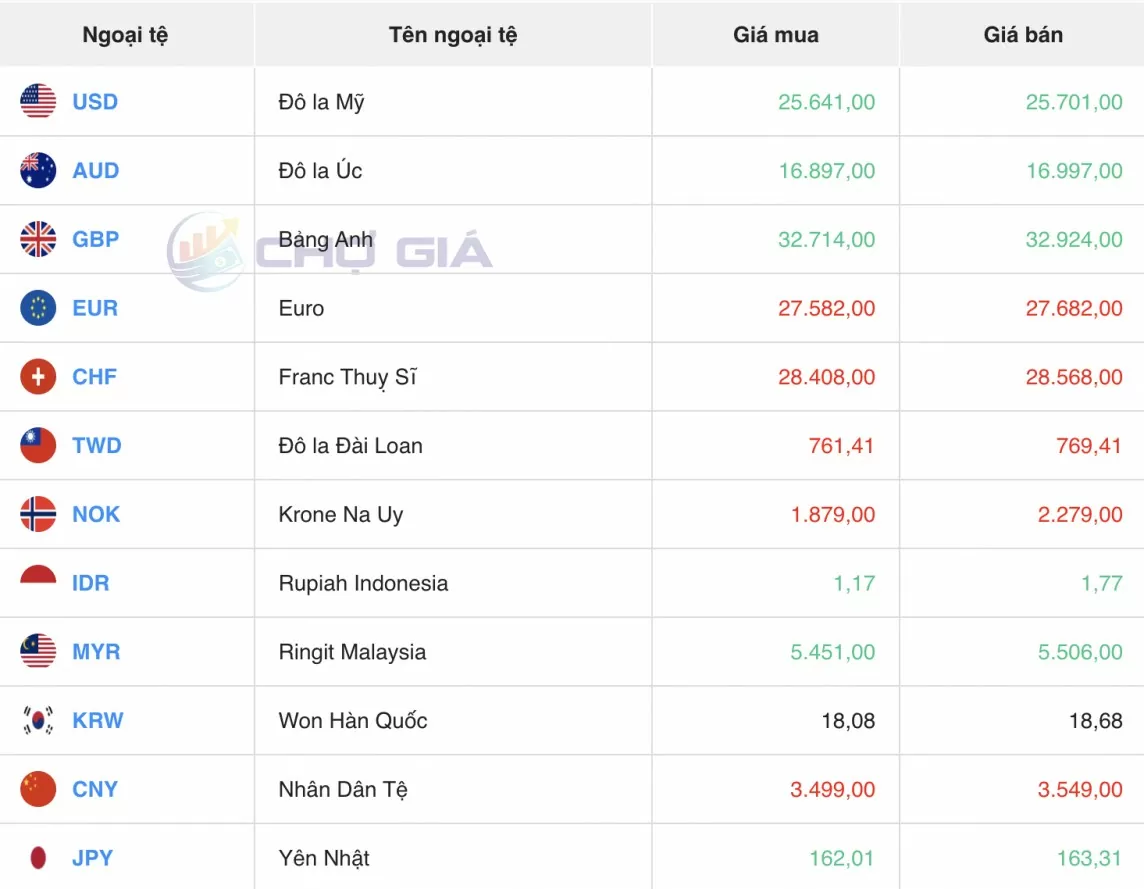

USD/VND exchange rate today, July 24, 2024 in the domestic market

USD exchange rate today July 24, 2024, USD VCB increased by 3 VND in both buying and selling directions, world USD increased when US political factors affected the foreign exchange market

The central VND/USD exchange rate today (July 24) was announced by the State Bank of Vietnam (SBV) at 24,264 VND/USD, an increase of 3 VND compared to the trading session on July 23.

Currently, the exchange rate allowed for trading by commercial banks (CBs) fluctuates from 23,400 - 25,450 VND/USD. The US Dollar exchange rate has also been brought to the buying and selling range by the State Bank of Vietnam (SBV) from 23,400 to 25,450 VND/USD.

The bank USD exchange rate, foreign exchange rate and domestic USD price this morning recorded a series of upward adjustments at banks. Specifically, Vietcombank has a buying price of 25,127 and a selling price of 25,477, an increase of 3 VND in both buying and selling compared to the trading session on July 23. The current USD buying and selling prices are in the range of 24,000 - 25,500 VND/USD.

| 1. VCB – Updated: 07/24/2024 04:55 – Time of the source website | ||||

| Foreign currency | Buy | Sell | ||

| Name | Code | Cash | Transfer | |

| AUSTRALIAN DOLLAR | AUD | 16,392.22 | 16,557.80 | 17,089.05 |

| CANADIAN DOLLAR | CAD | 17,947.93 | 18,129.22 | 18,710.90 |

| SWISS FRANC | CHF | 27,767.43 | 28,047.91 | 28,947.82 |

| YUAN RENMINBI | CNY | 3,412.29 | 3,446.76 | 3,557.88 |

| DANISH KRONE | DKK | – | 3,630.20 | 3,769.23 |

| EURO | EUR | 26,885.81 | 27,157.38 | 28,360.10 |

| Sterling Pound | GBP | 31,917.79 | 32,240.20 | 33,274.62 |

| HONGKONG DOLLAR | HKD | 3,163.60 | 3,195.56 | 3,298.09 |

| INDIAN RUPEE | INR | – | 302.06 | 314.13 |

| YEN | JPY | 156.80 | 158.38 | 165.96 |

| KOREAN WON | KRW | 15.83 | 17.59 | 19.18 |

| KUWAITIAN DINAR | KWD | – | 82,742.18 | 86,050.40 |

| MALAYSIAN RINGGIT | MYR | – | 5,360.13 | 5,477.05 |

| NORWEGIAN KRONER | NOK | – | 2,266.35 | 2,362.58 |

| RUSSIAN RUBLE | RUB | – | 274.51 | 303.88 |

| SAUDI RIAL | SAR | – | 6,737.09 | 7,006.45 |

| SWEDISH KRONA | SEK | – | 2,315.35 | 2,413.66 |

| SINGAPORE DOLLAR | SGD | 18,365.70 | 18,551.21 | 19,146.42 |

| THAILAND | THB | 617.18 | 685.75 | 712.02 |

| US DOLLAR | USD | 25,127.00 | 25,157.00 | 25,477.00 |

| 2. Agribank – Updated: 01/01/1970 08:00 – Time of website source | ||||

| Foreign currency | Buy | Sell | ||

| Name | Code | Cash | Transfer | |

| USD | USD | 25,160.00 | 25,177.00 | 25,477.00 |

| EUR | EUR | 27,065.00 | 27,174.00 | 28,310.00 |

| GBP | GBP | 32,089.00 | 32,283.00 | 33,255.00 |

| HKD | HKD | 3,182.00 | 3,195.00 | 3,298.00 |

| CHF | CHF | 27,944.00 | 28,056.00 | 28,928.00 |

| JPY | JPY | 157.73 | 158.36 | 165.80 |

| AUD | AUD | 16,518.00 | 16,584.00 | 17,080.00 |

| SGD | SGD | 18,492.00 | 18,566.00 | 19,112.00 |

| THB | THB | 680.00 | 683.00 | 711.00 |

| CAD | CAD | 18,080.00 | 18,153.00 | 18,680.00 |

| NZD | NZD | 14,890.00 | 15,385.00 | |

| KRW | KRW | 17.51 | 19.12 | |

| 3. Sacombank – Updated: 04/10/2008 07:16 – Time of website source | ||||

| Foreign currency | Buy | Sell | ||

| Name | Code | Cash | Transfer | |

| USD | USD | 25214 | 25214 | 25477 |

| AUD | AUD | 16609 | 16659 | 17169 |

| CAD | CAD | 18221 | 18271 | 18726 |

| CHF | CHF | 28246 | 28296 | 28862 |

| CNY | CNY | 0 | 3451.7 | 0 |

| CZK | CZK | 0 | 1047 | 0 |

| DKK | DKK | 0 | 3636 | 0 |

| EUR | EUR | 27351 | 27401 | 28361 |

| GBP | GBP | 32505 | 32555 | 33223 |

| HKD | HKD | 0 | 3265 | 0 |

| JPY | JPY | 160.06 | 160.56 | 165.09 |

| KHR | KHR | 0 | 6.2261 | 0 |

| KRW | KRW | 0 | 18.1 | 0 |

| LAK | LAK | 0 | 0.9705 | 0 |

| MYR | MYR | 0 | 5565 | 0 |

| NOK | NOK | 0 | 2380 | 0 |

| NZD | NZD | 0 | 14932 | 0 |

| PHP | PHP | 0 | 408 | 0 |

| SEK | SEK | 0 | 2400 | 0 |

| SGD | SGD | 18645 | 18695 | 19258 |

| THB | THB | 0 | 658.7 | 0 |

| TWD | TWD | 0 | 780 | 0 |

| XAU | XAU | 7750000 | 7750000 | 7950000 |

| XBJ | XBJ | 7150000 | 7150000 | 7610000 |

In the "black market", the black market USD exchange rate as of 5:15 a.m. on July 24, 2024 is as follows:

|

| Black Market July 24, 2024 |

USD exchange rate today July 24, 2024 on the world market

The Dollar Index (DXY), which measures the USD against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF), stopped at 104.44 points – up 0.13% compared to trading on July 23.

|

| USD (DXY) exchange rate developments in recent days (Source: Investing) |

The Dollar Index (DXY) edged up 0.13% today as US political factors continued to impact the forex market.

Factors that remain bearish for the dollar include a 1.0 basis point drop in the 10-year Treasury yield and weaker-than-expected US economic reports.

Existing home sales in the United States fell 5.4% to 3.89 million in June, weaker than market expectations for a 3.2% drop to 3.98 million. Home sales continue to be weighed down by high mortgage rates and high home prices.

In addition, the Richmond FED manufacturing index for July fell 7 points to 17, weaker than expectations for a 3-point increase to 7. The Richmond FED business conditions index for July fell 1 point to 8, although June was revised up 3 points to 8 from 11. The Philadelphia Federal Reserve non-manufacturing activity index for July fell sharply to 19.1 from 2.9 in June.

Vice President Harris locked up enough delegates in the virtual vote to clinch the Democratic presidential nomination at the Democratic convention in Chicago on August 19-22.

The recent market narrative is that a Trump win would be positive for the Dollar because the Trump administration would likely pursue tax cuts and fiscal stimulus, which would be positive for the Fed and therefore positive for the Dollar.

However, Mr. Trump has been vocal in his support for a weaker dollar as a way to stimulate U.S. exports. In contrast, a victory for Vice President Harris would favor the status quo and not be specifically favorable to the dollar.

Markets are looking to Friday's PCE deflator report for an update on when inflation might fall enough to allow the Fed to cut interest rates.

The PCE deflator is the Fed's preferred inflation measure. The consensus is that the upcoming June PCE deflator will fall to 2.4% year-over-year from 2.6% in May, and that the June core PCE deflator will fall to 2.5% year-over-year from 2.6% in May.

The PCE deflator report is expected to come in at 2.4% year-over-year (headline) and 2.5% year-over-year (core) which would represent new 3-1/2-year lows for both measures, which would give the Fed more confidence that inflation will continue to fall toward its 2% inflation target.

Markets are discounting a 25 basis point rate cut to 3% at the Federal Open Market Committee (FOMC) meeting on July 30-31 next week and 100% discounting the next meeting on September 17-18.

|

| USD price today 7/24/2024 |

Refer to the popular addresses for Foreign Currency Exchange - Buying and Selling USD in Hanoi: 1. Quoc Trinh Ha Trung Gold Shop – No. 27 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 2. Gold and Silver Fine Arts – No. 31 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 3. Minh Chien Gold and Silver Store – No. 119 Cau Giay, Cau Giay District, Hanoi 4. Thinh Quang Gold and Silver Company – No. 43 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 5. Toan Thuy Store – No. 455 Nguyen Trai, Thanh Xuan, Hanoi and No. 6 Nguyen Tuan, Thanh Xuan District, Hanoi 6. Bao Tin Minh Chau Gold, Silver and Gemstones – No. 19 Tran Nhan Tong, Hai Ba Trung District, Hanoi 7. Chinh Quang Store – No. 30 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 8. Kim Linh 3 Store – No. 47 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 9. Huy Khoi Store – No. 19 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 10. System of transaction offices at banks such as: Sacombank, VietinBank, Vietcombank, SHB Refer to the popular addresses for Foreign Currency Exchange - Buying and Selling USD in Ho Chi Minh City: 1. Minh Thu Currency Exchange – 22 Nguyen Thai Binh, District 1, HCMC 2. Kim Mai Gold Shop – 84 Cong Quynh, District 1, HCMC 3. Kim Chau Gold Shop – 784 Dien Bien Phu, Ward 10, District 10. Ho Chi Minh City 4. Saigon Jewelry Center – 40-42 Phan Boi Chau, District 1, HCMC 5. Kim Hung foreign currency exchange agency - No. 209 Pham Van Hai, Binh Chanh, Ho Chi Minh City 6. DOJI Jewelry Store – Diamond Plaza Le Duan, 34 Le Duan, Ben Nghe, District 1, HCMC 7. Kim Tam Hai Shop – No. 27 Truong Chinh, Tan Thoi Nhat Ward, District 12, HCMC 8. Bich Thuy Gold Shop – No. 39 Pham Van Hai Market, Ward 3, Tan Binh District, HCMC 9. Ha Tam Gold Shop – No. 2 Nguyen An Ninh, Ben Thanh Ward, District 1, HCMC 10. System of transaction offices at banks in Ho Chi Minh City such as: Sacombank, VietinBank, Vietcombank, SHB, Eximbank |

Comment (0)