|

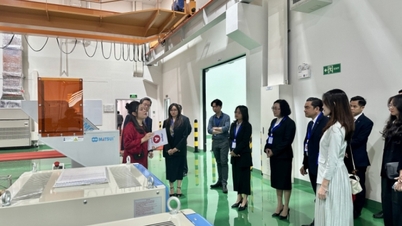

| According to the General Department of Taxation, in 2022, there will be about 1,015 FDI enterprises in Vietnam affected by the global minimum tax policy. (Source: VGP) |

The Government's report on the impact of the global minimum tax shows that there are about 122 foreign direct investment (FDI) corporations in Vietnam subject to adjustment with a total additional corporate income tax of VND14,600 billion/year.

The resolution clearly demonstrates Vietnam's determination, creating confidence for investors in the legal environment. Vietnam's proactive application of global minimum tax regulations from 2024 not only ensures the country's legitimate rights and interests but also creates confidence for foreign investors.

In the context of many countries and territories investing in Vietnam, in order to maintain the right to tax, at the 6th Session, the majority of delegates said that it is necessary to issue a legal document to create a legal basis for foreign-invested enterprises subject to the global minimum tax. These enterprises can declare additional corporate income tax in Vietnam, instead of having them pay this additional tax in their home country.

The global minimum tax is not an international treaty, not an international commitment, and does not require countries to apply it. Applying this tax will bring new opportunities to the country such as increasing budget revenue from additional tax collection and limiting tax evasion, tax avoidance, and transfer pricing.

Without internalizing the global minimum tax regulations, investment “exporting” countries will be able to collect additional corporate income tax up to the level of 15% for multinational companies with foreign investment projects in Vietnam and currently paying actual corporate income tax below 15%.

However, the issue of “retaining” investors is still a matter that needs to be considered when applying. To do this, we need to soon have a complementary policy when applying the global minimum tax to both ensure competitive advantage and attract foreign direct investment (FDI) - an important economic driving force of the economy. In particular, the Government needs to assess to determine the level of impact of the global minimum tax policy, review all current regulations on incentive policies, as a basis for accurately determining the scope and level of impact by industry and sector.

Vietnam is currently considered by foreign investors as an attractive destination, offering many advantages. For example, strong integration into the global value chain; clear commitments on free trade and investment protection; a large market with 100 million consumers and a growing wealthy middle class...

Seizing the important opportunity from the decision to implement the global minimum tax is necessary for Vietnam to reconsider the use of tax incentives, improve the investment policy framework, and continue to maintain its position as an attractive long-term destination where multinational enterprises place their trust.

The time to compete with global minimum taxes has also come, when some economies in the region such as India and Thailand have soon announced complementary policies through infrastructure incentives, personnel training or additional research and development (R&D) fees...

Source

![[Photo] General Secretary To Lam concludes visit to Russia, departs for Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/0acf1081a95e4b1d9886c67fdafd95ed)

![[Photo] General Secretary To Lam arrives in Minsk, begins state visit to Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/76602f587468437f8b5b7104495f444d)

![[Photo] General Secretary To Lam meets and expresses gratitude to Vietnam's Belarusian friends](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c515ee2054c54a87aa8a7cb520f2fa6e)

![[Photo] National Assembly Chairman Tran Thanh Man attends the Party Congress of the Committee for Culture and Social Affairs](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/f5ed02beb9404bca998a08b34ef255a6)

Comment (0)