(To Quoc) - Increasing value-added tax (VAT) on cultural and sports activities will limit people's access to these public products, goods and services and will make it even more difficult for businesses operating in the cultural sector, which is already facing difficulties after the Covid-19 pandemic.

At the 8th Session, the draft Law on Value Added Tax (amended) is expected to be discussed by the National Assembly on October 29, and is expected to be approved on November 26. In particular, some provisions in the draft Law related to taxes in the field of Culture are being interested in and commented on by National Assembly deputies, artists, creative practitioners, businesses and the public. It is noteworthy that this draft has removed the provision that goods and services of cultural activities, exhibitions, physical education, sports, performing arts, film production, import, film distribution and screening are entitled to a value added tax rate of 5%, increasing it to 10%.

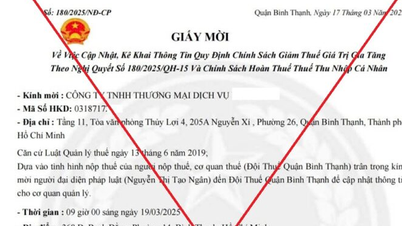

Increasing VAT on cultural and sports activities will limit people's access and is a "blow" to businesses operating in the cultural sector when they are facing many difficulties after the Covid-19 pandemic - Ms. Ngo Thi Bich Hanh, General Director of BHD - one of the first private companies in Vietnam operating in the fields of communication, distribution, and co-production of television and film programs - shared with us.

Increasing VAT on cultural and sports activities will limit people's access and is a "blow" to businesses operating in the cultural sector when they are facing many difficulties after the Covid-19 pandemic (illustrative photo)

+ Madam, cultural activities, exhibitions, physical education, sports, art performances, film production, film import, distribution and screening are currently enjoying a value-added tax rate of 5% according to Point n, Clause 2, Article 8 of the Law on Value Added Tax 2008. However, in the draft Law on Value Added Tax (amended), these goods and services are removed from the list of goods and services enjoying a tax rate of 5%, meaning they will be subject to a tax rate of 10% (Clause 3, Article 9, draft Law). What is your opinion on this issue?

- Recently, many policies and resolutions of the Party and the State on cultural development have been issued, emphasizing that there will be policies to support cultural development, bringing culture on par with economics and politics . Cultural enterprises are very happy to have received attention. However, it is unclear why, after many resolutions of the Party, policies of the State, and opinions of Party and State leaders that cultural development needs to be prioritized, when put into practice, the opposite is done, which is to increase taxes to 10%.

The policies and resolutions of the Party and the State when put into practice are reflected in the Laws. For example, the Law on Cinema (amended, effective from January 1, 2023) is that the State supports the development of cinema. However, how to support must be based on the practical basis of the Tax Law. When our business received information about the VAT Law, we were shocked. Instead of reducing taxes to support the development of the cultural industry, they were increased. And the increase from 5% to 10% is very high.

We hope the State will support cultural enterprises with specific policies so that enterprises can develop.

Ms. Ngo Thi Bich Hanh, General Director of BHD

+ After the difficult period caused by Covid-19, businesses in general, especially those in the cultural sector, are facing difficulties. How will this policy affect businesses and people, Madam?

- After Covid-19, box office revenue has only reached more than 80% compared to the pre-pandemic period. Film and cultural businesses are facing many difficulties. In fact, after Covid-19, economic businesses have been reduced and refunded taxes, but cultural businesses have not enjoyed any preferential policies. If the National Assembly passes this tax increase policy, it will greatly affect the development speed of the cultural industry, making it very difficult to develop culture.

During the pandemic, we still have to pay bank interest, pay staff salaries, theaters, and many other expenses, creating huge losses for businesses. For BHD in particular, and film businesses in general, the net loss and debt of 3-4 years of Covid-19 may not be compensated for in another ten years.

I think the Party and the State have always called for support for culture. But the cultural industry is being controlled by the market economy without any specific policies for culture. Increasing taxes will make it difficult for businesses that have worked very hard to do culture, and will also limit and slow down investment in culture, which will make it very difficult for the development of culture in general and the cultural industry in particular.

Exempting and reducing value added tax for cultural products and services is not only a financial policy, but also an important step forward in promoting the country's cultural development. By supporting culture through reasonable tax policies, we are investing in the spiritual foundation of society, building a strong, diverse and sustainably developing cultural community, contributing to building a rich, prosperous, civilized and happy country. Therefore, if we do not support, we should keep the tax rate the same, not increase it.

For cultural enterprises, the increase in VAT makes us confused and disappointed. As for consumers, I think this policy will limit consumers' access to cultural and sports products.

Consumers are very sensitive to prices. Currently, although wages are increasing, the general price of many things is increasing, so in reality, with an increase in wages, consumers can still buy fewer products. Because entertainment is the easiest thing to cut back on, and people only care about food and clothing, if ticket prices increase by another 5%, total revenue will decrease instead of growing. Another "blow" will deal a heavy blow to businesses in difficult times.

+ According to you, what kind of support policies do we need for the development of culture in general and cultural industry in particular?

- Many countries in the world have tax exemption and reduction policies for cultural development in general and specific cultural fields in particular. France, Taiwan (China), Korea, China... these countries have been doing it since the early stages of the cultural industry. They have supported for about 30-40 years, and now they are at the peak of the cultural industry and can stop and increase taxes. But we cannot apply the current policies in countries that have developed the cultural industry, but must apply policies to support the development of the cultural industry in the early stages.

+ Thank you very much!

Source: https://toquoc.vn/doanh-nghiep-soc-truoc-de-xuat-tang-thue-gia-tri-gia-tang-doi-voi-san-pham-hoat-dong-van-hoa-the-thao-20241028115023851.htm

![[Photo] Readers line up to visit the photo exhibition and receive a special publication commemorating the 135th birthday of President Ho Chi Minh at Nhan Dan Newspaper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/85b3197fc6bd43e6a9ee4db15101005b)

![[Photo] More than 17,000 candidates participate in the 2025 SPT Competency Assessment Test of Hanoi National University of Education](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/e538d9a1636c407cbb211b314e6303fd)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on science and technology development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/ae80dd74c384439789b12013c738a045)

![[Photo] Nearly 3,000 students moved by stories about soldiers](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/21da57c8241e42438b423eaa37215e0e)

Comment (0)