The central exchange rate decreased by 9 VND, the VN-Index increased by 5.26 points or the first period of December 2024, the trade balance of goods deficit of 760 million USD... are some notable economic information on December 23.

| Economic news review on December 19 Economic news review for the week of December 16-20 |

|

| Economic news review |

Domestic news

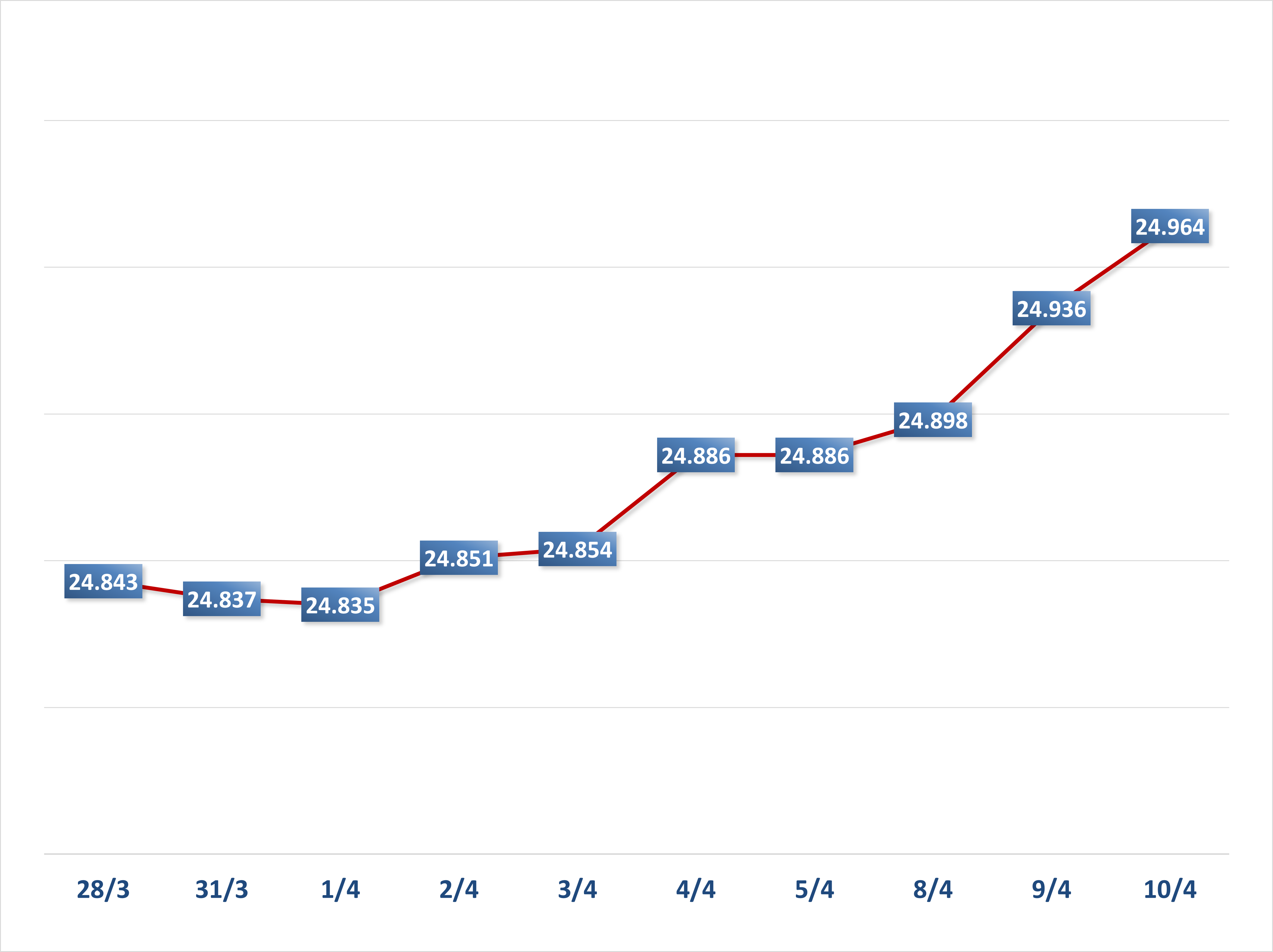

Foreign exchange market, session 23/12, State Bank listed the central exchange rate at 24,315 VND/USD, down 09 VND compared to the session at the end of last week.

The buying and selling prices of USD were kept unchanged by the State Bank of Vietnam at 23,400 VND/USD and 25,450 VND/USD, respectively.

On the interbank market, the USD-VND exchange rate closed at 25,452 VND/USD, down 3 VND compared to the session on December 20.

The dollar-dong exchange rate on the free market increased sharply by 130 VND for buying and 110 VND for selling, trading at 25,780 VND/USD and 25,860 VND/USD.

Interbank money market, on December 23, the average interbank VND interest rate increased by 0.04 - 0.34 percentage points for all terms from 1 month or less compared to the session at the end of last week; specifically: overnight 4.43%; 1 week 4.60%; 2 weeks 5.02 and 1 month 5.17%. The average interbank USD interest rate decreased by 0.01 percentage point for the overnight term while remaining unchanged for longer terms, trading at: overnight 4.42%; 1 week 4.50%; 2 weeks 4.58%, 1 month 4.62%.

Government bond yields in the secondary market increased sharply in most maturities except for a decrease in the 10-year term, closing at: 3-year 2.01%; 5-year 2.31%; 7-year 2.52%; 10-year 2.96%; 15-year 3.11%.

In the open market operations, on the mortgage channel, the State Bank bid 20,000 billion VND, 14-day term, interest rate at 4.0%. The entire volume was won; 1,000 billion VND matured. The State Bank bid for SBV bills with 7-day term, interest rate bidding. There were 2,800 billion VND won with interest rate at 4.0%. There were 6,000 billion VND matured bills.

Thus, the State Bank of Vietnam pumped a net VND22,200 billion into the market through the open market channel yesterday. There were VND32,999.93 billion circulating on the mortgage channel, and VND82,253 billion in treasury bills circulating on the market.

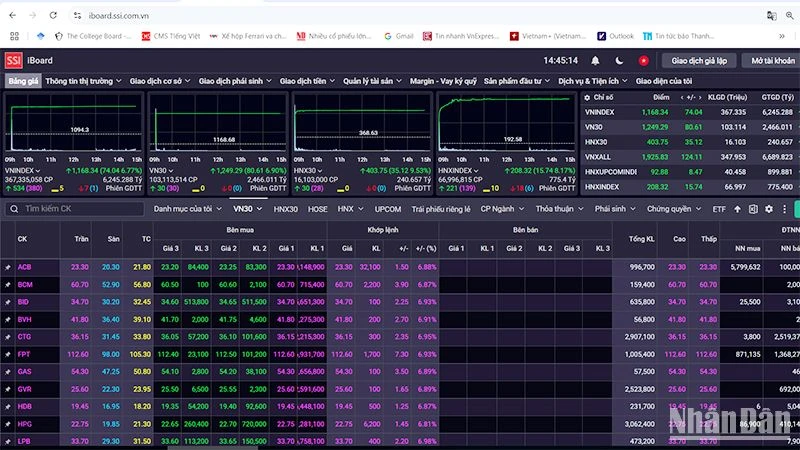

On the stock market, all three indices increased with a slight increase in liquidity, showing that investor sentiment is improving. At the end of the session, VN-Index increased by 5.26 points (+0.42%) to 1,262.76 points; HNX-Index added 1.44 points (+0.63%) to 228.51 points; UPCo monthly-Index increased by 0.33 points (+0.35%) to 93.72 points. Market liquidity was low with a trading value of nearly VND13,800 billion. Foreign investors net sold nearly VND340 billion on all three exchanges.

The latest preliminary statistics from the General Department of Customs show that in the first period of December 2024, the trade balance of goods had a deficit of 760 million USD. From the beginning of the year to December 15, 2024, the trade balance of goods had a surplus of 23.57 billion USD. The total value of Vietnam's exports in the first period of December reached 15.36 billion USD; imports reached 16.12 billion USD. From January 1 to December 15, the total value of Vietnam's exports reached 385.35 billion USD, an increase of 13.9% over the same period in 2023; imports reached 361.78 billion USD, an increase of 15.7%. The results achieved in the first half of December 2024 brought the total import-export value of the whole country up to December 15, 2024 to 747.13 billion USD, an increase of 14.7% over the same period.

International News

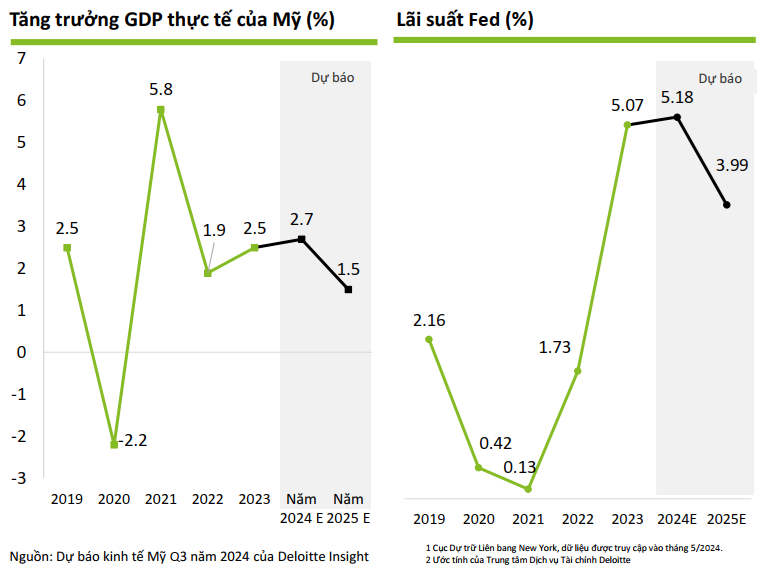

The Conference Board survey said the US consumer confidence index was at 104.7 points in December, down sharply from 112.8 points the previous month and lower than the forecast of 112.9 points.

The UK's Office for National Statistics (ONS) announced that the country's GDP officially remained flat in the third quarter, revised down from a slight increase of 0.1% according to preliminary statistics, and at the same time decelerated sharply compared to the increase of 0.5% in the second quarter and 0.7% in the first quarter. Next, the UK's current account balance showed a deficit of 18.1 billion GBP in the third quarter, smaller than the previous quarter's deficit of 24.0 billion and at the same time smaller than the forecast deficit of 22.9 billion.

The German Federal Statistical Office Destatis announced that the country's import price index increased by 0.9% month-on-month in November, following a 0.6% increase in October and beating the forecast 0.5%. Compared to the same period in 2023, this index increased slightly by about 0.6%. In addition, the export price index last month also increased by 1.2% month-on-month, higher than the 0.6% increase in October, compared to the same period in 2023.

Source: https://thoibaonganhang.vn/diem-lai-thong-tin-kinh-te-ngay-2312-159269-159269.html

![[Photo] April Festival in Can Tho City](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/bf5ae82870e648fabfbcc93a25b481ea)

![[Photo] Opening of the 11th Conference of the 13th Party Central Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/f9e717b67de343d7b687cb419c0829a2)

![[Photo] Unique folk games at Chuong Village Festival](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/cff805a06fdd443b9474c017f98075a4)

![[Infographic] March breakthrough, import-export turnover exceeds 75 billion USD](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/10fa4eb724ea40ceab4278cd16cf4aea)

Comment (0)