Credit surge in December 2023

With a credit growth target of about 15% in 2024 compared to the end of 2023, about VND 2 million billion will be released into the economy, bringing the total outstanding debt to about VND 15.6 million billion by the end of this year. In addition to providing a formula for calculating credit limits for each bank, the State Bank of Vietnam (SBV) also requires banks to implement safe credit growth, in accordance with risk management capacity, liquidity situation and capital mobilization capacity; ensuring credit quality as well as operational safety.

It is strictly forbidden to grant credit in violation of regulations, to the wrong subjects, to grant credit to the board of directors, executive board and related persons of credit institutions, enterprises in the ecosystem, backyard enterprises... with preferential interest rates while people and enterprises with legitimate and legal needs have difficulty accessing credit capital.

Banks proactively lend from the beginning of the year

Looking back at 2023, it can be said that credit growth has never struggled and ultimately failed to achieve the growth rate as planned. Outstanding credit in 2023 increased by 13.5% compared to the end of 2022 (the plan at the beginning of the year was to increase by 14-15%), with a total outstanding balance reaching about 13.6 million billion VND. But even if it did not reach that target, outstanding credit in December still increased dramatically, helping the growth figure for the whole year to almost reach the set plan, surprising the market. Because before that, at the end of November 2023, the State Bank announced credit growth of 9.15%, about 13 million billion VND. Thus, in December 2023 alone, banks lent to the economy nearly 600,000 billion VND, accounting for 1/3 of the total additional credit for the whole year of 2023.

Explaining the acceleration in the last month of last year, Dr. Le Dat Chi, Head of the Finance Department of Ho Chi Minh City University of Economics, said that credit started to increase in November, and there was a "terrifying" increase in the amount of money entering the market to reach the planned level. Mr. Chi raised the issue that the economy is still facing difficulties, but absorbing a large amount of credit in a short period of time is unusual. Therefore, it is necessary to clarify whether year-end credit goes into production and business or into speculative fields. Is it possible that banks will grow rapidly at the end of the year to receive an increased credit limit for 2024?

According to Mr. Le Dat Chi, the allocation of the entire credit growth limit to banks at the beginning of the year shows that the State Bank is confident that inflation will not be a problem for monetary policy. When the annual credit limit is allocated, commercial banks will know how much credit will be lent out in the year, and from there have a plan to approach customers. Compared to the way of allocating credit in the past 2 years in the form of "testing the waters" to control inflation, the State Bank will consider granting credit limits to the extent of economic developments, making commercial banks passive in considering granting credit to businesses, this year's allocation will help them be more proactive.

"With the jerky granting of credit limits like in previous years, not only will banks face difficulties but businesses will also have difficulty accessing bank loans. With the mechanism of allocating full credit limits, banks will calculate the credit flow to customers, which sectors, which businesses are prioritized for loans with low interest rates... Banks are clear in their development orientation and the whole economy is also promoted from the beginning of the year," Mr. Chi commented.

Need to monitor credit flows

With more than 2 million billion VND ready to be pumped into the economy, many businesses are optimistic that they will be able to access bank credit with less difficulty than last year. Mr. Le Dat Chi said that credit growth in 2024 at 15% or 20% is not the problem, but the core is where the credit capital will go. If credit was easy for bonds and real estate before, will it continue to be for these areas now?

In addition, whether the 15% credit growth target can help boost the economy, increase wealth, produce more export goods, earn foreign currency, and have factories with orders to maintain jobs for workers is important. If credit is only poured into speculative assets, or "irrigates" the backyards and ecosystems of bank owners, no amount of credit will be enough.

"Therefore, monitoring the flow of credit into the backyard and into the backyard ecosystem is not easy. How can the monitoring agency detect that the backyard is a company under someone else's name, typically in the case of Ms. Truong My Lan, there are thousands of backyard companies. If credit into the backyard cannot be monitored, it will be difficult for outside businesses to access credit capital," Mr. Chi raised the issue.

In particular, according to this expert, in 2023, credit growth will be 13.5%, close to the set plan, but economic growth will be lower than the plan, reaching 5.05%. With a credit growth rate of 15% in 2024, it is necessary to ensure that the economic growth target is achieved as planned, otherwise it is necessary to see where this credit flow goes. "Monetary policy must be clear in supporting which production and business sectors to have specific support. For example, adjusting the credit risk coefficient to promote credit to that sector. For example, real estate loans, if we increase credit growth for social housing loans, the risk coefficient will be low, but in the case of buying villas and luxury houses, the risk coefficient can be calculated higher," Mr. Chi proposed.

Dr. Le Xuan Nghia, member of the National Monetary and Financial Policy Advisory Council, commented that credit allocation from the beginning of the year will help banks be proactive in planning business strategies. Whether or not businesses can easily access loans depends on the loan conditions. For current loans, there are two conditions that businesses must ensure, which are the ability to repay debts based on project appraisal and collateral. For the ability to repay debts, businesses must have orders. As for the assets securing loans, most of the borrowing businesses have put their assets in the bank, not to mention that the current asset valuation is also complicated. In the current case, banks are more interested in the ability to effectively appraise projects and the ability to repay debts of businesses, so accessing loans will be easier.

Report on the results of the credit growth management inspection in January

In the context of low credit growth and failure to achieve the set target, in December 2023, the Government Office sent a document to the Government Inspectorate and the State Bank of Vietnam regarding the inspection of credit growth management. The document mentioned that access to credit capital is still difficult, the allocation of credit growth limits to credit institutions is not really scientific, timely, and effective, and there are also comments from National Assembly deputies and experts.

In order to promptly strengthen state management and improve the efficiency of credit growth management, Deputy Prime Minister Le Minh Khai requested the Government Inspectorate to conduct an inspection of the implementation of the assigned functions and tasks of the State Bank in credit growth management, building, assigning, and managing credit growth targets and limits in 2022 and 2023, and the management and supervision of credit growth implementation. The Government Inspectorate is assigned to report to the Prime Minister on the implementation in December 2023 and the inspection results in January 2024.

Source link

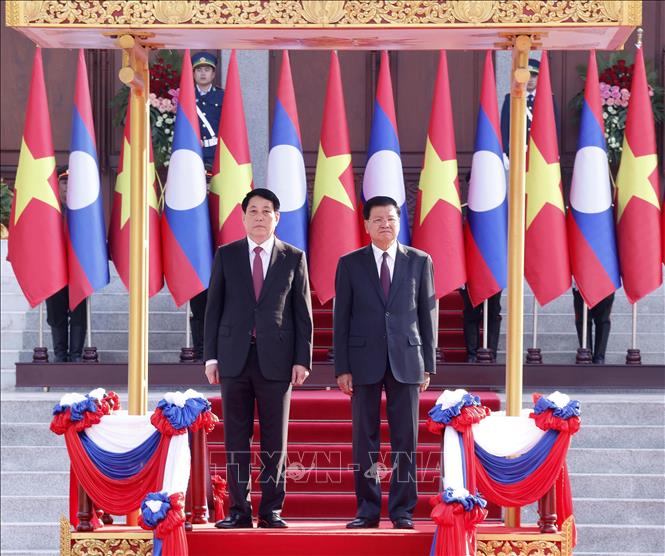

![[Photo] President Luong Cuong holds talks with Lao General Secretary and President Thongloun Sisoulith](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/24/98d46f3dbee14bb6bd15dbe2ad5a7338)

![[Photo] President Luong Cuong meets with Lao National Assembly Chairman Xaysomphone Phomvihane](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/25/dd9d8c5c3a1640adbc4022e2652c3401)

![[Photo] Liberation of Truong Sa archipelago - A strategic feat in liberating the South and unifying the country](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/25/d5d3f0607a6a4156807161f0f7f92362)

![[Photo] General Secretary To Lam receives Philippine Ambassador Meynardo Los Banos Montealegre](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/24/6b6762efa7ce44f0b61126a695adf05d)

Comment (0)