Liquidity down

During most of the trading session on October 11, the stock market continued to be gloomy and demand was low, thereby causing widespread downward pressure on prices. In the morning session, on the Ho Chi Minh City Stock Exchange (HOSE), only about VND4,400 billion worth of shares were transferred.

At the end of the morning session on October 11, the VN-Index fell more than 3 points to 1,140 points. The market was tilted towards the selling side with the number of stocks decreasing in price about one and a half times higher than the number of stocks increasing.

Liquidity was very low, on the HOSE floor, only about 200 million shares were transferred, worth more than 4,400 billion VND. On the Hanoi Stock Exchange (HNX), there were only about 770 billion VND.

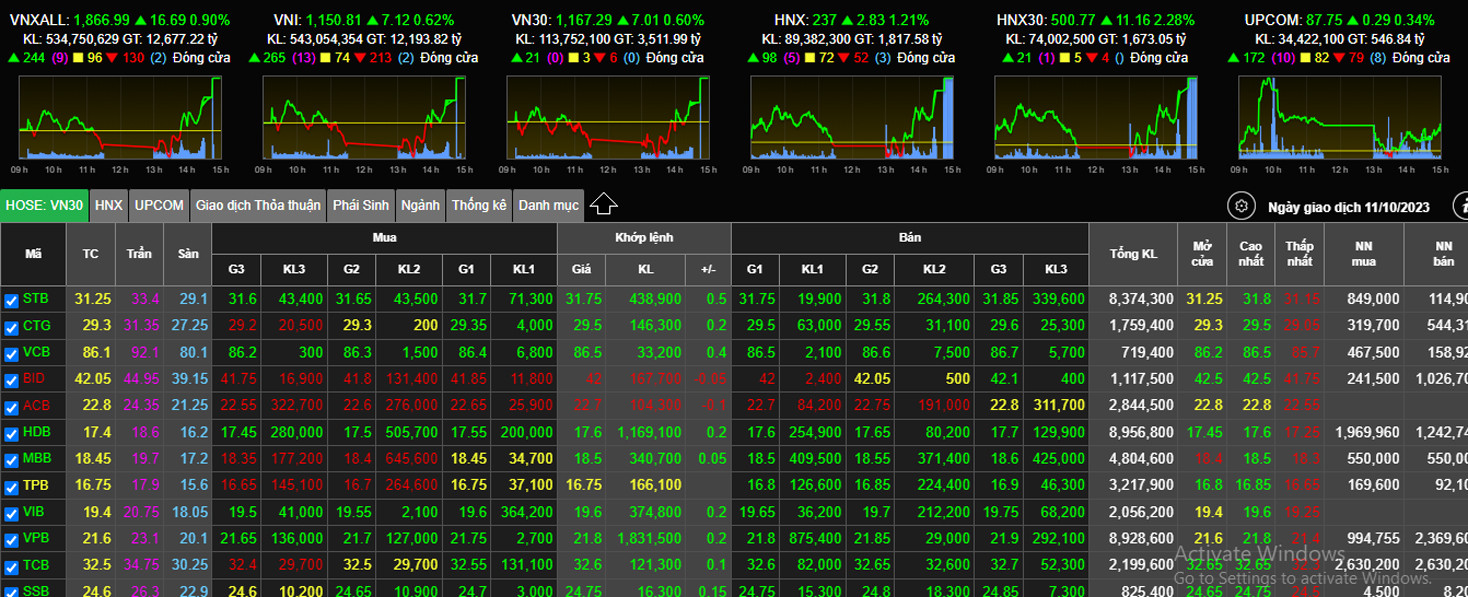

By the end of the trading session on October 11, the market suddenly turned around and increased in price. The VN-Index closed the session up 7.12 points (+0.62%) to 1,150.81 points. Liquidity on HOSE increased rapidly to VND12,194 billion.

However, this is still a very low level compared to the billion USD threshold during the bustling period about a month ago.

Recently, liquidity has been low, dropping, sometimes down to only 10,000 billion VND/session. Organizations have reduced their purchases, self-employed traders have also tended to sell, while foreign investors have been net sellers continuously. Foreign investors have net sold hundreds of billions of VND per session and since the beginning of the year, they have net sold about 9,000 billion VND.

Investors’ cautious sentiment is seen as a factor leading to the decline in liquidity in the stock market after a period of 6 consecutive months of stock price increases. The caution increased as the world was unstable and the domestic economy did not improve as expected.

Previously, many assessments said that Vietnam's economy and stock market were at the foot of a growth wave 10 years ahead.

The decline in global stocks, along with pressure on exchange rates, rising inflation, and geopolitical instability, have also made the cash flow into stocks less abundant.

In addition, the State Bank's moves to stabilize exchange rates and inflation through open market tools have made some people worry that the Central Bank of Vietnam may reverse monetary policy.

Positive signals

Although liquidity has declined, cash flow seems to be ready to pour in at any time to seize opportunities when deposit interest rates in the banking market have dropped sharply recently. The banking system still sends out signals of abundant liquidity and excess money with interbank interest rates as well as treasury bill interest rates at record lows, only around 1%/year.

In the trading session on October 11, the trading value increased sharply in the afternoon. If in the morning there was only about 4,400 billion VND transferred on HOSE, in the afternoon session, the transfer value was nearly double compared to the morning.

Investors poured money into the afternoon amid a sharp drop in domestic oil prices following world prices. The government held a meeting to discuss solutions to upgrade the stock market in the late afternoon. In addition, there were expectations of positive business results from enterprises in a number of industry groups.

Cash flow shows signs of infiltrating some small and mid-cap stocks in some groups considered to have good opportunities at the end of the year such as export, public investment and commodity market stocks.

The economy has recently received some positive signals. Public investment by the end of September reached VND363,000 billion, surpassing the 50% threshold for the first time. Foreign direct investment (FDI) flows into Vietnam remain quite stable and are forecast to increase. According to Eurocham, Vietnam is in the Top 10 FDI destinations. In fact, 31% of European businesses ranked Vietnam in the Top 3.

Despite positive economic signs, businesses in some industries, especially in the real estate sector, still face many difficulties. Many businesses are slow to repay bonds, delay paying dividends, and some even have to accelerate asset sales to restructure debt.

Meanwhile, the State Bank of Vietnam (SBV) must ensure its main task is to stabilize inflation and exchange rates. SBV still has to balance the pumping and withdrawing of money to ensure there is money for the economy, while at the same time controlling the exchange rate and inflation from escalating according to unfavorable developments in the world.

Many securities companies have also adjusted their forecasts for the VN-Index by the end of 2023 to a downward direction.

According to SSI Research, the stock market's downward momentum in October has weakened, as the VN-Index approaches the mid-term support zone of 1,100 - 1,110 points and is in a state of finding a stable balance.

However, in the medium term, the stock market is assessed positively. SSI Securities believes that the current P/E valuation at 11.3 times is significantly lower than the 5-year average of 14 times. Low interest rates are an advantage for the stock channel. In addition, efforts to promote public investment and consumer support policies from the Government are also factors supporting the stock market.

Exchange rate and inflation risks in Q3/2023 are lower than in the same period last year.

Some foreign investment funds have positive assessments of Vietnamese securities such as Dragon Capital, VinaCapital, etc.

Pyn Elite Fund recently placed its hopes on upgrading the Vietnamese stock market and predicted that the VN-Index would soon return to the peak of 1,500 points.

Source

Comment (0)