Banking, retail, information technology, infrastructure construction, industrial park stocks… are being recommended a lot.

Forecasting the stock market this year, investment funds, market analysis units and securities companies all agree that the VN-Index can increase by 15-25% in points thanks to the main support from low interest rates and increased corporate profits. Units generally forecast that corporate profits will recover by at least 15-20% this year. However, the recovery rate has a large differentiation between sectors. Therefore, investors need to observe, analyze and select carefully to optimize their portfolio.

According to VinaCapital, if investors know how to choose sectors and stocks wisely, they will have many opportunities to bring in superior performance compared to the general market level. This year, this foreign fund favors information technology, banking, real estate, non-essential consumer goods and securities stocks. Particularly, the consumer goods and real estate groups are forecasted to have a much better profit recovery due to the low base level of last year.

Mr. Michael Kokalari - Director of Macroeconomic Analysis and Market Research at VinaCapital, analyzed that consumer companies will benefit from the ongoing recovery in people's spending with total retail sales excluding inflation expected to increase by 7.5%. Accordingly, he expected the profits of businesses in this industry to recover from a decrease of 22% last year, to increase by 33% this year.

In addition to the consumer sector, real estate developers (except Vinhomes) are also assessed by VinaCapital to benefit from this year's modest recovery. Corporate profits are expected to increase by 109% in 2024 from a 51% decrease. Thus, compared to the general market level, the consumer and real estate sectors have profit growth that is twice and five times larger, respectively.

VinaCapital said that in addition to choosing the above sectors, choosing individual stocks is also important. The stock market has hundreds of small and mid-sized stocks, which are a potential source of opportunities for market-beating returns, with these stocks all increasing by about 30% last year, far exceeding the overall performance. However, the fund noted that this is an opportunity for professional investors, like VinaCapital itself. Meanwhile, many small and mid-sized stocks are not closely followed or well understood by domestic retail investors.

Investors monitor the market at a stock exchange in Ho Chi Minh City, March 2021. Photo: Quynh Tran

With the method of prioritizing industries with good profit growth, Dragon Capital has just announced its current investment portfolio. In particular, the DCDE fund is pouring the most money into the banking, retail, residential real estate, information technology, steel, chemicals and securities industries. According to the forecast of this foreign fund, the above industries all have the prospect of increasing profits at a double-digit rate this year. The highest is retail with nearly 153%, followed by the steel group (47%) and chemicals (39%).

In addition to profit growth, Dragon Capital also believes that these are groups with lower volatility than the general market level, in line with the fund's cautious strategy. Experts note that investors should not establish a portfolio that is too dependent on a certain industry to avoid risks that will affect all the money poured into the market.

Securities companies also suggest investors choose stocks this year based on the profit growth prospects of each industry. Vietcombank Securities (VCBS) believes that the differentiation between stocks will continue to be clearer in the context of large market fluctuations.

"Investors need to both screen and seek investment opportunities in businesses with good prospects, and pay attention to choosing the time to disburse when the stock price is still trading at a reasonable valuation range to ensure risk management goals," this analysis group noted.

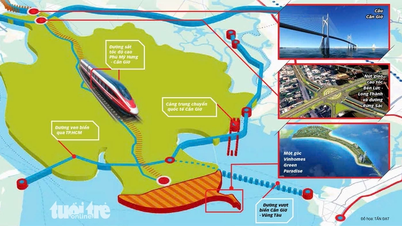

According to VCBS, interest rates continue to be low and may decrease further, the wave of shifting part of production activities from China, and public investment activities continue to be notable highlights in the coming time. Therefore, the sectors that will benefit will be banks, industrial park real estate, and infrastructure development enterprises.

For investors who want to hold stocks for the long term for the purpose of accumulating assets, VCBS suggests looking for opportunities in industries with "defensive" characteristics, especially leading enterprises with business results less dependent on economic cycles. In the stock market, stocks with such characteristics are often state-owned enterprises and operate in industries such as information technology, telecommunications, utility groups such as hydropower, thermal power, water supply, etc.

Siddhartha

Source link

![[Photo] Parade to celebrate the 50th anniversary of Laos' National Day](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F02%2F1764691918289_ndo_br_0-jpg.webp&w=3840&q=75)

![[Photo] Worshiping the Tuyet Son statue - a nearly 400-year-old treasure at Keo Pagoda](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F02%2F1764679323086_ndo_br_tempimageomw0hi-4884-jpg.webp&w=3840&q=75)

Comment (0)