Vietnam stocks enter accumulation zone; Yeah1 is sought after after concert success; Textiles make big profits; Dividend payment schedule.

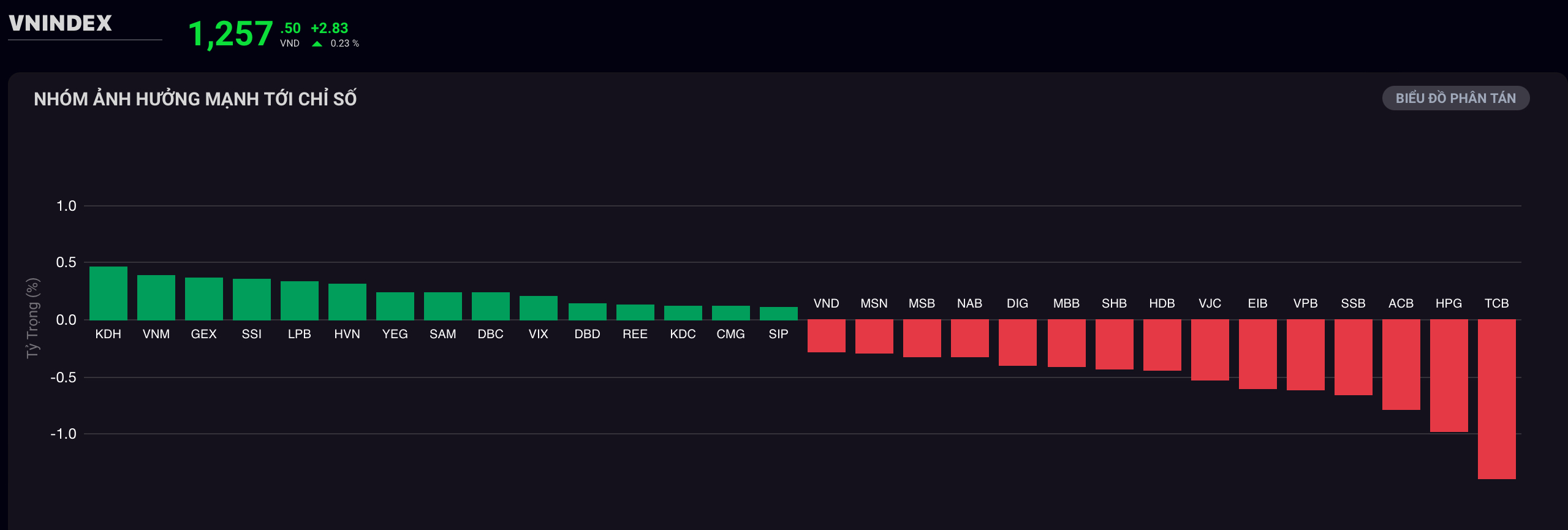

VN-Index fails to maintain 1,260 point mark

At the end of last trading week, VN-Index increased slightly by 2.83 points but still could not maintain the 1,260 mark at 1,257.5 points.

Liquidity weakened to VND 13,534 billion, trading volume was more than 568.9 million units.

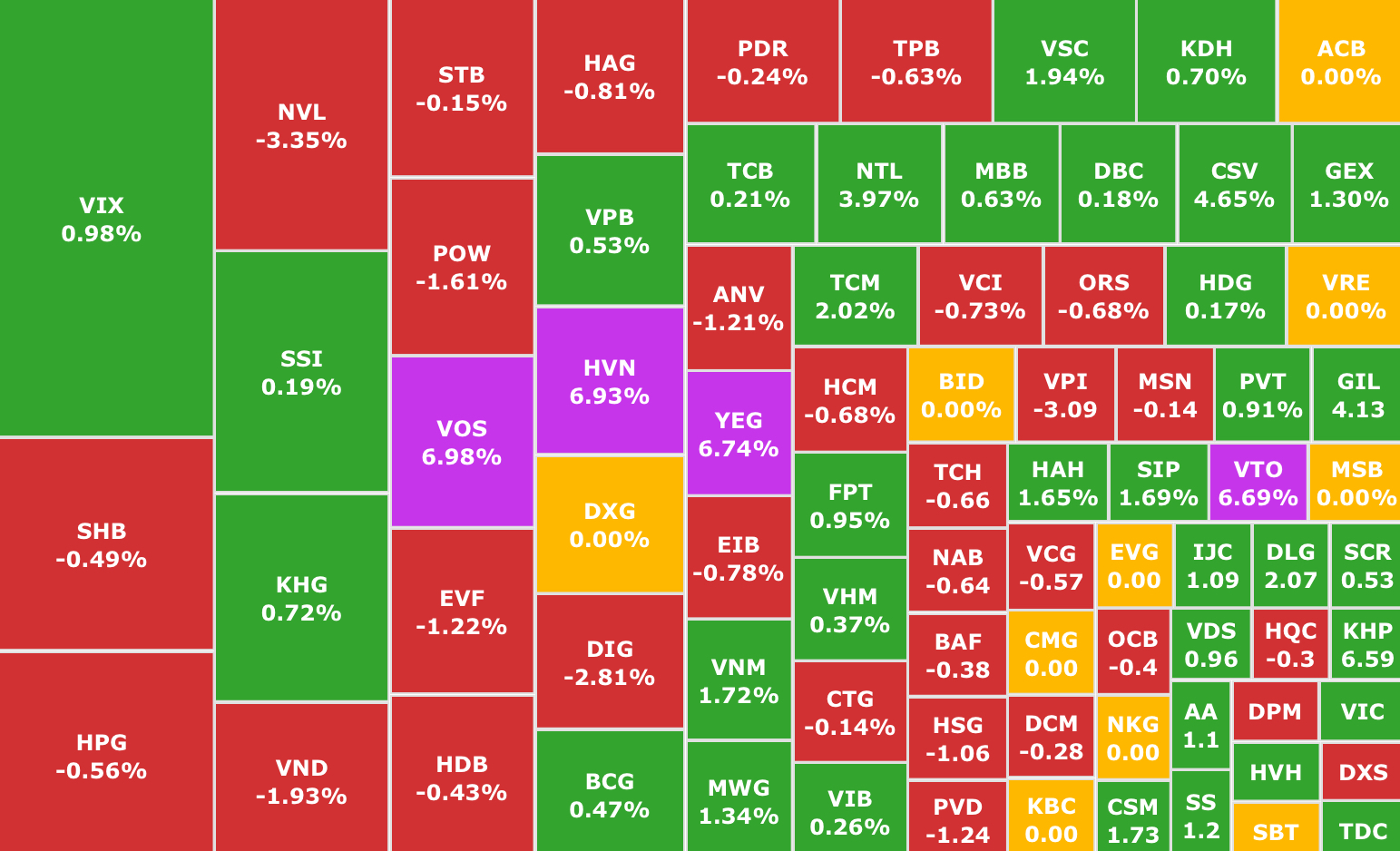

The bright spot came from the transportation stocks group, especially HVN (Vietnam Airlines, HOSE) when it hit the ceiling to its highest level in over 4 months. Liquidity reached 6.5 million units, 3 times the average of 10 sessions.

Next is the shipping code with VOS (Vietnam Sea Shipping, HOSE), VTO (Vitaco Petroleum Transport, HOSE) maintaining continuous purple color.

In addition, the textile group also had positive developments with TVT (VICOTEX, HOSE) increasing by 6.1%, GIL (GILIMEX, HOSE) increasing by 4.1%, TCM (Thanh Cong Garment, HOSE) increasing by 2%.

On the contrary, the pillar industries including banking, securities and steel had quite gloomy developments. The securities group had many codes below the reference such as VND (VNDirect Securities, HOSE), HCM (HCMC Securities, HOSE), VCI (Vietcap Securities, HOSE), etc.

Yeah1 shares continuously hit the ceiling after the success of "Brother Overcoming a Thousand Thorns"

YEG shares of Yeah1 Group - the producer of the concert "Anh trai vu ngan cong gai" recently broke all historical peaks after 2 and a half years.

YEG stock continuously breaks all records (Photo: SSI iBoard)

Starting from the session on December 17, YEG increased to the ceiling price of VND15,600/share, the highest level in the past 2.5 years, helping Yeah1's capitalization increase by more than 29% compared to the beginning of the year. This development continued until the end of the week, with a 6.74% increase in the session on December 20, reaching VND19,000/share.

This result comes right after Yeah1 successfully organized the second concert "Anh trai vu ngan chong gai" at Vinhomes Ocean Park 3 (Hung Yen) on December 14. It is estimated that this concert attracted about 30,000 spectators. Previously, the first concert "Anh trai vu ngan chong gai" held in Ho Chi Minh City also attracted about 20,000 spectators.

"Anh trai vu ngan cong gai" is a Vietnamese adaptation of the original version "Call Me By Fire" owned by MangoTV. Yeah1 Group is the only unit that owns the copyright to produce this program in Vietnam.

Yeah1 is successful after the series of shows "Beautiful Sister" - "Brother" (Photo: Internet)

Regarding the business situation, previously, Yeah1 had continuously suffered "heavy losses" in 2019-2020 after Google LLC terminated the Content Hosting Agreement with a subsidiary with business activities related to Yeah1's YouTube AdSense segment in 2019; along with a series of changes in the leadership apparatus.

By 2023, after purchasing the copyright of the popular Chinese TV show "Sister Riding the Wind and Breaking the Waves" and localizing it into the show "Beautiful Sister Riding the Wind and Breaking the Waves", Yeah1 reported a 2.5-fold increase in profit over the same period, reaching 27 billion VND.

After producing "Anh trai vu ngan cong gai" (buying Chinese copyright), in the first 9 months of 2024, the company recorded revenue and profit after tax increasing by 148% and 243% respectively over the same period.

Textile and garment enterprises report big profits

According to the Vietnam Textile and Apparel Association (VITAS), textile and garment export turnover will reach 44 billion USD in 2024, in line with the set plan. Mr. Vu Duc Giang, Chairman of VITAS, commented that although prices did not increase, the results in 2024 were still positive, because businesses had taken advantage of the shift in export orders from a number of countries, especially China. Currently, most textile and garment companies have orders until the first quarter of 2025 and are negotiating orders for the second quarter of 2025.

With this positive signal, many companies simultaneously reported large profits even though 2024 has not yet completely ended.

Textile and garment industry flourishes, full of orders in the first quarter of 2025 (Photo: Internet)

Specifically, Vietnam Textile and Garment Group - VINATEX (VGT, UPCoM) expects revenue in 2024 to reach VND 18,100 billion, pre-tax profit is estimated at VND 740 billion, up 3% and 38% respectively over the same period. Average income per employee is VND 10.1 million/month, up 7% compared to 2023.

Thanh Cong Textile Garment Investment Trading Joint Stock Company (TCM, HOSE) announced its 11-month results of 2024 with revenue of VND 3,481 billion and profit after tax of VND 263 billion, completing 94% and 163% of the yearly plan. Thanh Cong has fully booked orders for the first quarter of 2025 and is accepting orders for the second quarter of 2025.

Hoa Tho Textile and Garment Corporation (HTG, HOSE) recorded estimated revenue of VND4,950 billion, exceeding the annual plan by 10%, profit of VND336 billion, exceeding the annual plan by 53% and reaching a record level in its operating history.

Many banks expect big profits in 2024

Many banks are expected to meet and exceed their profit targets, with some estimating double-digit profit growth for the full year of 2024.

Specifically, Tien Phong Commercial Joint Stock Bank - TPBank (TPB, HOSE) announced its 11-month business results with pre-tax profit reaching more than VND 7,100 billion, up nearly 28% compared to the end of last year. Thus, TPBank's total profit in 11 months was higher than the profit for the whole year of 2023 and the bank expects the whole year of 2024 to increase by 34% compared to 2023.

Notably, TPBank's credit balance including customer loans and corporate bonds increased by 17% compared to the beginning of the year, far exceeding the industry average.

Saigon Thuong Tin Commercial Joint Stock Bank - Sacombank (STB, HOSE) has announced its preliminary business results for the fourth quarter and the whole year of 2024. Specifically, Sacombank's pre-tax profit in the fourth quarter of 2024 is estimated at more than VND 4,600 billion, an increase of 68% over the same period and the whole year of 2024 is estimated at over VND 12,700 billion, the highest level ever and exceeding the assigned target.

Ho Chi Minh City Development Joint Stock Commercial Bank - HDBank (HDB, HOSE) shared at the HDBank 2024 Investor Conference that it will exceed the profit target of 15,852 billion VND assigned by shareholders and is expected to reach over 16,000 billion VND. Previously, in the first 9 months of the year, this bank completed 79.8% of the annual profit plan.

If the expected results are achieved, HDBank will set a new record in profit scale and be in the Top 5 private banks with the highest profits in 2024.

In addition to the private banking group, at the Conference on Deploying the new banking tasks in 2025, leaders of four state-owned banks including Agribank, BIDV, Vietcombank and VietinBank announced their preliminary business results in 2024. In particular, these banks are confident in completing the assigned profit targets, estimated to exceed the billion USD mark.

Comments and recommendations

Mr. Nguyen Hung Phat, Consultant, Mirae Asset Securities , commented that the market next week may continue to reflect negative investor sentiment. VN-Index may reach the strong psychological support level of 1,240-1,250 before creating a balance zone with declining liquidity accompanied by net foreign selling.

The gloomy market trend is expected to last until the end of the year, which is also a good time for businesses to accumulate and create stronger growth momentum before the new year.

Market Accumulates for New Growth Momentum in 2025

In terms of macro information, the DXY Index (measures the USD against other currencies) increased again after the US Federal Reserve (Fed) slowed down the pace of interest rate cuts, leading to a decline in global financial markets, including Vietnam. In addition, exchange rate pressure has stimulated the State Bank to sell USD to balance liquidity for the banking system. This has increased volatility and negative sentiment.

However , the pressure on the exchange rate and DXY has gradually decreased at the end of the week and the domestic USD source is expected to improve thanks to: trade surplus, remittances and high disbursed FDI. Therefore, this adjustment will be short-term, and this is an opportunity for foreign investors and investors to re-evaluate the attractiveness of the Vietnamese market in the coming time.

According to him, this is the stage for investors to screen stocks and build investment portfolios around industry groups with supportive information and improved business prospects such as Maritime Transport, Import-Export (textiles, seafood) and Real Estate.

BSC Securities believes that the market recorded a slight recovery, closing at 1,257.5 points, up nearly 3 points in the last session of the week, the market is leaning towards the positive side with 14/18 sectors gaining points. In the upcoming sessions, the trend of VN-Index will depend heavily on the cash flow of investors in the psychological zone of 1,250 - 1,260 points.

Asean Securities assessed that the market developments are reflecting the lack of motivation for a breakthrough growth. However, according to technical analysis, positive points in demand have begun to appear, playing an important supporting role for the short-term price trend. On the contrary, foreign investors continued to net sell with a value of more than VND 1,500 billion, creating pressure on the market. Therefore, the market is still in the long-term accumulation phase. The adjustment periods along with fluctuations in the world market will be an opportunity for investors to disburse part of their capital in the context that the VN-Index is still at an attractive valuation level in the long term.

Dividend schedule this week

According to statistics, there are 31 enterprises that have fixed dividend rights from December 23 to December 27, of which, 28 enterprises pay in cash, 2 enterprises issue additional shares and 1 enterprise gives bonus shares.

The highest rate is 40%, the lowest is 2%.

2 additional issuers:

VINEXAD Advertising and Trade Fair JSC (VNX, UPCoM), ex-right trading date is December 25, ratio is 50%.

Taseco Real Estate Investment JSC (TAL, UPCoM) , ex-right trading date is December 24, rate 5%.

1 company rewards shares:

Joint Stock Commercial Bank for Investment and Development of Vietnam - BIDV (BID, HOSE) , ex-right trading date is December 23, rate 21%.

Cash dividend payment schedule

*Ex-right date: is the transaction date on which the buyer, upon establishing ownership of shares, will not enjoy related rights such as the right to receive dividends, the right to purchase additional issued shares, but will still enjoy the right to attend the shareholders' meeting.

| Code | Floor | GDKHQ Day | Date TH | Proportion |

|---|---|---|---|---|

| SCS | HOSE | 12/23/2024 | 8/1/2025 | 30% |

| PPC | HOSE | 12/24/2024 | February 19, 2025 | 2% |

| DHG | HOSE | 12/24/2024 | February 14, 2025 | 40% |

| NAV | HOSE | 12/24/2024 | 10/1/2025 | 10% |

| HTG | HOSE | 12/24/2024 | 1/23/2025 | 30% |

| HDM | UPCOM | 12/24/2024 | February 17, 2025 | 20% |

| HUG | UPCOM | 12/24/2024 | March 25, 2025 | 5% |

| CTD | HOSE | 12/24/2024 | 1/14/2025 | 10% |

| STW | UPCOM | 12/24/2024 | 10/2/2025 | 16.9% |

| HVH | HOSE | 12/25/2024 | 6/1/2025 | 3% |

| DSN | HOSE | 12/26/2024 | 1/22/2025 | 24% |

| SAB | HOSE | 12/26/2024 | 1/23/2025 | 20% |

| CMD | UPCOM | 12/26/2024 | 1/15/2025 | 18% |

| LIX | HOSE | 12/26/2024 | 1/14/2025 | 5% |

| PHN | HNX | 12/26/2024 | 1/15/2025 | 20% |

| BAX | HNX | 12/26/2024 | 1/22/2025 | 20% |

| VNM | HOSE | 12/26/2024 | 28/2/2025 | 5% |

| CII | HOSE | 12/26/2024 | 1/20/2025 | 2% (Phase 1/2023) |

| CII | HOSE | 12/26/2024 | 1/20/2025 | 3% (Phase 4/2022) |

| SGI | UPCOM | 12/26/2024 | 1/20/2025 | 5% (2023) |

| SGI | UPCOM | 12/26/2024 | 1/20/2025 | 5% (Phase 2/2022) |

| EIC | UPCOM | 12/26/2024 | August 14, 2025 | 6% |

| QTP | UPCOM | 12/26/2024 | 27/2/2025 | 10% |

| BCF | HNX | 12/26/2024 | 1/15/2025 | 10% |

| SBH | UPCOM | 12/27/2024 | 1/22/2025 | 5% |

| HND | UPCOM | 12/27/2024 | March 31, 2025 | 3% |

| DHP | HNX | 12/27/2024 | 1/15/2025 | 5% |

| TDB | UPCOM | 12/27/2024 | 1/20/2025 | 10% |

| TBC | HOSE | 12/27/2024 | February 14, 2025 | 5% |

| PAC | HOSE | 12/27/2024 | 1/20/2025 | 5% |

Source: https://phunuvietnam.vn/chung-khoan-tuan-cuoi-nam-2024-co-hoi-giai-ngan-cua-nha-dau-tu-20241222225426282.htm

![[Photo] April Festival in Can Tho City](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/bf5ae82870e648fabfbcc93a25b481ea)

![[Photo] Unique folk games at Chuong Village Festival](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/cff805a06fdd443b9474c017f98075a4)

![[Photo] Opening of the 11th Conference of the 13th Party Central Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/f9e717b67de343d7b687cb419c0829a2)

Comment (0)