The EU is currently the third largest export market for Vietnamese goods.

The European Green Deal (EGD) is the EU’s response to the environmental emergency, in particular the global climate emergency. A set of policies that re-establish the European Commission’s commitment, with a vision for 2050. The EGD covers all sectors of the economy: from agriculture to energy and from transport to construction, trade, etc.

|

| export goods |

On 14 July 2021, the European Commission adopted a series of proposals to align EU policies to reduce net greenhouse gas emissions by at least 55% by 2030, compared to 1990 levels.

Reducing greenhouse gas emissions by at least 55% by 2030 requires a higher share of renewable energy in electricity generation and greater energy efficiency.

On 11 November 2022, negotiators from the European Parliament (EP) and the European Council, representing the 27 EU member states, reached an agreement on the law, known as the Land Use, Land Use Change and Forestry (LULUCF) Regulation. The new law aims to remove 310 million tonnes of CO2 by 2030 through the use of land, trees, vegetation, biomass and wood.

The EU's carbon border adjustment mechanism (CBAM) is an environmental trade policy that includes carbon taxes on goods imported into EU markets based on the intensity of greenhouse gas emissions in the production process in the host country.

This mechanism would help to equalize carbon prices between domestic and imported products, preventing the risk of EU businesses shifting carbon-intensive production to other countries to take advantage of lax standards (carbon leakage).

The EU believes that a green mechanism for imports from outside the EU through a carbon pricing system would encourage cleaner industry in non-EU countries.

The operation of the CBAM during the transition period will be studied and reviewed before the system officially enters into force in 2026. The European Commission will assess whether to extend the scope of the CBAM to other goods identified during the negotiations, including certain downstream products and other sectors such as organic chemicals and polymers as previously proposed by the Parliament.

After a transition period, the mechanism will officially enter into force on 1 January 2026 and become fully operational in 2034. During this period, the CBAM will be gradually applied in parallel with the phase-out of free allowances in the EU Emissions Trading System (EU ETS). Therefore, the CBAM will only apply to the share of emissions that do not benefit from free allowances in the ETS during the period 2026 – 2034.

Mr. Do Huu Hung - Department of European - American Markets (Ministry of Industry and Trade) - said that the impact of CBAM on export output is certain, first of all on steel and cement products due to large emission rates.

The impact of CBAM on export output depends on a number of factors such as the elasticity of demand for goods, the availability of substitute goods, and the extent to which producers can pass on the tax costs to consumers.

Many countries may approach this direction and expand to many other products, so this is also a trend that businesses need to consider from the beginning in the process of building and planning production strategies.

Mr. Huynh Minh Vu - Deputy Director in charge of the Ho Chi Minh City Center for International Integration (CIIS) - said that the EU is one of Vietnam's important trade partners. In particular, since the Vietnam - EU Free Trade Agreement (EVFTA) took effect, the trade turnover of goods between Vietnam and the EU has increased significantly.

According to Mr. Huynh Minh Vu, the EU is currently the third largest export market for Vietnamese goods. Therefore, the EU's import-related policies have more or less affected Vietnamese export enterprises. This is a big challenge for some export industries, but at the same time, it is also a driving force for enterprises to proactively make green transformation towards sustainable development standards.

How should businesses prepare?

According to experts, Vietnam has committed to achieving net zero by 2050 and is accelerating the transition from fossil fuels to renewable energy, green industry, sustainable agriculture and circular economy. In this context, businesses need to proactively build quality management systems, innovate management and production and business activities.

The export market applying tax on carbon-emitting goods not only encourages enterprises that directly export to go green but also motivates other enterprises to participate in the carbon credit market. Accordingly, enterprises whose activities help absorb carbon are converted into carbon credits for buying, selling and exchanging.

Mr. Do Huu Hung said that in order to adapt to the general global trend including CBAM, all sectors, whether their products are on the taxable list or not, must have a clear understanding of the regulations and requirements of the markets to which the business exports.

Greening production is a mandatory trend through conversion, investment in cleaner production technologies/practices, reduction in product costs, investment in energy saving measures and renewable energy sources including solar and wind power to reduce dependence on fossil fuels.

Enterprises in particular and stakeholders in general need to cooperate and dialogue with the EU to ensure that CBAM is implemented in a fair and equitable manner; cooperate with third-party certification organizations to verify the accuracy of carbon content in reports of Vietnamese enterprises.

According to Mr. Do Huu Hung, Vietnam has indirectly imposed carbon tax through the Environmental Protection Tax on enterprises producing and importing fossil fuels (which does not really reflect the nature of carbon pricing). Vietnam has also developed and issued regulations and decrees on greenhouse gas inventory as shown in Articles 91, 92 and 139 of the Law on Environmental Protection 2020, Decree No. 06/2022/ND-CP on regulations on greenhouse gas emission reduction and ozone layer protection, and Decision No. 01/2022/QD-TTg of the Prime Minister stipulating the list of sectors and facilities emitting greenhouse gases that must conduct greenhouse gas inventories.

Currently, relevant ministries and branches are also making efforts to complete the Carbon Market Development Project in Vietnam, preparing for the pilot operation of the carbon trading floor in 2025, official operation in 2028,...

According to the roadmap, from October 2023, CBAM will begin a transitional period. Importers will be required to comply with reporting obligations and will not be subject to CBAM fees. From January 2026, CBAM will begin to be gradually introduced in parallel with the phase-out of the free quota of the European Union Emissions Trading System (EU ETS). In 2027, the European Commission will conduct a comprehensive review of CBAM and in 2034 CBAM will be fully operational. The products currently covered by CBAM are iron and steel, aluminium, hydrogen, fertilisers, cement and electricity. |

Source link

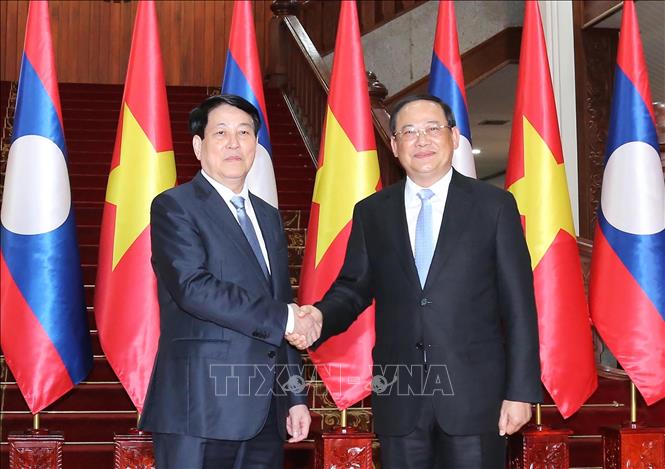

![[Photo] President Luong Cuong meets with Lao Prime Minister Sonexay Siphandone](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/25/3d70fe28a71c4031b03cd141cb1ed3b1)

![[Photo] Liberation of Truong Sa archipelago - A strategic feat in liberating the South and unifying the country](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/25/d5d3f0607a6a4156807161f0f7f92362)

![[Photo] Ho Chi Minh City welcomes a sudden increase in tourists](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/25/dd8c289579e64fccb12c1a50b1f59971)

Comment (0)