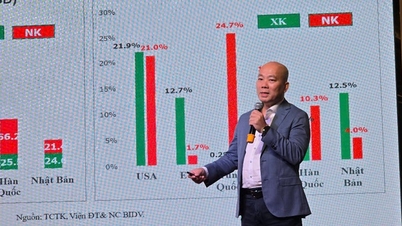

HAGL could reach the trillion-dollar profit mark for the third consecutive year after posting a high profit in the third quarter thanks to its success with “2 trees, 1 animal” - the field that Mr. Duc is betting on in his old age with the support of LPBank led by tycoon Nguyen Duc Thuy.

Ability to make trillions in profit for 3 consecutive years

Hoang Anh Gia Lai Joint Stock Company (HAGL, code HAG), chaired by Mr. Doan Nguyen Duc (Bau Duc), reported a third-quarter after-tax profit of nearly VND351 billion, up 8% over the same period, although consolidated revenue decreased by 24% to VND1,432 billion.

Accumulated in the first 9 months of the year, net revenue decreased by 17% to 4,194 billion VND, profit after tax increased by 20% to 851 billion VND. Accumulated loss was only 626 billion VND.

It is likely that HAG will reach the profit milestone of a thousand billion VND for the third consecutive year, getting closer to eliminating accumulated losses. This is the goal that Mr. Duc wants to achieve by the end of this year.

In 2024, HAGL targets revenue of VND 7,750 billion, up 20% compared to 2023 and after-tax profit of VND 1,320 billion, down 26%.

Regarding the business details in Fund III, the “2 trees, 1 animal” model - growing bananas, durians and raising pigs to eat bananas continues to bring growth to HAG. Durian is considered super profitable. Mr. Duc once shared that the selling price is very high, 1 capital 4 profits. The fruit segment in the third quarter had the highest profit margin, up to nearly 52%, meaning selling fruit for 2 dong earns 1 dong profit.

Specifically, net revenue from fruit reached VND880 billion, down 12% year-on-year; revenue from pork sales decreased by more than 50% to VND234 billion. Gross profit margin increased thanks to reduced financial expenses, from VND232 billion in the same period to VND165 billion. Increased financial revenue helped HAG's profits increase sharply.

Is there any mark from tycoon Nguyen Duc Thuy?

By the end of the third quarter, HAG's assets increased by nearly VND1,590 billion, reaching more than VND22,490 billion, while liabilities decreased slightly to VND13,532 billion. Total short- and long-term loans were more than VND7,313 billion, down about VND555 billion compared to the beginning of the year.

HAG borrowed more than VND1,540 billion in short-term loans from Loc Phat Vietnam Joint Stock Commercial Bank (LPBank), chaired by Mr. Nguyen Duc Thuy, an increase from VND750 billion at the beginning of the year.

HAG borrowed more than 86 billion VND from LPBank on a long-term basis, while at the beginning of the year there was no outstanding long-term debt. In March 2024, LPBank and HAGL signed a financing contract of 5,000 billion VND.

In recent years, HAG has had less difficulty selling its agricultural division (HAGL Agrico - HNG) to Thaco of billionaire Tran Ba Duong, earning a large amount of money to pay off debt and receiving capital from LPBank and Thaiholdings. HAG has actively cleared debt and benefited from expanding durian gardens and rising selling prices.

At the 2024 Annual General Meeting of Shareholders, Mr. Doan Nguyen Duc said that if HAG can erase accumulated losses, many funds will invest in it. With a profit target of VND 1,320 billion in 2024, HAGL cannot yet erase accumulated losses. Mr. Duc expects HAG to have a profit of VND 2,000 billion/year in the coming years.

Currently, HAGL is still facing many difficulties, including using short-term capital to finance long-term assets, negative business cash flow and investment cash flow.

At the end of September, HAGL announced a delay in paying more than VND 4,500 billion in principal and interest on bonds due to not having collected enough money from HAGL Agrico's debt (a 3-party debt repayment schedule had been agreed upon) and not being able to liquidate some unprofitable assets.

In the first half of the year audit report, HAG was found by the auditor to have violated some commitments to the bond contract and had not paid the principal and interest of the bond loans due. According to the auditor, there are material uncertainties that may lead to significant doubts about the group's ability to continue as a going concern.

In 2023, HAG liquidated many assets such as Hoang Anh Gia Lai Hotel, University of Medicine and Pharmacy Hospital - HAGL. HAG received loan interest exemption from Eximbank, helping profits increase dramatically.

At the end of the session on October 18, HAG shares decreased by 200 VND, down to 10,600 VND/share.

Source: https://vietnamnet.vn/cu-danh-cuoc-xe-chieu-bau-duc-bao-lai-lon-co-dau-an-dai-gia-nguyen-duc-thuy-2333394.html

![[Photo] Prime Minister Pham Minh Chinh chairs conference on anti-smuggling, trade fraud, and counterfeit goods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/14/6cd67667e99e4248b7d4f587fd21e37c)

Comment (0)