Recently, Dragon Viet Securities Corporation (VDSC – HoSE: VDS) announced its audited financial report for the first half of 2023, recording operating revenue of VND 331 billion, down 24% compared to the first half of 2022.

The company reported a profit after tax of VND160 billion, while in the same period last year it lost VND141 billion. The pre-tax profit completed 75.8% of the yearly plan, reaching VND205.3 billion.

At the end of the first 6 months of 2023, VN-Index closed at 1,120.8 points, up 11.23% compared to the end of 2022, average liquidity in 6 months reached 13,733 billion VND, down 46.5% compared to the same period in 2022. However, the recovery in market scores has had a positive impact on the business results of Rong Viet Securities, especially proprietary trading activities.

Accordingly, Rong Viet's self-trading portfolio returned VND 186.3 billion from the cost of assessing the reduction in the value of the investment portfolio, helping to sharply reduce the total cost to only VND 146.8 billion.

As of June 30, 2023, VDSC's total assets reached more than VND 4,481 billion, equity reached VND 2,248 billion, officially erasing all accumulated losses at the end of 2022. Thanks to that, Rong Viet's VDS shares were removed from the warning list by HoSE since August 17. Margin lending balance was at VND 1,969 billion, while the company held VND 681 billion in cash and cash equivalents.

With the orientations since the beginning of the year, and the context of the stock market having more positive developments, Rong Viet Securities also expects to soon exceed the target of VND 270.8 billion in pre-tax profit (consolidated) approved by the General Meeting of Shareholders.

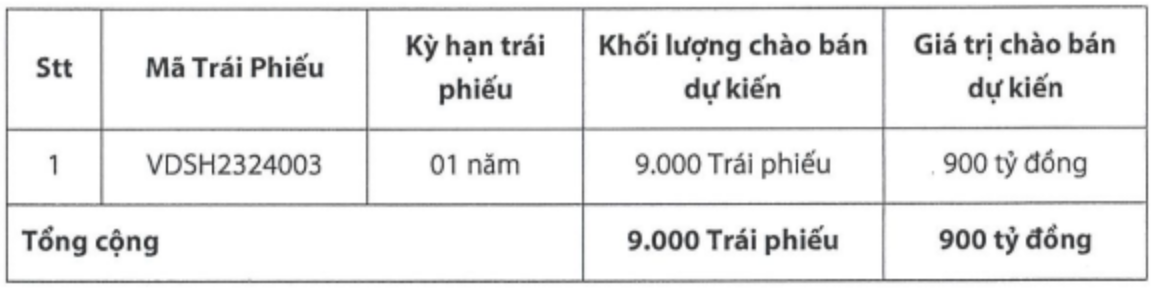

Previously, VDSC's Board of Directors also approved the bond issuance plan (3rd time in 2023). The company plans to issue a bond lot with code VDSH2324003, volume of 9,000 bonds and the offering price is equal to the par value of VND 100 million/bond.

Thus, the total expected offering value is 900 billion VND. The expected issuance date is from August 18. This bond is non-convertible, without warrants and without collateral. The fixed interest rate is 9.5%/year.

Regarding the payment method, the principal will be paid once on the maturity date, except in the case of bonds being redeemed before maturity; interest will be paid periodically once a month.

VDSC issues bonds for the third time in 2023 (Source: VDSC).

The proceeds from the offering of approximately VND900 billion will be used to restructure the issuer's debt, including paying the principal of maturing bonds/repurchasing them early and/or paying part/all of the bank loan on the maturity date or paying them early.

In addition, the capital obtained if temporarily idle, that is, during the period before the due date for bond principal payment and/or bank loan payment, will be deposited in savings.

Regarding the repurchase plan, depending on the business situation and capital capacity, VDSC can repurchase a portion of issued bonds before maturity at the request of bondholders with the maximum repurchase amount being 50% of the issued bonds, the repurchase period is 6 months from the date of issuance and the maximum repurchase interest rate is 8.3%/year .

Source

![[Photo] The moment Harry Kane lifted the Bundesliga trophy for the first time](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/68e4a433c079457b9e84dd4b9fa694fe)

Comment (0)