After a short-term decline to retest supply, the stock market is returning to around the 1.23x mark, accompanied by stable liquidity and supporting catalysts such as exchange rates, inflation and the FED's interest rate hike will no longer worry investors.

Along with the market's increase, real estate stocks have also contributed significantly to the recent recovery, typically the "locomotive" Vingroup has led this group to grow simultaneously. Among them, DXG stock of Dat Xanh Group Joint Stock Company (HoSE: DXG).

DXG stock is one of the real estate stocks that has been the focus of the stock market recently. This stock has increased by 18% in just the last 9 trading days, when the board of directors of Dat Xanh Group said that the strategic project Gem Riverside is expected to receive a construction permit in the fourth quarter of 2023, from the price range of VND 18,600/share to VND 21,500/share.

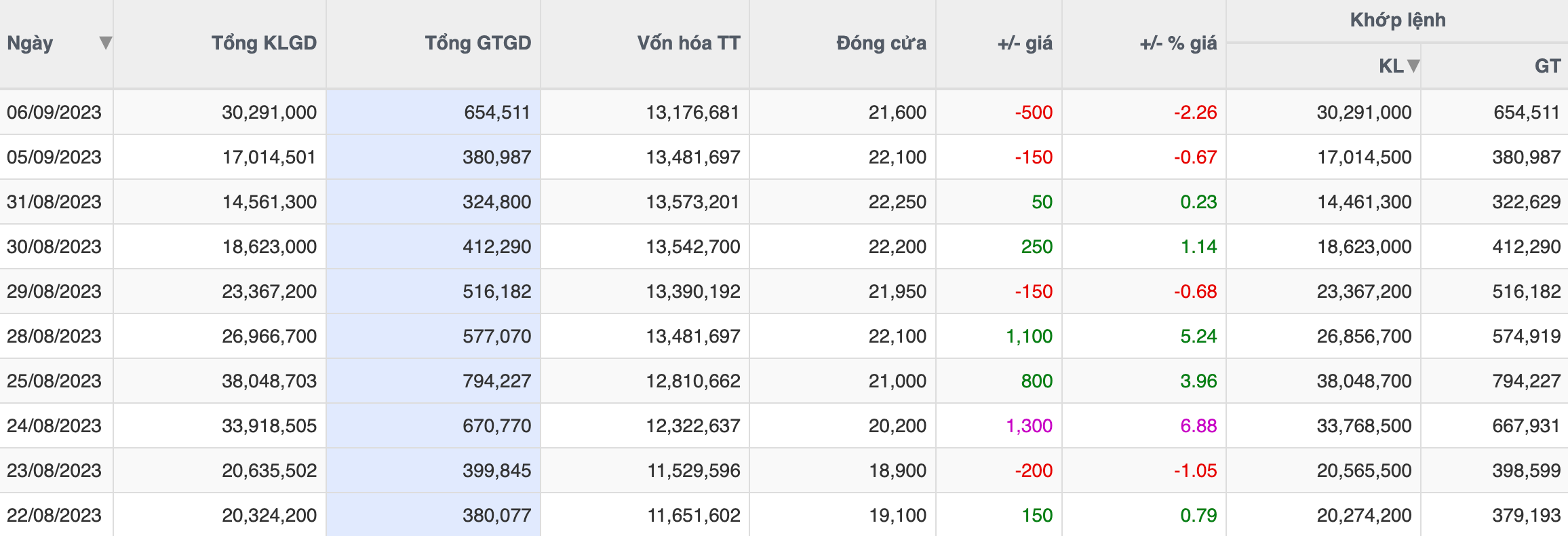

Compared to the bottom in November 2022, DXG's stock price has now increased 2.5 times to around VND 21,700/share. Average liquidity is about 30.3 million matched units, among the stocks with the largest trading volume on the HoSE.

DXG transaction statistics in the last 9 sessions.

At this bottom, Mr. Luong Tri Thin - Chairman of the Board of Directors of Dat Xanh Group bought 10 million DXG shares from October 27 to November 8, 2022. Previously, from August 23 to September 21, 2022, the Chairman of Dat Xanh also bought 5 million DXG shares.

In addition, the Resolution of Dat Xanh's Board of Directors approved the policy of Mr. Luong Tri Thin to support the company with a loan of up to 300 billion VND with a maximum term of 6 months, interest rate of 6%/year.

Then, from September 11 to October 10, 2023, when DXG's market price had increased significantly, Mr. Luong Tri Thin registered to sell more than 20 million shares with the purpose of supporting the company's loan.

After completing the transaction, Mr. Thin will reduce his ownership ratio at Dat Xanh from 20.41% (equivalent to 124.8 million shares) to 17.15% (equivalent to 104.8 million shares) of charter capital at Dat Xanh.

Temporarily calculating at the current price of about 22,000 VND/share, the Chairman of Dat Xanh can earn about 440 billion VND, this revenue is already higher than the amount of money that Mr. Thin intends to lend Dat Xanh to supplement capital by hundreds of billions of VND.

Regarding the Gem Riverside project, Vietcap Securities' report said that Dat Xanh Group's board of directors is expected to receive a construction permit for the Gem Riverside project in the fourth quarter of 2023. This project is considered a strategic project of Dat Xanh Group, located in the center of Thu Duc City with a scale of 12 blocks 31 floors high, with 3,175 apartments and an investment capital of more than 5,200 billion VND.

Vietcap Securities expects the project to be re-opened for sale in 2024, with Dat Xanh Group's sales forecast (excluding real estate development projects of its subsidiary Dat Xanh Services) reaching around VND6,300 billion. It is expected that the Gem Riverside project will be sold out in the period of 2024 - 2026, instead of 2027 as previously forecast.

DXG stock price movements on the market (Source: Trading View).

This year, Dat Xanh Group's revenue is expected to mainly come from the expected handover of the Gem Sky World and Opal Skyline projects in the second half of 2023. Accordingly, Vietcap Securities estimates that Dat Xanh Group's profit after tax after minority interests in 2023 will be at VND397 billion, up 85% compared to 2022.

Previously, Dat Xanh's general meeting of shareholders also approved the plan to issue nearly 168 million shares at VND12,000-15,000/share, raising charter capital to nearly VND7,800 billion. At the same time, Dat Xanh Services also wants to issue 121 million shares to existing shareholders to increase charter capital.

Regarding the business situation, after two consecutive quarters of losses, Dat Xanh reported a profit again, thanks to drastic cost cuts and a large reduction in the number of employees. In the second quarter of 2023, the company recorded a 54% decrease in revenue compared to the same period, down to 714 billion VND.

After deducting expenses, Dat Xanh's after-tax profit was VND 157 billion, down 40% compared to the second quarter of 2022, but this is still relatively positive information after the company reported a net loss in the previous two quarters. Accumulated in the first 6 months of the year, Dat Xanh's after-tax profit was VND 40 billion, down 94% compared to the same period last year .

Source

![[Photo] Fireworks light up the sky of Ho Chi Minh City 50 years after Liberation Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/30/8efd6e5cb4e147b4897305b65eb00c6f)

![[Photo] Feast your eyes on images of parades and marching groups seen from above](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/30/3525302266124e69819126aa93c41092)

Comment (0)